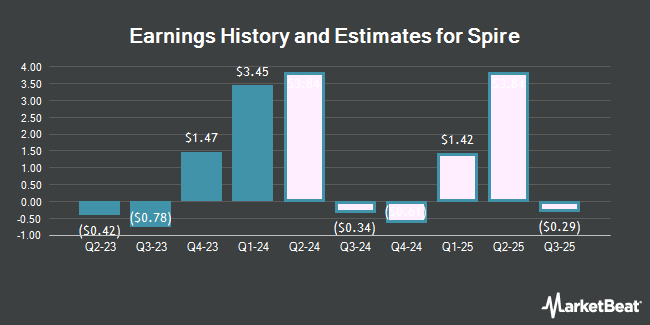

Spire (NYSE:SR - Get Free Report) issued an update on its FY25 earnings guidance on Wednesday morning. The company provided earnings per share guidance of $4.40-$4.60 for the period, compared to the consensus earnings per share estimate of $4.55. Spire also updated its FY 2025 guidance to 4.400-4.600 EPS.

Wall Street Analysts Forecast Growth

SR has been the subject of several recent analyst reports. LADENBURG THALM/SH SH cut shares of Spire from a "neutral" rating to a "sell" rating and decreased their target price for the stock from $65.50 to $60.50 in a report on Thursday, October 17th. Wells Fargo & Company boosted their target price on shares of Spire from $72.00 to $73.00 and gave the company an "equal weight" rating in a research note on Wednesday, October 16th. Morgan Stanley raised their target price on Spire from $70.00 to $76.00 and gave the stock an "equal weight" rating in a research report on Wednesday, September 25th. Mizuho increased their price target on shares of Spire from $62.00 to $65.00 and gave the stock a "neutral" rating in a research report on Tuesday. Finally, Stifel Nicolaus boosted their price target on shares of Spire from $64.00 to $70.00 and gave the company a "hold" rating in a report on Thursday, August 1st. Two investment analysts have rated the stock with a sell rating, six have assigned a hold rating and one has given a buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Hold" and an average price target of $66.56.

View Our Latest Stock Report on Spire

Spire Stock Performance

SR stock traded up $0.45 during trading on Wednesday, reaching $68.39. 326,499 shares of the stock were exchanged, compared to its average volume of 415,009. The stock has a 50 day simple moving average of $65.56 and a 200-day simple moving average of $63.68. The company has a current ratio of 0.48, a quick ratio of 0.35 and a debt-to-equity ratio of 1.11. The company has a market capitalization of $3.95 billion, a P/E ratio of 16.14, a price-to-earnings-growth ratio of 2.96 and a beta of 0.52. Spire has a twelve month low of $56.36 and a twelve month high of $68.44.

Spire Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, January 3rd. Investors of record on Wednesday, December 11th will be given a $3.14 dividend. This is a boost from Spire's previous quarterly dividend of $0.76. This represents a $12.56 annualized dividend and a yield of 18.37%. The ex-dividend date of this dividend is Wednesday, December 11th. Spire's dividend payout ratio (DPR) is 75.48%.

Insider Buying and Selling at Spire

In related news, VP Gerard J. Gorla sold 500 shares of the business's stock in a transaction on Thursday, August 22nd. The stock was sold at an average price of $64.82, for a total value of $32,410.00. Following the sale, the vice president now owns 7,311 shares of the company's stock, valued at $473,899.02. The trade was a 6.40 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Insiders own 2.86% of the company's stock.

About Spire

(

Get Free Report)

Spire Inc, together with its subsidiaries, engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States. The company operates through three segments: Gas Utility, Gas Marketing, and Midstream. It is also involved in the marketing of natural gas and related services; and transportation and storage of natural gas.

See Also

Before you consider Spire, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spire wasn't on the list.

While Spire currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.