Tapestry (NYSE:TPR - Get Free Report) had its price target upped by stock analysts at Robert W. Baird from $58.00 to $64.00 in a note issued to investors on Friday,Benzinga reports. The firm presently has an "outperform" rating on the luxury accessories retailer's stock. Robert W. Baird's price target would suggest a potential upside of 11.83% from the company's previous close.

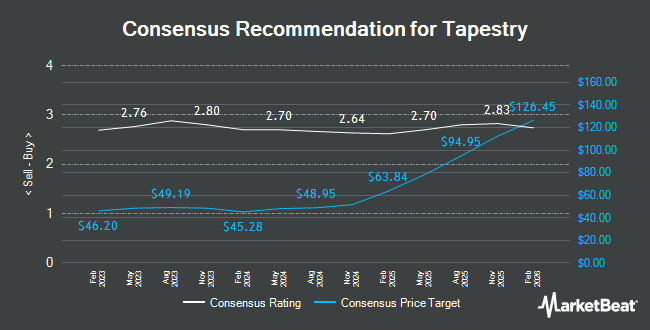

TPR has been the topic of several other research reports. Telsey Advisory Group upped their price target on shares of Tapestry from $58.00 to $67.00 and gave the stock an "outperform" rating in a research report on Friday. Wells Fargo & Company upped their target price on shares of Tapestry from $50.00 to $65.00 and gave the company an "overweight" rating in a research report on Friday, October 25th. JPMorgan Chase & Co. upped their target price on shares of Tapestry from $51.00 to $66.00 and gave the company an "overweight" rating in a research report on Friday, October 25th. Raymond James restated an "outperform" rating and set a $57.00 target price (up from $55.00) on shares of Tapestry in a research report on Friday, November 8th. Finally, Evercore ISI upped their target price on shares of Tapestry from $47.00 to $63.00 and gave the company an "outperform" rating in a research report on Friday, October 25th. Five investment analysts have rated the stock with a hold rating and eleven have given a buy rating to the stock. According to MarketBeat.com, Tapestry currently has a consensus rating of "Moderate Buy" and an average price target of $57.69.

Read Our Latest Analysis on Tapestry

Tapestry Price Performance

NYSE TPR traded down $0.59 on Friday, hitting $57.23. 4,443,701 shares of the company were exchanged, compared to its average volume of 3,337,417. The firm has a 50 day moving average of $46.21 and a two-hundred day moving average of $42.83. The company has a market cap of $13.34 billion, a P/E ratio of 16.53, a P/E/G ratio of 1.78 and a beta of 1.53. The company has a current ratio of 4.93, a quick ratio of 4.38 and a debt-to-equity ratio of 2.35. Tapestry has a 1-year low of $29.83 and a 1-year high of $58.49.

Tapestry (NYSE:TPR - Get Free Report) last issued its quarterly earnings results on Thursday, August 15th. The luxury accessories retailer reported $0.92 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.88 by $0.04. The business had revenue of $1.59 billion for the quarter, compared to the consensus estimate of $1.58 billion. Tapestry had a net margin of 12.12% and a return on equity of 36.26%. The firm's quarterly revenue was down 1.8% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.95 EPS. On average, equities analysts predict that Tapestry will post 4.54 EPS for the current year.

Institutional Trading of Tapestry

Hedge funds and other institutional investors have recently made changes to their positions in the business. Waldron Private Wealth LLC acquired a new stake in shares of Tapestry in the third quarter valued at approximately $25,000. Massmutual Trust Co. FSB ADV grew its stake in shares of Tapestry by 54.0% in the second quarter. Massmutual Trust Co. FSB ADV now owns 935 shares of the luxury accessories retailer's stock valued at $40,000 after buying an additional 328 shares in the last quarter. Brooklyn Investment Group bought a new position in shares of Tapestry in the third quarter valued at $47,000. Blue Trust Inc. grew its stake in shares of Tapestry by 111.9% in the second quarter. Blue Trust Inc. now owns 1,053 shares of the luxury accessories retailer's stock valued at $50,000 after buying an additional 556 shares in the last quarter. Finally, MUFG Securities EMEA plc grew its stake in shares of Tapestry by 34.9% in the second quarter. MUFG Securities EMEA plc now owns 1,226 shares of the luxury accessories retailer's stock valued at $52,000 after buying an additional 317 shares in the last quarter. 90.77% of the stock is currently owned by institutional investors and hedge funds.

About Tapestry

(

Get Free Report)

Tapestry, Inc provides luxury accessories and branded lifestyle products in the United States, Japan, Greater China, and internationally. The company operates in three segments: Coach, Kate Spade, and Stuart Weitzman. It offers women's handbags; and women's accessories, such as small leather goods which includes mini and micro handbags, money pieces, wristlets, pouches, and cosmetic cases, as well as novelty accessories including address books, time management and travel accessories, sketchbooks, and portfolios; and belts, key rings, and charms.

Recommended Stories

Before you consider Tapestry, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tapestry wasn't on the list.

While Tapestry currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.