Telemark Asset Management LLC acquired a new position in Electronic Arts Inc. (NASDAQ:EA - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 50,000 shares of the game software company's stock, valued at approximately $7,172,000.

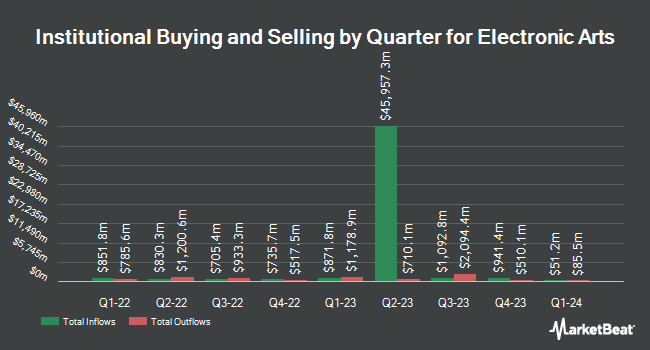

A number of other institutional investors and hedge funds have also bought and sold shares of EA. Ashton Thomas Securities LLC bought a new stake in shares of Electronic Arts during the third quarter valued at approximately $25,000. Opal Wealth Advisors LLC acquired a new stake in Electronic Arts during the second quarter valued at approximately $28,000. Family Firm Inc. bought a new stake in Electronic Arts in the second quarter valued at $33,000. New Covenant Trust Company N.A. bought a new stake in shares of Electronic Arts in the 1st quarter worth about $35,000. Finally, Reston Wealth Management LLC acquired a new stake in shares of Electronic Arts during the third quarter worth approximately $36,000. Institutional investors own 90.23% of the company's stock.

Analyst Upgrades and Downgrades

EA has been the subject of a number of research analyst reports. Robert W. Baird lifted their price target on Electronic Arts from $170.00 to $175.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. Argus upped their price objective on Electronic Arts from $161.00 to $183.00 and gave the stock a "buy" rating in a report on Thursday, November 7th. Benchmark reissued a "buy" rating and issued a $163.00 target price on shares of Electronic Arts in a research note on Wednesday, October 30th. Morgan Stanley reaffirmed an "equal weight" rating and set a $150.00 price target on shares of Electronic Arts in a research note on Wednesday, September 18th. Finally, The Goldman Sachs Group raised their price target on Electronic Arts from $139.00 to $150.00 and gave the company a "neutral" rating in a report on Wednesday, July 31st. Eight investment analysts have rated the stock with a hold rating, twelve have issued a buy rating and two have issued a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $165.37.

Get Our Latest Report on EA

Electronic Arts Stock Down 0.8 %

Shares of Electronic Arts stock traded down $1.30 on Friday, hitting $166.67. The company had a trading volume of 1,638,028 shares, compared to its average volume of 2,049,793. The stock has a 50-day moving average of $148.94 and a 200-day moving average of $143.49. The company has a debt-to-equity ratio of 0.25, a current ratio of 1.43 and a quick ratio of 1.43. Electronic Arts Inc. has a twelve month low of $124.92 and a twelve month high of $168.50. The firm has a market capitalization of $43.71 billion, a P/E ratio of 43.21, a P/E/G ratio of 2.17 and a beta of 0.78.

Electronic Arts Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Wednesday, November 27th will be issued a $0.19 dividend. The ex-dividend date of this dividend is Wednesday, November 27th. This represents a $0.76 dividend on an annualized basis and a dividend yield of 0.46%. Electronic Arts's dividend payout ratio (DPR) is 19.54%.

Insider Transactions at Electronic Arts

In other news, EVP Jacob J. Schatz sold 1,500 shares of the firm's stock in a transaction dated Wednesday, August 28th. The stock was sold at an average price of $149.32, for a total value of $223,980.00. Following the completion of the transaction, the executive vice president now owns 27,860 shares in the company, valued at $4,160,055.20. This trade represents a 5.11 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Vijayanthimala Singh sold 7,384 shares of the company's stock in a transaction dated Wednesday, August 28th. The stock was sold at an average price of $149.91, for a total value of $1,106,935.44. Following the sale, the insider now owns 31,190 shares in the company, valued at $4,675,692.90. The trade was a 19.14 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 31,384 shares of company stock valued at $4,776,635 over the last three months. Company insiders own 0.22% of the company's stock.

About Electronic Arts

(

Free Report)

Electronic Arts Inc develops, markets, publishes, and distributes games, content, and services for game consoles, PCs, mobile phones, and tablets worldwide. It develops and publishes games and services across various genres, such as sports, racing, first-person shooter, action, role-playing, and simulation primarily under the Battlefield, The Sims, Apex Legends, Need for Speed, and license games from others, including FIFA, Madden NFL, UFC, and Star Wars brands.

Featured Articles

Before you consider Electronic Arts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Electronic Arts wasn't on the list.

While Electronic Arts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.