SpiderRock Advisors LLC lifted its stake in shares of Masco Co. (NYSE:MAS - Free Report) by 242.1% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 12,266 shares of the construction company's stock after acquiring an additional 8,680 shares during the quarter. SpiderRock Advisors LLC's holdings in Masco were worth $1,030,000 at the end of the most recent reporting period.

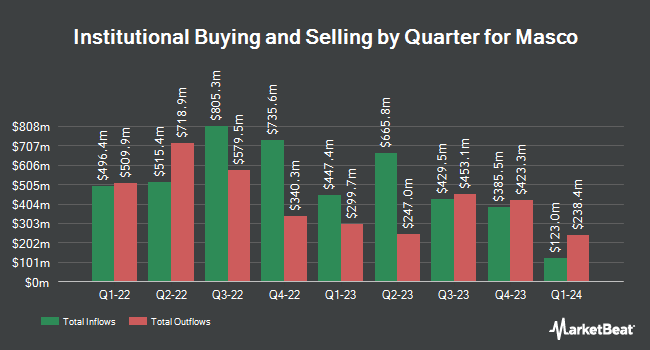

A number of other institutional investors have also recently bought and sold shares of MAS. Mitsubishi UFJ Trust & Banking Corp lifted its position in shares of Masco by 14.3% during the 1st quarter. Mitsubishi UFJ Trust & Banking Corp now owns 542,096 shares of the construction company's stock worth $42,245,000 after purchasing an additional 67,806 shares during the last quarter. Manning & Napier Advisors LLC bought a new stake in Masco in the 2nd quarter valued at $82,363,000. Vanguard Group Inc. grew its position in Masco by 2.8% in the 1st quarter. Vanguard Group Inc. now owns 26,300,591 shares of the construction company's stock worth $2,074,591,000 after purchasing an additional 721,117 shares during the last quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. raised its position in shares of Masco by 119.1% during the first quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 290,123 shares of the construction company's stock valued at $22,885,000 after buying an additional 157,711 shares during the last quarter. Finally, Boston Trust Walden Corp grew its position in Masco by 28.3% during the second quarter. Boston Trust Walden Corp now owns 467,897 shares of the construction company's stock worth $31,195,000 after buying an additional 103,310 shares in the last quarter. Hedge funds and other institutional investors own 93.91% of the company's stock.

Analyst Upgrades and Downgrades

MAS has been the topic of several recent research reports. JPMorgan Chase & Co. lifted their target price on shares of Masco from $80.00 to $83.50 and gave the company a "neutral" rating in a research report on Tuesday, November 5th. Evercore ISI increased their price objective on Masco from $78.00 to $82.00 and gave the stock an "in-line" rating in a research note on Wednesday, October 30th. Robert W. Baird dropped their target price on shares of Masco from $95.00 to $94.00 and set an "outperform" rating for the company in a research report on Wednesday, October 30th. UBS Group upped their price objective on shares of Masco from $89.00 to $94.00 and gave the stock a "buy" rating in a research note on Wednesday, October 30th. Finally, StockNews.com raised Masco from a "hold" rating to a "buy" rating in a report on Thursday. Seven research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $85.96.

Check Out Our Latest Stock Report on Masco

Masco Price Performance

NYSE MAS traded up $0.03 during trading on Monday, reaching $80.98. The company's stock had a trading volume of 484,280 shares, compared to its average volume of 1,799,169. The firm has a fifty day moving average of $81.74 and a 200 day moving average of $74.88. Masco Co. has a one year low of $55.43 and a one year high of $86.70. The company has a debt-to-equity ratio of 20.74, a current ratio of 1.83 and a quick ratio of 1.21. The stock has a market capitalization of $17.47 billion, a PE ratio of 21.53, a P/E/G ratio of 2.62 and a beta of 1.24.

Masco (NYSE:MAS - Get Free Report) last released its earnings results on Tuesday, October 29th. The construction company reported $1.08 earnings per share for the quarter, meeting analysts' consensus estimates of $1.08. Masco had a return on equity of 615.54% and a net margin of 10.54%. The company had revenue of $1.98 billion during the quarter, compared to analyst estimates of $2 billion. During the same quarter in the previous year, the company posted $1.00 EPS. Masco's revenue for the quarter was up .2% on a year-over-year basis. Analysts expect that Masco Co. will post 4.09 EPS for the current fiscal year.

Masco Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, November 25th. Stockholders of record on Friday, November 8th will be paid a dividend of $0.29 per share. This represents a $1.16 dividend on an annualized basis and a dividend yield of 1.43%. The ex-dividend date is Friday, November 8th. Masco's payout ratio is 30.85%.

Insiders Place Their Bets

In other Masco news, VP Kenneth G. Cole sold 37,814 shares of Masco stock in a transaction on Tuesday, September 10th. The stock was sold at an average price of $78.32, for a total transaction of $2,961,592.48. Following the completion of the transaction, the vice president now owns 36,980 shares in the company, valued at approximately $2,896,273.60. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. 1.10% of the stock is currently owned by company insiders.

Masco Profile

(

Free Report)

Masco Corporation designs, manufactures, and distributes home improvement and building products in North America, Europe, and internationally. The company's Plumbing Products segment offers faucets, showerheads, handheld showers, valves, bath hardware and accessories, bathing units, shower bases and enclosures, sinks, toilets, acrylic tubs, shower trays, spas, exercise pools, and fitness systems; brass, copper, and composite plumbing system components; connected water products; thermoplastic solutions, extruded plastic profiles, specialized fabrications, and PEX tubing products; and other non-decorative plumbing products.

See Also

Before you consider Masco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Masco wasn't on the list.

While Masco currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.