Shift4 Payments (NYSE:FOUR - Free Report) had its price target lifted by Susquehanna from $105.00 to $120.00 in a report published on Wednesday,Benzinga reports. Susquehanna currently has a positive rating on the stock.

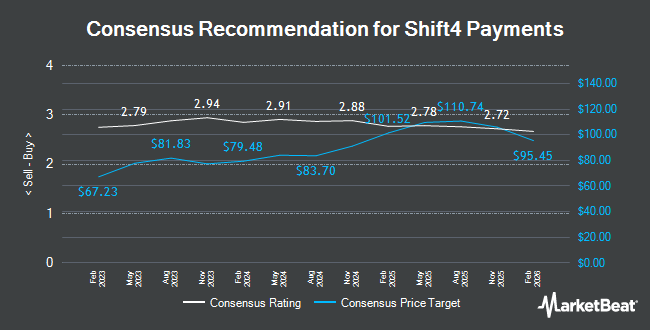

Several other research analysts also recently commented on FOUR. DA Davidson raised their price target on shares of Shift4 Payments from $104.00 to $118.00 and gave the stock a "buy" rating in a research note on Monday, October 21st. The Goldman Sachs Group boosted their target price on shares of Shift4 Payments from $96.00 to $106.00 and gave the company a "buy" rating in a report on Monday, October 14th. Barclays assumed coverage on shares of Shift4 Payments in a research report on Wednesday, October 9th. They set an "overweight" rating and a $120.00 price target for the company. Wells Fargo & Company raised their price target on Shift4 Payments from $75.00 to $95.00 and gave the stock an "overweight" rating in a research report on Friday, September 20th. Finally, Oppenheimer began coverage on shares of Shift4 Payments in a report on Tuesday, October 1st. They issued an "outperform" rating and a $109.00 price objective for the company. Three investment analysts have rated the stock with a hold rating and eighteen have issued a buy rating to the company's stock. According to data from MarketBeat.com, Shift4 Payments presently has a consensus rating of "Moderate Buy" and an average price target of $99.10.

Check Out Our Latest Stock Analysis on FOUR

Shift4 Payments Trading Up 2.3 %

FOUR traded up $2.25 on Wednesday, hitting $101.37. The company had a trading volume of 2,238,889 shares, compared to its average volume of 1,369,629. Shift4 Payments has a 12-month low of $55.87 and a 12-month high of $106.31. The company has a quick ratio of 1.34, a current ratio of 1.35 and a debt-to-equity ratio of 1.83. The business's fifty day simple moving average is $89.41 and its 200 day simple moving average is $77.05. The company has a market cap of $8.98 billion, a PE ratio of 56.16, a PEG ratio of 1.16 and a beta of 1.64.

Shift4 Payments (NYSE:FOUR - Get Free Report) last released its quarterly earnings results on Tuesday, November 12th. The company reported $0.91 earnings per share for the quarter, meeting the consensus estimate of $0.91. The company had revenue of $365.10 million for the quarter, compared to analyst estimates of $369.07 million. Shift4 Payments had a return on equity of 24.78% and a net margin of 4.04%. Equities research analysts expect that Shift4 Payments will post 3.04 EPS for the current year.

Insider Buying and Selling at Shift4 Payments

In other news, CFO Nancy Disman sold 20,000 shares of the company's stock in a transaction that occurred on Friday, September 13th. The stock was sold at an average price of $81.30, for a total value of $1,626,000.00. Following the completion of the transaction, the chief financial officer now directly owns 182,959 shares of the company's stock, valued at $14,874,566.70. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. In related news, insider Jordan Frankel sold 12,500 shares of the business's stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $82.57, for a total value of $1,032,125.00. Following the sale, the insider now directly owns 228,021 shares in the company, valued at approximately $18,827,693.97. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, CFO Nancy Disman sold 20,000 shares of the firm's stock in a transaction that occurred on Friday, September 13th. The stock was sold at an average price of $81.30, for a total transaction of $1,626,000.00. Following the completion of the transaction, the chief financial officer now directly owns 182,959 shares of the company's stock, valued at approximately $14,874,566.70. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 30.57% of the company's stock.

Hedge Funds Weigh In On Shift4 Payments

Hedge funds and other institutional investors have recently made changes to their positions in the business. Jennison Associates LLC grew its position in shares of Shift4 Payments by 9.3% during the 3rd quarter. Jennison Associates LLC now owns 2,834,061 shares of the company's stock valued at $251,098,000 after acquiring an additional 242,179 shares during the period. Clearbridge Investments LLC raised its holdings in Shift4 Payments by 11.3% in the second quarter. Clearbridge Investments LLC now owns 2,314,928 shares of the company's stock worth $169,800,000 after purchasing an additional 235,355 shares in the last quarter. The Manufacturers Life Insurance Company grew its stake in Shift4 Payments by 11,776.9% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 1,730,704 shares of the company's stock worth $126,947,000 after buying an additional 1,716,132 shares during the last quarter. Westfield Capital Management Co. LP grew its position in Shift4 Payments by 0.9% during the 3rd quarter. Westfield Capital Management Co. LP now owns 1,455,085 shares of the company's stock worth $128,921,000 after purchasing an additional 12,804 shares during the last quarter. Finally, Janus Henderson Group PLC raised its holdings in shares of Shift4 Payments by 21.7% in the first quarter. Janus Henderson Group PLC now owns 1,434,890 shares of the company's stock worth $94,803,000 after buying an additional 255,741 shares during the last quarter. Institutional investors own 98.87% of the company's stock.

Shift4 Payments Company Profile

(

Get Free Report)

Shift4 Payments, Inc (NYSE FOUR) provides integrated payment processing and technology solutions in the United States. Its payments platform provides omni-channel card acceptance and processing solutions, including end-to-end payment processing for various payment types; merchant acquiring; proprietary omni-channel gateway; complementary software integrations; integrated and mobile point-of-sale (POS) solutions; security and risk management solutions; and reporting and analytical tools, as well as tokenization, risk management/underwriting, payment device and chargeback management, fraud prevention, and gift card solutions.

Read More

Before you consider Shift4 Payments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shift4 Payments wasn't on the list.

While Shift4 Payments currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.