TPG (NASDAQ:TPG - Free Report) had its target price hoisted by The Goldman Sachs Group from $67.00 to $77.00 in a report released on Tuesday,Benzinga reports. The firm currently has a buy rating on the stock.

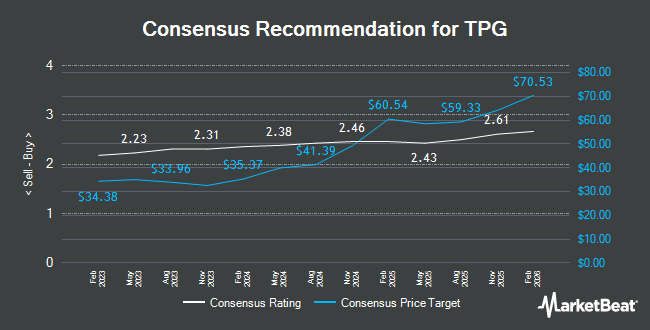

Other research analysts have also recently issued reports about the stock. JPMorgan Chase & Co. increased their price target on shares of TPG from $44.00 to $49.00 and gave the stock a "neutral" rating in a report on Wednesday, August 7th. BMO Capital Markets raised their price objective on shares of TPG from $45.00 to $60.00 and gave the stock a "market perform" rating in a research note on Tuesday, November 5th. Wells Fargo & Company raised their price objective on shares of TPG from $67.00 to $68.00 and gave the stock an "overweight" rating in a research note on Tuesday, November 5th. Evercore ISI raised their target price on shares of TPG from $46.00 to $60.00 and gave the stock an "in-line" rating in a research report on Monday, October 14th. Finally, Deutsche Bank Aktiengesellschaft raised their target price on shares of TPG from $67.00 to $69.00 and gave the stock a "buy" rating in a research report on Monday, November 11th. Seven analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $58.83.

Get Our Latest Stock Analysis on TPG

TPG Trading Up 2.2 %

NASDAQ TPG traded up $1.49 on Tuesday, reaching $67.92. The stock had a trading volume of 1,625,060 shares, compared to its average volume of 883,143. TPG has a 12-month low of $34.07 and a 12-month high of $70.67. The stock has a fifty day moving average price of $62.36 and a two-hundred day moving average price of $51.02. The company has a quick ratio of 0.25, a current ratio of 0.25 and a debt-to-equity ratio of 0.39. The firm has a market capitalization of $24.79 billion, a price-to-earnings ratio of -199.76, a P/E/G ratio of 1.08 and a beta of 1.49.

TPG (NASDAQ:TPG - Get Free Report) last issued its earnings results on Monday, November 4th. The company reported $0.45 EPS for the quarter, hitting analysts' consensus estimates of $0.45. TPG had a net margin of 0.69% and a return on equity of 23.45%. The firm had revenue of $855.40 million during the quarter, compared to the consensus estimate of $449.98 million. During the same quarter in the previous year, the firm posted $0.56 earnings per share. As a group, sell-side analysts forecast that TPG will post 1.94 EPS for the current fiscal year.

TPG Cuts Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 2nd. Shareholders of record on Thursday, November 14th will be issued a $0.38 dividend. This represents a $1.52 dividend on an annualized basis and a yield of 2.24%. The ex-dividend date is Thursday, November 14th. TPG's dividend payout ratio (DPR) is currently -447.05%.

Institutional Trading of TPG

A number of hedge funds have recently modified their holdings of TPG. Janney Montgomery Scott LLC raised its position in TPG by 7.2% in the 1st quarter. Janney Montgomery Scott LLC now owns 7,410 shares of the company's stock valued at $331,000 after purchasing an additional 500 shares during the last quarter. SG Americas Securities LLC lifted its holdings in TPG by 44.7% during the first quarter. SG Americas Securities LLC now owns 5,505 shares of the company's stock worth $246,000 after acquiring an additional 1,700 shares in the last quarter. Vanguard Group Inc. lifted its holdings in TPG by 21.6% during the first quarter. Vanguard Group Inc. now owns 7,356,280 shares of the company's stock worth $328,826,000 after acquiring an additional 1,305,799 shares in the last quarter. Seven Eight Capital LP bought a new position in TPG during the first quarter worth about $935,000. Finally, CANADA LIFE ASSURANCE Co lifted its holdings in shares of TPG by 38.0% in the first quarter. CANADA LIFE ASSURANCE Co now owns 84,661 shares of the company's stock valued at $3,785,000 after purchasing an additional 23,305 shares in the last quarter. Institutional investors own 86.79% of the company's stock.

TPG Company Profile

(

Get Free Report)

TPG Inc operates as an alternative asset manager in the United States and internationally. The company offers investment management services to TPG Funds, limited partners, and other vehicles. It also offers monitoring services to portfolio companies; advisory, debt and equity arrangement, and underwriting and placement services; and capital structuring and other advisory services to portfolio companies.

Featured Stories

Before you consider TPG, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TPG wasn't on the list.

While TPG currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.