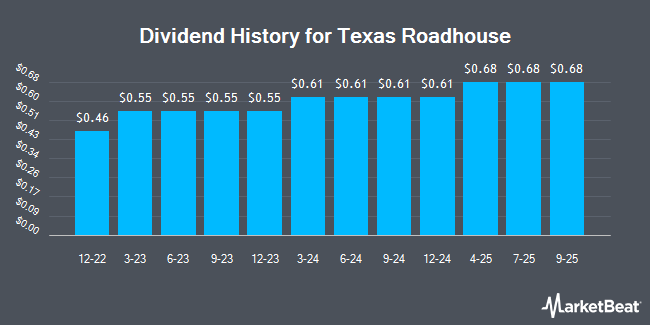

Texas Roadhouse, Inc. (NASDAQ:TXRH - Get Free Report) declared a quarterly dividend on Thursday, November 7th,Zacks Dividends reports. Investors of record on Tuesday, December 10th will be given a dividend of 0.61 per share by the restaurant operator on Tuesday, December 31st. This represents a $2.44 annualized dividend and a yield of 1.23%. The ex-dividend date is Tuesday, December 10th.

Texas Roadhouse has increased its dividend payment by an average of 82.8% per year over the last three years. Texas Roadhouse has a payout ratio of 34.1% meaning its dividend is sufficiently covered by earnings. Analysts expect Texas Roadhouse to earn $7.22 per share next year, which means the company should continue to be able to cover its $2.44 annual dividend with an expected future payout ratio of 33.8%.

Texas Roadhouse Stock Performance

TXRH stock traded up $1.18 during midday trading on Friday, reaching $197.77. 504,653 shares of the company's stock traded hands, compared to its average volume of 775,453. The firm has a market capitalization of $13.19 billion, a PE ratio of 33.98, a price-to-earnings-growth ratio of 1.69 and a beta of 0.98. The company has a 50-day moving average price of $177.12 and a two-hundred day moving average price of $171.34. Texas Roadhouse has a 52 week low of $101.73 and a 52 week high of $201.24.

Texas Roadhouse (NASDAQ:TXRH - Get Free Report) last announced its quarterly earnings results on Thursday, October 24th. The restaurant operator reported $1.26 EPS for the quarter, missing the consensus estimate of $1.32 by ($0.06). The firm had revenue of $1.27 billion during the quarter, compared to the consensus estimate of $1.27 billion. Texas Roadhouse had a net margin of 7.65% and a return on equity of 31.33%. The firm's revenue for the quarter was up 13.5% on a year-over-year basis. During the same period in the previous year, the business earned $0.95 earnings per share. As a group, analysts predict that Texas Roadhouse will post 6.39 EPS for the current fiscal year.

Analyst Ratings Changes

Several research firms have weighed in on TXRH. Robert W. Baird raised their price target on Texas Roadhouse from $190.00 to $205.00 and gave the company an "outperform" rating in a report on Friday, October 25th. Evercore ISI raised their target price on shares of Texas Roadhouse from $195.00 to $200.00 and gave the company an "outperform" rating in a research note on Tuesday, October 15th. Wedbush lifted their target price on shares of Texas Roadhouse from $190.00 to $200.00 and gave the company an "outperform" rating in a research report on Friday, October 25th. Guggenheim increased their price target on shares of Texas Roadhouse from $190.00 to $195.00 and gave the stock a "buy" rating in a report on Wednesday, September 25th. Finally, Loop Capital dropped their price objective on shares of Texas Roadhouse from $215.00 to $209.00 and set a "buy" rating for the company in a report on Monday, October 28th. Twelve equities research analysts have rated the stock with a hold rating and eleven have issued a buy rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $189.00.

Check Out Our Latest Report on TXRH

About Texas Roadhouse

(

Get Free Report)

Texas Roadhouse, Inc, together with its subsidiaries, operates casual dining restaurants in the United States and internationally. It also operates and franchises restaurants under the Texas Roadhouse, Bubba's 33, and Jaggers names in 49 states and ten internationally. Texas Roadhouse, Inc was founded in 1993 and is based in Louisville, Kentucky.

Further Reading

Before you consider Texas Roadhouse, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Roadhouse wasn't on the list.

While Texas Roadhouse currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.