Sumitomo Mitsui Trust Group Inc. raised its position in shares of Carnival Co. & plc (NYSE:CCL - Free Report) by 1.2% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 2,490,686 shares of the company's stock after buying an additional 28,403 shares during the quarter. Sumitomo Mitsui Trust Group Inc. owned about 0.22% of Carnival Co. & worth $46,028,000 at the end of the most recent quarter.

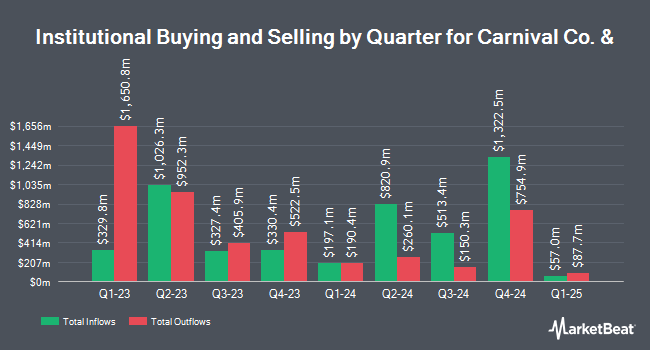

A number of other hedge funds have also recently modified their holdings of CCL. Apollon Wealth Management LLC raised its stake in Carnival Co. & by 25.1% during the third quarter. Apollon Wealth Management LLC now owns 20,250 shares of the company's stock valued at $374,000 after buying an additional 4,062 shares during the last quarter. Ashton Thomas Securities LLC bought a new position in Carnival Co. & in the 3rd quarter worth about $25,000. River Global Investors LLP grew its position in Carnival Co. & by 5.0% during the 3rd quarter. River Global Investors LLP now owns 72,907 shares of the company's stock valued at $1,348,000 after purchasing an additional 3,471 shares during the last quarter. Sigma Planning Corp increased its stake in Carnival Co. & by 23.7% during the 3rd quarter. Sigma Planning Corp now owns 39,877 shares of the company's stock valued at $737,000 after purchasing an additional 7,633 shares in the last quarter. Finally, Assetmark Inc. raised its holdings in Carnival Co. & by 1,431.5% in the third quarter. Assetmark Inc. now owns 1,654 shares of the company's stock worth $31,000 after buying an additional 1,546 shares during the last quarter. Institutional investors own 67.19% of the company's stock.

Carnival Co. & Stock Performance

NYSE:CCL remained flat at $24.31 during trading hours on Friday. The company's stock had a trading volume of 18,241,910 shares, compared to its average volume of 29,568,859. The company has a debt-to-equity ratio of 3.10, a current ratio of 0.30 and a quick ratio of 0.26. The company has a market capitalization of $28.06 billion, a PE ratio of 21.69 and a beta of 2.66. Carnival Co. & plc has a 1-year low of $13.78 and a 1-year high of $24.99. The company's 50 day moving average price is $20.31 and its 200 day moving average price is $17.64.

Carnival Co. & (NYSE:CCL - Get Free Report) last announced its quarterly earnings results on Monday, September 30th. The company reported $1.27 earnings per share for the quarter, topping the consensus estimate of $1.17 by $0.10. Carnival Co. & had a net margin of 6.39% and a return on equity of 22.30%. The company had revenue of $7.90 billion for the quarter, compared to analysts' expectations of $7.82 billion. During the same quarter in the previous year, the business posted $0.86 earnings per share. Carnival Co. &'s quarterly revenue was up 15.2% on a year-over-year basis. Equities research analysts predict that Carnival Co. & plc will post 1.33 EPS for the current year.

Insider Activity at Carnival Co. &

In other Carnival Co. & news, Director Sir Jonathon Band sold 17,500 shares of the business's stock in a transaction on Tuesday, October 29th. The shares were sold at an average price of $21.72, for a total transaction of $380,100.00. Following the transaction, the director now owns 65,789 shares in the company, valued at $1,428,937.08. The trade was a 21.01 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. 11.00% of the stock is owned by insiders.

Wall Street Analyst Weigh In

CCL has been the subject of several analyst reports. Morgan Stanley raised their price target on shares of Carnival Co. & from $15.00 to $16.50 and gave the company an "underweight" rating in a research report on Tuesday, October 1st. Citigroup increased their price objective on Carnival Co. & from $25.00 to $28.00 and gave the company a "buy" rating in a research report on Wednesday, October 9th. Hsbc Global Res raised Carnival Co. & to a "moderate sell" rating in a research report on Tuesday, September 3rd. JPMorgan Chase & Co. raised their price target on shares of Carnival Co. & from $23.00 to $25.00 and gave the company an "overweight" rating in a report on Wednesday, July 24th. Finally, Macquarie boosted their price objective on shares of Carnival Co. & from $25.00 to $26.00 and gave the company an "outperform" rating in a report on Thursday, October 3rd. One analyst has rated the stock with a sell rating, two have issued a hold rating and fourteen have issued a buy rating to the company's stock. According to MarketBeat.com, Carnival Co. & presently has an average rating of "Moderate Buy" and a consensus target price of $23.78.

Read Our Latest Analysis on Carnival Co. &

About Carnival Co. &

(

Free Report)

Carnival Corporation & plc engages in the provision of leisure travel services in North America, Australia, Europe, Asia, and internationally. The company operates through four segments: NAA Cruise Operations, Europe Cruise Operations, Cruise Support, and Tour and Other. It operates port destinations, private islands, and a solar park, as well as owns and operates hotels, lodges, glass-domed railcars, and motor coaches.

Featured Articles

Before you consider Carnival Co. &, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carnival Co. & wasn't on the list.

While Carnival Co. & currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.