Markel Group Inc. lifted its stake in The Hershey Company (NYSE:HSY - Free Report) by 67.4% in the third quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 36,000 shares of the company's stock after purchasing an additional 14,500 shares during the quarter. Markel Group Inc.'s holdings in Hershey were worth $6,904,000 as of its most recent filing with the Securities & Exchange Commission.

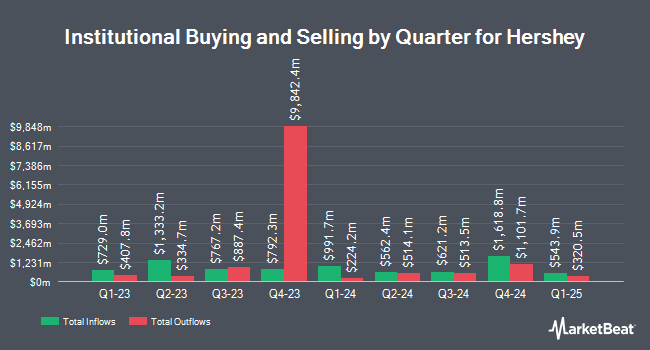

A number of other hedge funds and other institutional investors have also modified their holdings of the stock. LPL Financial LLC boosted its position in Hershey by 10.0% during the 2nd quarter. LPL Financial LLC now owns 320,680 shares of the company's stock worth $58,951,000 after acquiring an additional 29,246 shares during the period. CreativeOne Wealth LLC raised its stake in shares of Hershey by 179.4% in the first quarter. CreativeOne Wealth LLC now owns 6,958 shares of the company's stock valued at $1,353,000 after purchasing an additional 4,468 shares in the last quarter. SG Americas Securities LLC grew its position in Hershey by 239.2% in the first quarter. SG Americas Securities LLC now owns 22,035 shares of the company's stock valued at $4,286,000 after acquiring an additional 15,538 shares during the period. Sei Investments Co. grew its position in Hershey by 2.2% in the first quarter. Sei Investments Co. now owns 54,540 shares of the company's stock valued at $10,608,000 after acquiring an additional 1,168 shares during the period. Finally, Loring Wolcott & Coolidge Fiduciary Advisors LLP MA grew its position in Hershey by 20.1% in the second quarter. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA now owns 15,716 shares of the company's stock valued at $2,986,000 after acquiring an additional 2,635 shares during the period. Institutional investors and hedge funds own 57.96% of the company's stock.

Hershey Stock Up 1.6 %

NYSE HSY traded up $2.82 during mid-day trading on Friday, reaching $175.67. The stock had a trading volume of 3,115,302 shares, compared to its average volume of 1,375,510. The Hershey Company has a 1 year low of $171.67 and a 1 year high of $211.92. The stock has a market cap of $35.54 billion, a PE ratio of 19.52, a price-to-earnings-growth ratio of 4.09 and a beta of 0.38. The company has a fifty day moving average price of $189.17 and a 200 day moving average price of $192.13. The company has a debt-to-equity ratio of 0.87, a current ratio of 0.86 and a quick ratio of 0.48.

Hershey (NYSE:HSY - Get Free Report) last announced its earnings results on Thursday, November 7th. The company reported $2.34 earnings per share for the quarter, missing analysts' consensus estimates of $2.50 by ($0.16). The company had revenue of $2.99 billion for the quarter, compared to analysts' expectations of $3.07 billion. Hershey had a net margin of 16.76% and a return on equity of 45.36%. On average, research analysts expect that The Hershey Company will post 9.39 earnings per share for the current year.

Hershey Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, November 18th will be given a dividend of $1.37 per share. The ex-dividend date is Monday, November 18th. This represents a $5.48 dividend on an annualized basis and a dividend yield of 3.12%. Hershey's payout ratio is 60.89%.

Insider Activity

In other news, CAO Jennifer Mccalman sold 538 shares of the firm's stock in a transaction dated Monday, August 12th. The stock was sold at an average price of $199.17, for a total transaction of $107,153.46. Following the completion of the transaction, the chief accounting officer now owns 3,238 shares in the company, valued at $644,912.46. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Company insiders own 0.34% of the company's stock.

Analysts Set New Price Targets

Several equities analysts recently issued reports on the company. Argus cut Hershey from a "buy" rating to a "hold" rating in a report on Wednesday, August 14th. Deutsche Bank Aktiengesellschaft lifted their price objective on Hershey from $191.00 to $199.00 and gave the company a "hold" rating in a report on Tuesday, September 10th. JPMorgan Chase & Co. lowered their price target on Hershey from $188.00 to $180.00 and set a "neutral" rating for the company in a report on Monday, October 14th. Royal Bank of Canada reduced their price objective on Hershey from $205.00 to $183.00 and set a "sector perform" rating on the stock in a research report on Friday. Finally, Barclays reduced their price target on Hershey from $204.00 to $202.00 and set an "equal weight" rating on the stock in a research report on Tuesday, September 24th. Five equities research analysts have rated the stock with a sell rating and fourteen have given a hold rating to the stock. According to MarketBeat, Hershey presently has a consensus rating of "Hold" and a consensus target price of $190.56.

Check Out Our Latest Stock Analysis on Hershey

About Hershey

(

Free Report)

The Hershey Company, together with its subsidiaries, engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally. The company operates through three segments: North America Confectionery, North America Salty Snacks, and International. It offers chocolate and non-chocolate confectionery products; gum and mint refreshment products, including mints, chewing gums, and bubble gums; protein bars; pantry items, such as baking ingredients, toppings, beverages, and sundae syrups; and snack items comprising spreads, bars, snack bites, mixes, popcorn, and pretzels.

Further Reading

Before you consider Hershey, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hershey wasn't on the list.

While Hershey currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.