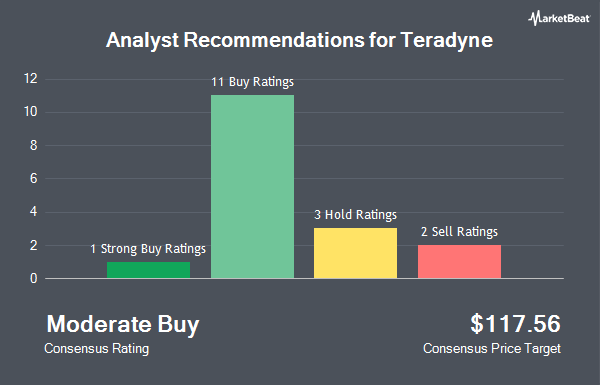

Teradyne, Inc. (NASDAQ:TER - Get Free Report) has received an average rating of "Moderate Buy" from the fourteen research firms that are currently covering the stock, Marketbeat reports. One equities research analyst has rated the stock with a sell rating, five have given a hold rating and eight have issued a buy rating on the company. The average 1-year price objective among brokers that have issued a report on the stock in the last year is $142.62.

Several research firms have recently issued reports on TER. Cantor Fitzgerald upgraded Teradyne from a "neutral" rating to an "overweight" rating and set a $160.00 price target for the company in a research note on Friday, August 16th. StockNews.com raised Teradyne from a "sell" rating to a "hold" rating in a research report on Sunday, October 27th. Stifel Nicolaus reduced their price objective on shares of Teradyne from $140.00 to $125.00 and set a "hold" rating for the company in a research note on Friday, October 25th. Evercore ISI upped their price objective on shares of Teradyne from $130.00 to $145.00 and gave the stock an "overweight" rating in a report on Wednesday, October 9th. Finally, Craig Hallum dropped their target price on shares of Teradyne from $124.00 to $111.00 and set a "hold" rating on the stock in a report on Friday, October 25th.

Get Our Latest Analysis on TER

Teradyne Stock Performance

Shares of NASDAQ TER traded down $1.35 during trading hours on Tuesday, hitting $102.80. The stock had a trading volume of 2,031,738 shares, compared to its average volume of 2,046,168. The company has a market capitalization of $16.74 billion, a P/E ratio of 32.63, a P/E/G ratio of 2.22 and a beta of 1.52. The firm's 50-day moving average price is $121.93 and its two-hundred day moving average price is $132.16. Teradyne has a 52 week low of $90.24 and a 52 week high of $163.21.

Teradyne (NASDAQ:TER - Get Free Report) last announced its quarterly earnings results on Wednesday, October 23rd. The company reported $0.90 EPS for the quarter, topping the consensus estimate of $0.78 by $0.12. The company had revenue of $737.30 million for the quarter, compared to analyst estimates of $716.40 million. Teradyne had a net margin of 18.75% and a return on equity of 18.56%. Teradyne's quarterly revenue was up 4.8% on a year-over-year basis. During the same quarter in the prior year, the business posted $0.80 EPS. As a group, analysts expect that Teradyne will post 3.17 EPS for the current fiscal year.

Teradyne declared that its board has approved a share repurchase program on Monday, November 11th that allows the company to buyback $100.00 million in shares. This buyback authorization allows the company to repurchase up to 0.6% of its shares through open market purchases. Shares buyback programs are often a sign that the company's board believes its shares are undervalued.

Teradyne Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, December 18th. Shareholders of record on Monday, November 25th will be paid a dividend of $0.12 per share. The ex-dividend date of this dividend is Monday, November 25th. This represents a $0.48 dividend on an annualized basis and a yield of 0.47%. Teradyne's dividend payout ratio is currently 15.24%.

Insider Activity

In related news, insider Richard John Burns sold 789 shares of Teradyne stock in a transaction dated Tuesday, October 1st. The shares were sold at an average price of $132.80, for a total transaction of $104,779.20. Following the completion of the transaction, the insider now directly owns 21,864 shares of the company's stock, valued at $2,903,539.20. This trade represents a 3.48 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Mercedes Johnson sold 625 shares of the company's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $133.49, for a total transaction of $83,431.25. Following the sale, the director now directly owns 16,518 shares in the company, valued at $2,204,987.82. This represents a 3.65 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 8,199 shares of company stock worth $1,080,634. Corporate insiders own 0.18% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of the business. Blair William & Co. IL lifted its position in Teradyne by 0.6% during the 1st quarter. Blair William & Co. IL now owns 15,004 shares of the company's stock worth $1,693,000 after buying an additional 83 shares in the last quarter. Vanguard Group Inc. increased its holdings in shares of Teradyne by 0.7% in the first quarter. Vanguard Group Inc. now owns 18,421,186 shares of the company's stock valued at $2,078,462,000 after purchasing an additional 135,286 shares in the last quarter. Covestor Ltd raised its position in Teradyne by 10.2% in the 1st quarter. Covestor Ltd now owns 1,162 shares of the company's stock worth $131,000 after purchasing an additional 108 shares during the last quarter. O Shaughnessy Asset Management LLC lifted its holdings in Teradyne by 17.9% during the 1st quarter. O Shaughnessy Asset Management LLC now owns 6,215 shares of the company's stock worth $701,000 after buying an additional 942 shares in the last quarter. Finally, CANADA LIFE ASSURANCE Co boosted its position in Teradyne by 17.6% in the 1st quarter. CANADA LIFE ASSURANCE Co now owns 335,636 shares of the company's stock valued at $37,887,000 after buying an additional 50,156 shares during the last quarter. 99.77% of the stock is owned by institutional investors and hedge funds.

About Teradyne

(

Get Free ReportTeradyne, Inc designs, develops, manufactures, and sells automated test systems and robotics products worldwide. It operates through four segments; Semiconductor Test, System Test, Robotics, and Wireless Test. The Semiconductor Test segment offers products and services for wafer level and device package testing of semiconductor devices in automotive, industrial, communications, consumer, smartphones, cloud, computer and electronic game, and other applications.

Further Reading

Before you consider Teradyne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teradyne wasn't on the list.

While Teradyne currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.