Telemark Asset Management LLC acquired a new position in Agnico Eagle Mines Limited (NYSE:AEM - Free Report) TSE: AEM in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor acquired 100,000 shares of the mining company's stock, valued at approximately $8,056,000.

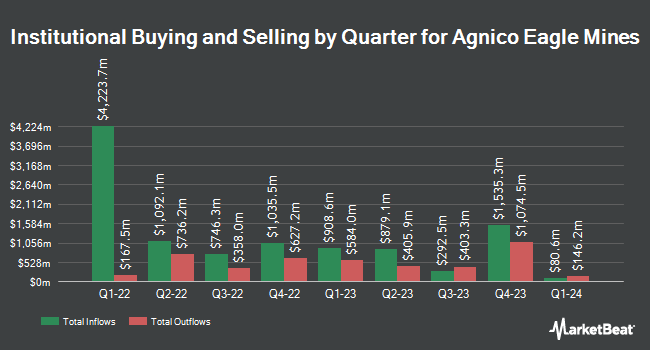

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Continuum Advisory LLC raised its stake in shares of Agnico Eagle Mines by 1,134.4% in the 2nd quarter. Continuum Advisory LLC now owns 395 shares of the mining company's stock valued at $26,000 after acquiring an additional 363 shares during the period. Abich Financial Wealth Management LLC purchased a new stake in Agnico Eagle Mines in the second quarter valued at approximately $32,000. FSC Wealth Advisors LLC acquired a new position in Agnico Eagle Mines during the third quarter worth $32,000. McClarren Financial Advisors Inc. boosted its position in shares of Agnico Eagle Mines by 684.6% during the third quarter. McClarren Financial Advisors Inc. now owns 510 shares of the mining company's stock worth $41,000 after buying an additional 445 shares during the period. Finally, WASHINGTON TRUST Co grew its stake in shares of Agnico Eagle Mines by 92.1% in the second quarter. WASHINGTON TRUST Co now owns 730 shares of the mining company's stock valued at $48,000 after buying an additional 350 shares in the last quarter. Institutional investors and hedge funds own 68.34% of the company's stock.

Wall Street Analyst Weigh In

AEM has been the subject of a number of research analyst reports. TD Securities raised their target price on Agnico Eagle Mines from $90.00 to $91.00 and gave the company a "buy" rating in a report on Friday, August 2nd. Royal Bank of Canada boosted their price target on shares of Agnico Eagle Mines from $80.00 to $87.00 and gave the stock an "outperform" rating in a report on Tuesday, September 10th. UBS Group started coverage on shares of Agnico Eagle Mines in a research report on Tuesday, September 17th. They issued a "buy" rating and a $95.00 price objective on the stock. Scotiabank lifted their price objective on shares of Agnico Eagle Mines from $81.00 to $94.00 and gave the stock a "sector outperform" rating in a research report on Monday, August 19th. Finally, Jefferies Financial Group increased their target price on Agnico Eagle Mines from $68.00 to $85.00 and gave the company a "hold" rating in a report on Friday, October 4th. One research analyst has rated the stock with a hold rating and eight have assigned a buy rating to the company. Based on data from MarketBeat.com, Agnico Eagle Mines presently has an average rating of "Moderate Buy" and a consensus target price of $86.78.

View Our Latest Analysis on AEM

Agnico Eagle Mines Stock Performance

Shares of AEM stock traded up $0.73 during trading hours on Friday, hitting $84.30. The stock had a trading volume of 1,496,193 shares, compared to its average volume of 2,657,214. The stock's 50 day moving average is $82.65 and its 200 day moving average is $75.83. The firm has a market capitalization of $42.32 billion, a PE ratio of 41.79, a PEG ratio of 0.72 and a beta of 1.09. Agnico Eagle Mines Limited has a twelve month low of $44.37 and a twelve month high of $89.00. The company has a debt-to-equity ratio of 0.06, a current ratio of 1.75 and a quick ratio of 0.83.

Agnico Eagle Mines Company Profile

(

Free Report)

Agnico Eagle Mines Limited, a gold mining company, exploration, development, and production of precious metals. It explores for gold. The company's mines are located in Canada, Australia, Finland and Mexico, with exploration and development activities in Canada, Australia, Europe, Latin America, and the United States.

Recommended Stories

Before you consider Agnico Eagle Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agnico Eagle Mines wasn't on the list.

While Agnico Eagle Mines currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.