The Cigna Group (NYSE:CI - Get Free Report) updated its FY24 earnings guidance on Monday. The company provided earnings per share guidance of at least $28.40 for the period, compared to the consensus earnings per share estimate of $28.50. The Cigna Group also updated its FY 2024 guidance to 28.400- EPS.

The Cigna Group Trading Up 7.5 %

NYSE:CI traded up $23.96 during mid-day trading on Monday, hitting $343.73. The company had a trading volume of 1,968,771 shares, compared to its average volume of 1,537,131. The company has a debt-to-equity ratio of 0.71, a quick ratio of 0.72 and a current ratio of 0.72. The Cigna Group has a fifty-two week low of $253.95 and a fifty-two week high of $370.83. The firm has a market cap of $95.61 billion, a P/E ratio of 32.45, a P/E/G ratio of 0.96 and a beta of 0.51. The business's fifty day moving average is $341.73 and its two-hundred day moving average is $340.26.

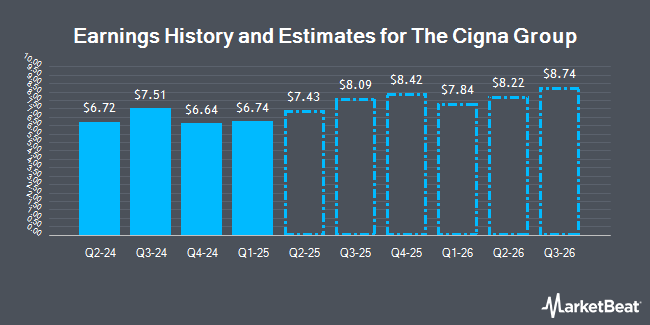

The Cigna Group (NYSE:CI - Get Free Report) last announced its quarterly earnings results on Thursday, October 31st. The health services provider reported $7.51 earnings per share for the quarter, topping analysts' consensus estimates of $7.22 by $0.29. The company had revenue of $63.70 billion for the quarter, compared to analysts' expectations of $59.58 billion. The Cigna Group had a net margin of 1.31% and a return on equity of 18.42%. The business's quarterly revenue was up 29.8% compared to the same quarter last year. During the same period last year, the firm posted $6.77 earnings per share. As a group, research analysts expect that The Cigna Group will post 28.5 earnings per share for the current year.

The Cigna Group Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Thursday, December 19th. Investors of record on Wednesday, December 4th will be given a $1.40 dividend. This represents a $5.60 dividend on an annualized basis and a dividend yield of 1.63%. The ex-dividend date of this dividend is Wednesday, December 4th. The Cigna Group's payout ratio is currently 52.83%.

Analyst Upgrades and Downgrades

Several research analysts have recently issued reports on CI shares. Piper Sandler reiterated an "overweight" rating and set a $394.00 price target (up from $392.00) on shares of The Cigna Group in a report on Tuesday, November 5th. JPMorgan Chase & Co. lifted their target price on shares of The Cigna Group from $435.00 to $438.00 and gave the stock an "overweight" rating in a research report on Wednesday, August 21st. Deutsche Bank Aktiengesellschaft dropped their price target on shares of The Cigna Group from $398.00 to $394.00 and set a "buy" rating for the company in a research note on Monday, November 4th. Cantor Fitzgerald reaffirmed an "overweight" rating and set a $400.00 target price on shares of The Cigna Group in a report on Wednesday, October 23rd. Finally, Jefferies Financial Group raised their price objective on The Cigna Group from $402.00 to $422.00 and gave the stock a "buy" rating in a research report on Tuesday, September 17th. One analyst has rated the stock with a hold rating, fourteen have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Buy" and a consensus target price of $394.64.

Check Out Our Latest Stock Analysis on CI

Insider Buying and Selling at The Cigna Group

In other news, Director William J. Delaney III sold 2,691 shares of the company's stock in a transaction dated Monday, August 19th. The shares were sold at an average price of $342.68, for a total value of $922,151.88. Following the sale, the director now directly owns 17,539 shares of the company's stock, valued at $6,010,264.52. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Corporate insiders own 0.60% of the company's stock.

About The Cigna Group

(

Get Free Report)

The Cigna Group, together with its subsidiaries, provides insurance and related products and services in the United States. Its Evernorth Health Services segment provides a range of coordinated and point solution health services, including pharmacy benefits, home delivery pharmacy, specialty pharmacy, distribution, and care delivery and management solutions to health plans, employers, government organizations, and health care providers.

Featured Stories

Before you consider The Cigna Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Cigna Group wasn't on the list.

While The Cigna Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.