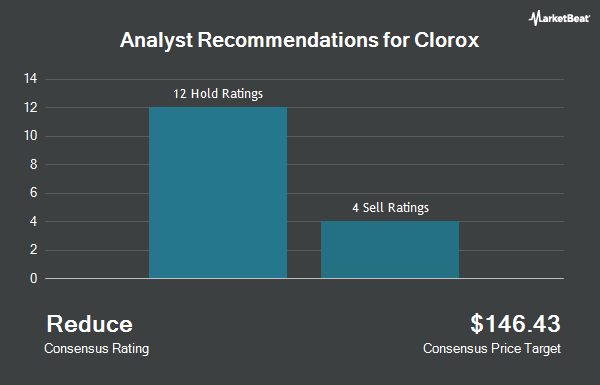

The Clorox Company (NYSE:CLX - Get Free Report) has earned an average recommendation of "Reduce" from the fifteen research firms that are currently covering the stock, MarketBeat reports. Five research analysts have rated the stock with a sell rating, nine have assigned a hold rating and one has issued a buy rating on the company. The average 12 month price objective among brokers that have updated their coverage on the stock in the last year is $155.00.

A number of equities analysts have recently weighed in on the stock. Jefferies Financial Group raised shares of Clorox from a "hold" rating to a "buy" rating and boosted their price objective for the company from $174.00 to $187.00 in a research report on Tuesday, October 1st. Barclays boosted their price target on Clorox from $137.00 to $139.00 and gave the company an "underweight" rating in a report on Friday, November 1st. Deutsche Bank Aktiengesellschaft raised their price objective on Clorox from $144.00 to $151.00 and gave the stock a "hold" rating in a report on Friday, August 2nd. Citigroup upped their target price on Clorox from $165.00 to $170.00 and gave the company a "neutral" rating in a research note on Friday, September 6th. Finally, TD Cowen upgraded Clorox from a "sell" rating to a "hold" rating and increased their target price for the stock from $155.00 to $170.00 in a research report on Wednesday, November 6th.

Check Out Our Latest Stock Analysis on CLX

Insider Activity

In other Clorox news, EVP Angela C. Hilt sold 1,733 shares of the company's stock in a transaction dated Friday, September 6th. The shares were sold at an average price of $165.52, for a total value of $286,846.16. Following the completion of the transaction, the executive vice president now directly owns 13,471 shares of the company's stock, valued at $2,229,719.92. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Insiders own 0.57% of the company's stock.

Hedge Funds Weigh In On Clorox

Several institutional investors and hedge funds have recently made changes to their positions in CLX. Russell Investments Group Ltd. lifted its holdings in Clorox by 25.7% during the 1st quarter. Russell Investments Group Ltd. now owns 149,357 shares of the company's stock worth $22,862,000 after buying an additional 30,497 shares during the last quarter. Entropy Technologies LP acquired a new position in Clorox in the first quarter worth $961,000. State Board of Administration of Florida Retirement System increased its stake in Clorox by 4.1% during the first quarter. State Board of Administration of Florida Retirement System now owns 150,011 shares of the company's stock valued at $23,738,000 after purchasing an additional 5,936 shares during the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. raised its holdings in shares of Clorox by 9.4% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 186,301 shares of the company's stock worth $28,525,000 after purchasing an additional 16,012 shares during the period. Finally, Wilkins Investment Counsel Inc. lifted its position in shares of Clorox by 51.6% in the 1st quarter. Wilkins Investment Counsel Inc. now owns 16,514 shares of the company's stock worth $2,528,000 after buying an additional 5,624 shares during the last quarter. 78.53% of the stock is currently owned by hedge funds and other institutional investors.

Clorox Price Performance

NYSE:CLX traded up $0.51 during trading hours on Wednesday, reaching $165.30. 388,120 shares of the company traded hands, compared to its average volume of 1,241,731. The company has a debt-to-equity ratio of 11.08, a current ratio of 1.00 and a quick ratio of 0.62. The firm's 50-day moving average is $162.35 and its 200-day moving average is $147.08. The stock has a market cap of $20.46 billion, a P/E ratio of 57.70, a P/E/G ratio of 3.04 and a beta of 0.41. Clorox has a 1-year low of $127.60 and a 1-year high of $169.09.

Clorox (NYSE:CLX - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The company reported $1.86 EPS for the quarter, beating analysts' consensus estimates of $1.36 by $0.50. The business had revenue of $1.76 billion for the quarter, compared to analyst estimates of $1.64 billion. Clorox had a return on equity of 316.08% and a net margin of 4.78%. The business's revenue for the quarter was up 27.0% compared to the same quarter last year. During the same quarter last year, the company earned $0.49 earnings per share. Equities research analysts expect that Clorox will post 6.85 earnings per share for the current fiscal year.

Clorox Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Thursday, November 7th. Stockholders of record on Wednesday, October 23rd were given a $1.22 dividend. This represents a $4.88 annualized dividend and a dividend yield of 2.95%. The ex-dividend date of this dividend was Wednesday, October 23rd. Clorox's payout ratio is 170.04%.

About Clorox

(

Get Free ReportThe Clorox Company manufactures and markets consumer and professional products worldwide. It operates through four segments: Health and Wellness, Household, Lifestyle, and International. The Health and Wellness segment offers cleaning products, such as laundry additives and home care products primarily under the Clorox, Clorox2, Scentiva, Pine-Sol, Liquid-Plumr, Tilex, and Formula 409 brands; professional cleaning and disinfecting products under the CloroxPro and Clorox Healthcare brands; professional food service products under the Hidden Valley brand; and vitamins, minerals and supplement products under the RenewLife, Natural Vitality, NeoCell, and Rainbow Light brands in the United States.

Further Reading

Before you consider Clorox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clorox wasn't on the list.

While Clorox currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.