Signature Estate & Investment Advisors LLC raised its stake in Prologis, Inc. (NYSE:PLD - Free Report) by 5.0% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 183,424 shares of the real estate investment trust's stock after acquiring an additional 8,766 shares during the quarter. Signature Estate & Investment Advisors LLC's holdings in Prologis were worth $23,163,000 as of its most recent filing with the Securities and Exchange Commission.

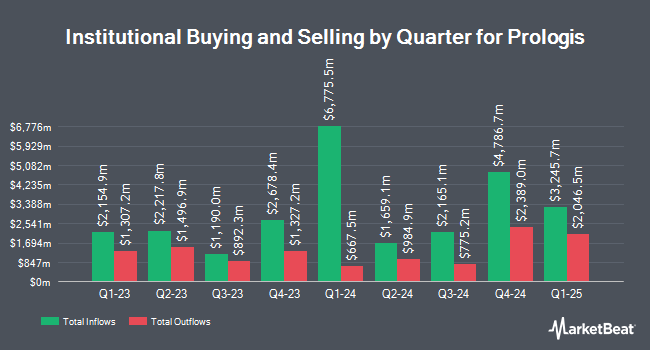

Several other institutional investors have also recently bought and sold shares of PLD. Swedbank AB grew its holdings in Prologis by 9.2% during the second quarter. Swedbank AB now owns 5,002,274 shares of the real estate investment trust's stock valued at $561,805,000 after purchasing an additional 420,687 shares during the period. Envestnet Portfolio Solutions Inc. grew its position in shares of Prologis by 36.1% in the 2nd quarter. Envestnet Portfolio Solutions Inc. now owns 162,990 shares of the real estate investment trust's stock valued at $18,305,000 after purchasing an additional 43,235 shares during the period. Sunflower Bank N.A. bought a new stake in Prologis during the 3rd quarter worth approximately $249,000. Centersquare Investment Management LLC lifted its stake in Prologis by 5.7% in the first quarter. Centersquare Investment Management LLC now owns 6,840,176 shares of the real estate investment trust's stock valued at $890,728,000 after buying an additional 367,565 shares in the last quarter. Finally, Cetera Advisors LLC boosted its holdings in shares of Prologis by 118.7% in the first quarter. Cetera Advisors LLC now owns 37,992 shares of the real estate investment trust's stock valued at $4,947,000 after buying an additional 20,623 shares during the period. Institutional investors own 93.50% of the company's stock.

Wall Street Analysts Forecast Growth

PLD has been the topic of several recent research reports. Wells Fargo & Company lifted their price target on Prologis from $142.00 to $146.00 and gave the company an "overweight" rating in a research note on Wednesday, August 28th. Truist Financial lifted their price objective on shares of Prologis from $125.00 to $137.00 and gave the company a "buy" rating in a research report on Monday, August 5th. Royal Bank of Canada downgraded Prologis from an "outperform" rating to a "sector perform" rating and boosted their price target for the stock from $124.00 to $127.00 in a research report on Monday, August 5th. Morgan Stanley lifted their target price on Prologis from $132.00 to $133.00 and gave the stock an "overweight" rating in a research note on Wednesday, August 14th. Finally, JPMorgan Chase & Co. cut their price target on Prologis from $138.00 to $131.00 and set an "overweight" rating for the company in a report on Monday, October 21st. Eight analysts have rated the stock with a hold rating, nine have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $131.12.

View Our Latest Stock Report on PLD

Insider Buying and Selling

In related news, CIO Joseph Ghazal sold 5,200 shares of Prologis stock in a transaction on Friday, August 23rd. The shares were sold at an average price of $129.07, for a total value of $671,164.00. Following the sale, the executive now owns 13,187 shares in the company, valued at $1,702,046.09. The trade was a 28.28 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. 0.50% of the stock is owned by company insiders.

Prologis Trading Down 1.2 %

Shares of NYSE PLD traded down $1.37 during trading on Friday, reaching $113.38. The company had a trading volume of 3,889,047 shares, compared to its average volume of 3,654,745. The company's fifty day moving average price is $121.62 and its 200-day moving average price is $117.88. Prologis, Inc. has a 12 month low of $101.11 and a 12 month high of $137.52. The stock has a market cap of $105.01 billion, a P/E ratio of 34.50, a PEG ratio of 3.06 and a beta of 1.08. The company has a quick ratio of 0.43, a current ratio of 0.43 and a debt-to-equity ratio of 0.56.

Prologis (NYSE:PLD - Get Free Report) last announced its quarterly earnings results on Wednesday, October 16th. The real estate investment trust reported $1.08 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.37 by ($0.29). The firm had revenue of $1.90 billion during the quarter, compared to the consensus estimate of $1.91 billion. Prologis had a return on equity of 5.34% and a net margin of 39.08%. The firm's revenue was up 6.9% on a year-over-year basis. During the same quarter in the previous year, the company posted $1.30 EPS. As a group, research analysts expect that Prologis, Inc. will post 5.45 earnings per share for the current year.

Prologis Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, September 30th. Investors of record on Monday, September 16th were given a $0.96 dividend. The ex-dividend date of this dividend was Monday, September 16th. This represents a $3.84 dividend on an annualized basis and a dividend yield of 3.39%. Prologis's dividend payout ratio (DPR) is presently 116.01%.

Prologis Company Profile

(

Free Report)

Prologis, Inc is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. At March 31, 2024, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet (115 million square meters) in 19 countries.

See Also

Before you consider Prologis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prologis wasn't on the list.

While Prologis currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.