Sumitomo Mitsui Trust Group Inc. cut its stake in shares of Joby Aviation, Inc. (NYSE:JOBY - Free Report) by 6.2% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 2,602,424 shares of the company's stock after selling 170,877 shares during the period. Sumitomo Mitsui Trust Group Inc. owned about 0.36% of Joby Aviation worth $13,090,000 at the end of the most recent quarter.

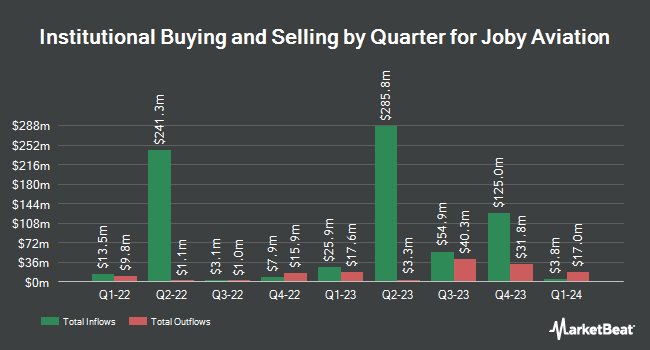

Several other institutional investors and hedge funds also recently bought and sold shares of the stock. Vanguard Group Inc. lifted its position in Joby Aviation by 9.1% during the first quarter. Vanguard Group Inc. now owns 34,659,624 shares of the company's stock valued at $185,776,000 after purchasing an additional 2,889,012 shares in the last quarter. Ieq Capital LLC lifted its position in Joby Aviation by 68.6% during the second quarter. Ieq Capital LLC now owns 4,441,574 shares of the company's stock valued at $22,652,000 after purchasing an additional 1,807,054 shares in the last quarter. Healthcare of Ontario Pension Plan Trust Fund purchased a new position in Joby Aviation during the first quarter valued at $15,357,000. Bank of New York Mellon Corp lifted its position in Joby Aviation by 41.8% during the second quarter. Bank of New York Mellon Corp now owns 1,474,677 shares of the company's stock valued at $7,521,000 after purchasing an additional 435,069 shares in the last quarter. Finally, Susquehanna Fundamental Investments LLC lifted its position in Joby Aviation by 1,018.5% during the second quarter. Susquehanna Fundamental Investments LLC now owns 677,116 shares of the company's stock valued at $3,453,000 after purchasing an additional 616,579 shares in the last quarter. 45.54% of the stock is currently owned by hedge funds and other institutional investors.

Joby Aviation Trading Down 2.0 %

Shares of NYSE:JOBY traded down $0.12 during mid-day trading on Monday, reaching $5.62. The stock had a trading volume of 11,724,649 shares, compared to its average volume of 7,450,668. The company has a market cap of $4.02 billion, a P/E ratio of -8.09 and a beta of 1.97. Joby Aviation, Inc. has a 1 year low of $4.50 and a 1 year high of $7.69. The business's 50 day moving average price is $5.43 and its 200 day moving average price is $5.34.

Joby Aviation (NYSE:JOBY - Get Free Report) last posted its earnings results on Wednesday, November 6th. The company reported ($0.21) EPS for the quarter, missing analysts' consensus estimates of ($0.19) by ($0.02). The firm had revenue of $0.28 million during the quarter, compared to analysts' expectations of $0.06 million. Joby Aviation had a negative return on equity of 51.76% and a negative net margin of 42,844.57%. During the same quarter in the prior year, the firm posted ($0.13) earnings per share. Analysts predict that Joby Aviation, Inc. will post -0.69 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several equities analysts have recently commented on the company. Canaccord Genuity Group lowered their price objective on Joby Aviation from $10.50 to $9.75 and set a "buy" rating on the stock in a research report on Tuesday, October 29th. Cantor Fitzgerald restated an "overweight" rating and issued a $10.00 price objective on shares of Joby Aviation in a research report on Monday, September 30th. JPMorgan Chase & Co. lowered their price objective on Joby Aviation from $6.00 to $5.00 and set a "neutral" rating on the stock in a research report on Tuesday, October 29th. Finally, HC Wainwright restated a "buy" rating and issued a $9.00 price objective on shares of Joby Aviation in a research report on Wednesday, October 2nd.

View Our Latest Stock Analysis on JOBY

Insider Buying and Selling at Joby Aviation

In related news, insider Kate Dehoff sold 27,898 shares of the stock in a transaction that occurred on Wednesday, October 16th. The stock was sold at an average price of $5.50, for a total value of $153,439.00. Following the transaction, the insider now owns 199,413 shares of the company's stock, valued at $1,096,771.50. This represents a 12.27 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Matthew Field sold 5,643 shares of the stock in a transaction that occurred on Monday, October 7th. The stock was sold at an average price of $5.96, for a total value of $33,632.28. Following the completion of the transaction, the insider now directly owns 293,143 shares in the company, valued at approximately $1,747,132.28. This trade represents a 1.89 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 525,499 shares of company stock worth $2,667,151 over the last ninety days. Company insiders own 32.40% of the company's stock.

Joby Aviation Profile

(

Free Report)

Joby Aviation, Inc, a vertically integrated air mobility company, engages in building an electric vertical takeoff and landing aircraft optimized to deliver air transportation as a service. The company intends to build an aerial ridesharing service, as well as developing an application-based platform that will enable consumers to book rides.

Further Reading

Before you consider Joby Aviation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Joby Aviation wasn't on the list.

While Joby Aviation currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.