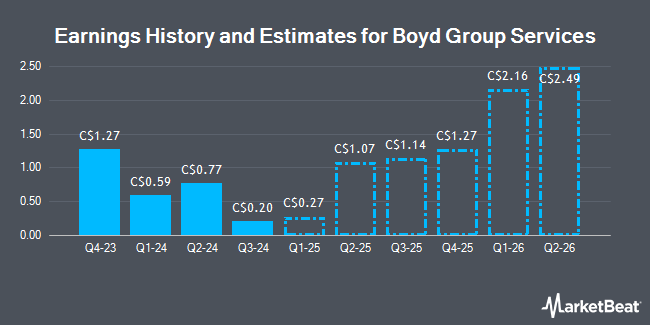

Boyd Group Services Inc. (TSE:BYD - Free Report) - Investment analysts at Stifel Canada decreased their Q4 2024 earnings per share estimates for Boyd Group Services in a research report issued on Wednesday, November 6th. Stifel Canada analyst D. Young now expects that the company will post earnings per share of $0.68 for the quarter, down from their prior estimate of $0.84. The consensus estimate for Boyd Group Services' current full-year earnings is $7.15 per share. Stifel Canada also issued estimates for Boyd Group Services' FY2025 earnings at $5.57 EPS and FY2026 earnings at $7.08 EPS.

Boyd Group Services (TSE:BYD - Get Free Report) last released its earnings results on Tuesday, November 5th. The company reported C$0.20 EPS for the quarter, missing the consensus estimate of C$0.66 by C($0.46). The company had revenue of C$1.03 billion for the quarter, compared to analyst estimates of C$1.03 billion. Boyd Group Services had a net margin of 1.93% and a return on equity of 7.21%.

Several other research firms have also weighed in on BYD. ATB Capital reduced their price objective on shares of Boyd Group Services from C$340.00 to C$320.00 in a research report on Wednesday. Jefferies Financial Group decreased their price target on shares of Boyd Group Services from C$325.00 to C$300.00 in a report on Friday, August 9th. Raymond James dropped their price objective on shares of Boyd Group Services from C$295.00 to C$285.00 in a research note on Thursday. National Bankshares lowered their price target on shares of Boyd Group Services from C$270.00 to C$245.00 in a report on Wednesday. Finally, TD Securities cut their price objective on Boyd Group Services from C$300.00 to C$270.00 in a report on Wednesday. Two research analysts have rated the stock with a hold rating, eight have given a buy rating and two have given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Buy" and a consensus target price of C$277.75.

Get Our Latest Stock Analysis on BYD

Boyd Group Services Price Performance

TSE:BYD traded down C$2.71 during mid-day trading on Friday, reaching C$217.42. 76,544 shares of the stock were exchanged, compared to its average volume of 57,357. The company has a current ratio of 0.61, a quick ratio of 0.30 and a debt-to-equity ratio of 146.14. The business has a fifty day moving average price of C$213.76 and a 200 day moving average price of C$233.62. Boyd Group Services has a 1-year low of C$198.61 and a 1-year high of C$324.75. The firm has a market capitalization of C$4.67 billion, a PE ratio of 58.70, a PEG ratio of -56.72 and a beta of 0.99.

Boyd Group Services Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, October 29th. Investors of record on Monday, September 30th were paid a $0.15 dividend. This represents a $0.60 dividend on an annualized basis and a dividend yield of 0.28%. The ex-dividend date of this dividend was Friday, September 27th. Boyd Group Services's payout ratio is 16.00%.

Insider Buying and Selling

In other news, Senior Officer Jeff Murray acquired 456 shares of the firm's stock in a transaction that occurred on Monday, August 12th. The stock was acquired at an average cost of C$223.12 per share, with a total value of C$101,742.72. Corporate insiders own 0.37% of the company's stock.

About Boyd Group Services

(

Get Free Report)

Boyd Group Services Inc, together with its subsidiaries, operates non-franchised collision repair centers in North America. The company operates its locations under the Boyd Autobody & Glass and Assured Automotive names in Canada; and Gerber Collision & Glass name in the United States. It also operates as a retail auto glass operator under the Gerber Collision & Glass, Glass America, Auto Glass Service, Auto Glass Authority, and Autoglassonly.com names in the United States.

See Also

Before you consider Boyd Group Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boyd Group Services wasn't on the list.

While Boyd Group Services currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.