Summit Global Investments decreased its position in UBS Group AG (NYSE:UBS - Free Report) by 50.9% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 23,445 shares of the bank's stock after selling 24,287 shares during the quarter. Summit Global Investments' holdings in UBS Group were worth $725,000 at the end of the most recent quarter.

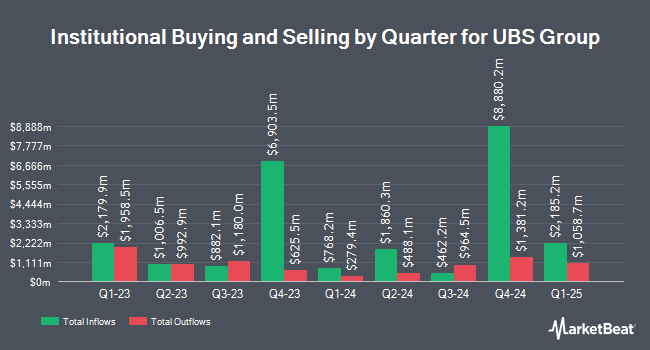

A number of other institutional investors also recently modified their holdings of UBS. Drive Wealth Management LLC lifted its position in shares of UBS Group by 3.2% in the 2nd quarter. Drive Wealth Management LLC now owns 11,100 shares of the bank's stock worth $328,000 after purchasing an additional 349 shares during the period. Rosenberg Matthew Hamilton boosted its position in UBS Group by 15.6% during the 3rd quarter. Rosenberg Matthew Hamilton now owns 2,624 shares of the bank's stock valued at $81,000 after acquiring an additional 355 shares in the last quarter. D Orazio & Associates Inc. grew its holdings in shares of UBS Group by 3.5% during the 1st quarter. D Orazio & Associates Inc. now owns 11,264 shares of the bank's stock worth $346,000 after acquiring an additional 381 shares during the period. Parallel Advisors LLC raised its position in shares of UBS Group by 2.6% in the 2nd quarter. Parallel Advisors LLC now owns 16,552 shares of the bank's stock worth $489,000 after acquiring an additional 420 shares in the last quarter. Finally, Traveka Wealth LLC raised its position in shares of UBS Group by 6.2% in the 2nd quarter. Traveka Wealth LLC now owns 7,466 shares of the bank's stock worth $221,000 after acquiring an additional 435 shares in the last quarter.

UBS Group Price Performance

NYSE UBS traded down $0.74 during trading on Friday, hitting $32.34. 1,739,990 shares of the stock traded hands, compared to its average volume of 1,418,295. The company has a quick ratio of 1.05, a current ratio of 1.05 and a debt-to-equity ratio of 3.87. The company has a market capitalization of $103.70 billion, a P/E ratio of 26.95 and a beta of 1.15. UBS Group AG has a 12-month low of $24.07 and a 12-month high of $33.34. The firm has a 50-day simple moving average of $31.01 and a 200-day simple moving average of $30.37.

UBS Group (NYSE:UBS - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The bank reported $0.43 EPS for the quarter, topping the consensus estimate of $0.28 by $0.15. The company had revenue of $19.31 billion during the quarter, compared to analyst estimates of $11.20 billion. UBS Group had a net margin of 5.13% and a return on equity of 4.69%. During the same period in the previous year, the firm earned ($0.24) earnings per share. As a group, analysts predict that UBS Group AG will post 1.45 EPS for the current year.

Analysts Set New Price Targets

A number of equities analysts have issued reports on the company. Bank of America started coverage on UBS Group in a report on Thursday, September 19th. They issued a "neutral" rating for the company. StockNews.com upgraded shares of UBS Group from a "hold" rating to a "buy" rating in a report on Friday, November 1st. Three research analysts have rated the stock with a hold rating and three have issued a buy rating to the company. According to MarketBeat, UBS Group has an average rating of "Moderate Buy".

Check Out Our Latest Stock Report on UBS Group

UBS Group Profile

(

Free Report)

UBS Group AG provides financial advice and solutions to private, institutional, and corporate clients worldwide. It operates through five divisions: Global Wealth Management, Personal & Corporate Banking, Asset Management, Investment Bank, and Non-core and Legacy. The company offers investment advice, estate and wealth planning, investing, corporate and banking, and investment management, as well as mortgage, securities-based, and structured lending solutions.

Further Reading

Before you consider UBS Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UBS Group wasn't on the list.

While UBS Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.