Victory Capital Management Inc. boosted its position in Texas Capital Bancshares, Inc. (NASDAQ:TCBI - Free Report) by 326.6% during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 70,103 shares of the bank's stock after acquiring an additional 53,669 shares during the period. Victory Capital Management Inc. owned 0.15% of Texas Capital Bancshares worth $5,010,000 as of its most recent SEC filing.

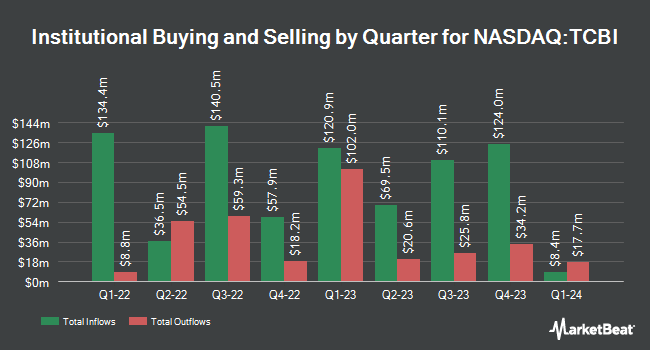

Other hedge funds have also recently added to or reduced their stakes in the company. Innealta Capital LLC purchased a new position in shares of Texas Capital Bancshares in the 2nd quarter worth about $26,000. Blue Trust Inc. increased its stake in Texas Capital Bancshares by 89.9% in the 3rd quarter. Blue Trust Inc. now owns 357 shares of the bank's stock worth $26,000 after acquiring an additional 169 shares during the last quarter. CWM LLC lifted its position in Texas Capital Bancshares by 40.8% during the second quarter. CWM LLC now owns 949 shares of the bank's stock valued at $58,000 after purchasing an additional 275 shares during the last quarter. Crossmark Global Holdings Inc. purchased a new position in shares of Texas Capital Bancshares in the 3rd quarter worth about $201,000. Finally, Vanguard Personalized Indexing Management LLC bought a new position in Texas Capital Bancshares during the second quarter valued at approximately $207,000. Institutional investors and hedge funds own 96.88% of the company's stock.

Insiders Place Their Bets

In other news, Director Robert W. Stallings purchased 20,000 shares of the company's stock in a transaction that occurred on Tuesday, October 22nd. The stock was purchased at an average cost of $21.28 per share, with a total value of $425,600.00. Following the purchase, the director now owns 84,587 shares in the company, valued at approximately $1,800,011.36. This trade represents a 30.97 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. 0.99% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

A number of brokerages have commented on TCBI. Truist Financial lifted their price target on Texas Capital Bancshares from $80.00 to $86.00 and gave the stock a "hold" rating in a research note on Monday, October 21st. Hovde Group upped their price objective on shares of Texas Capital Bancshares from $73.00 to $79.00 and gave the stock a "market perform" rating in a report on Friday, October 18th. Keefe, Bruyette & Woods reaffirmed an "outperform" rating and issued a $74.00 target price on shares of Texas Capital Bancshares in a report on Monday, September 9th. Bank of America upgraded Texas Capital Bancshares from an "underperform" rating to a "buy" rating and boosted their price target for the stock from $51.00 to $77.00 in a research note on Monday, September 9th. Finally, StockNews.com upgraded shares of Texas Capital Bancshares from a "sell" rating to a "hold" rating in a report on Wednesday, November 6th. Four analysts have rated the stock with a sell rating, nine have given a hold rating and four have issued a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Hold" and an average price target of $74.00.

Check Out Our Latest Analysis on TCBI

Texas Capital Bancshares Price Performance

TCBI traded up $2.65 on Friday, hitting $87.73. 365,680 shares of the company's stock traded hands, compared to its average volume of 520,804. The firm has a market cap of $4.05 billion, a price-to-earnings ratio of 487.39, a P/E/G ratio of 0.81 and a beta of 1.12. The company has a current ratio of 1.01, a quick ratio of 1.01 and a debt-to-equity ratio of 0.22. Texas Capital Bancshares, Inc. has a one year low of $53.69 and a one year high of $91.29. The company's 50 day simple moving average is $77.60 and its 200-day simple moving average is $67.57.

Texas Capital Bancshares (NASDAQ:TCBI - Get Free Report) last posted its earnings results on Thursday, October 17th. The bank reported $1.62 EPS for the quarter, beating analysts' consensus estimates of $0.97 by $0.65. Texas Capital Bancshares had a return on equity of 8.06% and a net margin of 1.40%. The firm had revenue of $304.91 million during the quarter, compared to the consensus estimate of $279.64 million. As a group, research analysts anticipate that Texas Capital Bancshares, Inc. will post 4.15 EPS for the current year.

Texas Capital Bancshares Profile

(

Free Report)

Texas Capital Bancshares, Inc operates as the bank holding company for Texas Capital Bank, is a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs, and individual customers. The company offers commercial banking; consumer banking; investment banking solutions, including capital markets, mergers and acquisitions, and syndicated finance, as well as financial sponsor coverage, capital solutions, and institutional services; and wealth management services, such as investment management, financial planning, lockbox and insurance, securities-based lending, estate planning, and business succession, as well as philanthropic, trustee and executor, custom credit, and depository services.

Read More

Before you consider Texas Capital Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Capital Bancshares wasn't on the list.

While Texas Capital Bancshares currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.