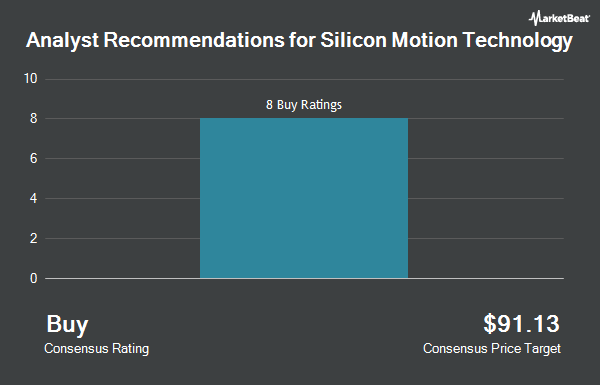

Silicon Motion Technology Co. (NASDAQ:SIMO - Get Free Report) has received an average recommendation of "Moderate Buy" from the nine ratings firms that are presently covering the company, Marketbeat Ratings reports. One investment analyst has rated the stock with a sell rating and eight have given a buy rating to the company. The average 12 month price objective among analysts that have covered the stock in the last year is $81.67.

A number of research firms have weighed in on SIMO. Wedbush reiterated an "outperform" rating and set a $90.00 target price on shares of Silicon Motion Technology in a report on Wednesday, October 2nd. Bank of America cut Silicon Motion Technology from a "buy" rating to an "underperform" rating and reduced their price target for the stock from $90.00 to $60.00 in a research note on Friday, August 16th. Morgan Stanley dropped their target price on shares of Silicon Motion Technology from $78.00 to $65.00 and set an "overweight" rating on the stock in a report on Monday, September 16th. Susquehanna reduced their target price on shares of Silicon Motion Technology from $110.00 to $95.00 and set a "positive" rating on the stock in a research report on Friday, November 1st. Finally, B. Riley lowered their price target on shares of Silicon Motion Technology from $112.00 to $95.00 and set a "buy" rating for the company in a research report on Monday, August 5th.

Get Our Latest Analysis on Silicon Motion Technology

Silicon Motion Technology Stock Performance

Shares of Silicon Motion Technology stock traded down $2.82 during midday trading on Friday, reaching $51.20. 329,108 shares of the company's stock traded hands, compared to its average volume of 373,409. The stock has a 50 day moving average of $56.92 and a 200-day moving average of $67.98. Silicon Motion Technology has a 12 month low of $50.50 and a 12 month high of $85.87. The company has a market cap of $1.72 billion, a PE ratio of 19.39, a price-to-earnings-growth ratio of 1.43 and a beta of 0.84.

Silicon Motion Technology (NASDAQ:SIMO - Get Free Report) last issued its quarterly earnings data on Wednesday, October 30th. The semiconductor producer reported $0.92 EPS for the quarter, topping the consensus estimate of $0.85 by $0.07. Silicon Motion Technology had a net margin of 10.90% and a return on equity of 11.52%. The business had revenue of $212.40 million during the quarter, compared to analyst estimates of $209.49 million. During the same period in the prior year, the business earned $0.32 EPS. The company's revenue for the quarter was up 23.3% on a year-over-year basis. On average, equities analysts anticipate that Silicon Motion Technology will post 2.59 earnings per share for the current fiscal year.

Silicon Motion Technology Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, November 27th. Stockholders of record on Thursday, November 14th will be paid a $0.50 dividend. The ex-dividend date of this dividend is Thursday, November 14th. This represents a $2.00 annualized dividend and a dividend yield of 3.91%. Silicon Motion Technology's dividend payout ratio is presently 75.38%.

Hedge Funds Weigh In On Silicon Motion Technology

A number of hedge funds have recently added to or reduced their stakes in the company. M&G Plc bought a new stake in shares of Silicon Motion Technology in the 1st quarter worth $6,304,000. Morse Asset Management Inc purchased a new stake in shares of Silicon Motion Technology during the 1st quarter valued at about $700,000. Harbor Capital Advisors Inc. boosted its holdings in shares of Silicon Motion Technology by 95.7% during the 3rd quarter. Harbor Capital Advisors Inc. now owns 128,299 shares of the semiconductor producer's stock valued at $7,793,000 after acquiring an additional 62,733 shares during the last quarter. National Bank of Canada FI grew its stake in shares of Silicon Motion Technology by 6,186.7% in the second quarter. National Bank of Canada FI now owns 47,150 shares of the semiconductor producer's stock worth $3,766,000 after acquiring an additional 46,400 shares during the period. Finally, Resolute Capital Asset Partners LLC raised its holdings in shares of Silicon Motion Technology by 44.4% during the second quarter. Resolute Capital Asset Partners LLC now owns 65,000 shares of the semiconductor producer's stock valued at $5,264,000 after purchasing an additional 20,000 shares during the last quarter. 78.02% of the stock is currently owned by hedge funds and other institutional investors.

About Silicon Motion Technology

(

Get Free ReportSilicon Motion Technology Corporation, together with its subsidiaries, designs, develops, and markets NAND flash controllers for solid-state storage devices. The company offers controllers for computing-grade solid state drives (SSDs), which are used in PCs and other client devices; enterprise-grade SSDs used in data centers; eMMC and UFS mobile embedded storage for use in smartphones and IoT devices; flash memory cards and flash drives for use in expandable storage; and specialized SSDs that are used in industrial, commercial, and automotive applications.

Further Reading

Before you consider Silicon Motion Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silicon Motion Technology wasn't on the list.

While Silicon Motion Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.