Take-Two Interactive Software (NASDAQ:TTWO - Get Free Report) had its price objective increased by equities researchers at TD Cowen from $176.00 to $211.00 in a note issued to investors on Friday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. TD Cowen's price objective would indicate a potential upside of 12.52% from the stock's current price.

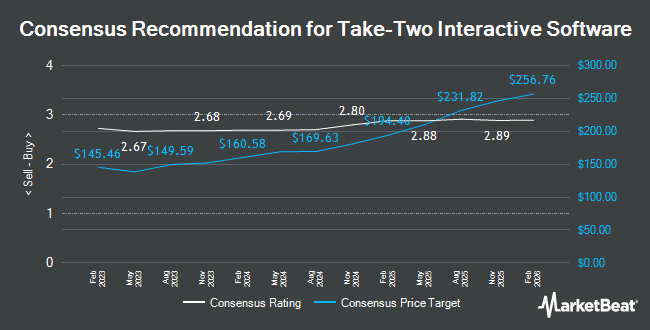

TTWO has been the topic of a number of other reports. Roth Mkm boosted their price target on Take-Two Interactive Software from $182.00 to $208.00 and gave the stock a "buy" rating in a research report on Tuesday. JPMorgan Chase & Co. cut their target price on shares of Take-Two Interactive Software from $200.00 to $195.00 and set an "overweight" rating for the company in a research report on Tuesday, October 22nd. BMO Capital Markets raised their price target on Take-Two Interactive Software from $185.00 to $190.00 and gave the stock an "outperform" rating in a research note on Thursday, November 7th. Benchmark increased their target price on Take-Two Interactive Software from $200.00 to $210.00 and gave the company a "buy" rating in a report on Wednesday, August 21st. Finally, Redburn Atlantic started coverage on shares of Take-Two Interactive Software in a research note on Thursday, August 29th. They set a "buy" rating and a $194.00 price target on the stock. Two research analysts have rated the stock with a hold rating, eighteen have given a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $191.75.

Get Our Latest Stock Report on TTWO

Take-Two Interactive Software Stock Up 0.5 %

Take-Two Interactive Software stock traded up $0.95 during trading hours on Friday, hitting $187.53. 312,245 shares of the stock traded hands, compared to its average volume of 1,600,423. Take-Two Interactive Software has a one year low of $135.24 and a one year high of $187.76. The firm's 50-day moving average price is $161.46 and its two-hundred day moving average price is $156.14. The company has a current ratio of 0.85, a quick ratio of 0.85 and a debt-to-equity ratio of 0.53. The company has a market cap of $32.94 billion, a PE ratio of -8.86, a PEG ratio of 5.61 and a beta of 0.85.

Insider Activity at Take-Two Interactive Software

In other Take-Two Interactive Software news, Director Laverne Evans Srinivasan sold 2,000 shares of the stock in a transaction dated Friday, November 8th. The shares were sold at an average price of $179.17, for a total transaction of $358,340.00. Following the completion of the transaction, the director now owns 9,692 shares of the company's stock, valued at $1,736,515.64. This trade represents a 17.11 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. 1.45% of the stock is currently owned by insiders.

Hedge Funds Weigh In On Take-Two Interactive Software

Several large investors have recently made changes to their positions in the stock. Itau Unibanco Holding S.A. acquired a new stake in shares of Take-Two Interactive Software in the third quarter valued at $27,000. Crewe Advisors LLC grew its position in shares of Take-Two Interactive Software by 297.9% during the second quarter. Crewe Advisors LLC now owns 191 shares of the company's stock worth $30,000 after buying an additional 143 shares in the last quarter. UMB Bank n.a. increased its stake in shares of Take-Two Interactive Software by 155.1% during the second quarter. UMB Bank n.a. now owns 199 shares of the company's stock worth $31,000 after buying an additional 121 shares during the period. Truvestments Capital LLC acquired a new stake in Take-Two Interactive Software in the third quarter valued at approximately $31,000. Finally, HHM Wealth Advisors LLC purchased a new position in Take-Two Interactive Software in the second quarter worth approximately $37,000. 95.46% of the stock is currently owned by institutional investors and hedge funds.

About Take-Two Interactive Software

(

Get Free Report)

Take-Two Interactive Software, Inc develops, publishes, and markets interactive entertainment solutions for consumers worldwide. It develops and publishes action/adventure products under the Grand Theft Auto, LA Noire, Max Payne, Midnight Club, and Red Dead Redemption names, as well as other franchises.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Take-Two Interactive Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Take-Two Interactive Software wasn't on the list.

While Take-Two Interactive Software currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.