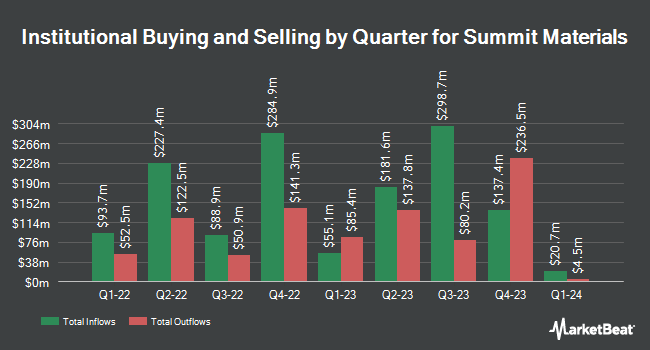

The Manufacturers Life Insurance Company boosted its holdings in Summit Materials, Inc. (NYSE:SUM - Free Report) by 3.8% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 1,232,524 shares of the construction company's stock after purchasing an additional 45,467 shares during the period. The Manufacturers Life Insurance Company owned about 0.70% of Summit Materials worth $48,105,000 as of its most recent SEC filing.

A number of other institutional investors have also recently bought and sold shares of SUM. Dynamic Technology Lab Private Ltd bought a new stake in shares of Summit Materials during the 3rd quarter worth $1,129,000. Citigroup Inc. increased its holdings in Summit Materials by 166.4% during the third quarter. Citigroup Inc. now owns 113,579 shares of the construction company's stock worth $4,433,000 after buying an additional 70,937 shares during the last quarter. Charles Schwab Investment Management Inc. raised its position in Summit Materials by 21.8% in the third quarter. Charles Schwab Investment Management Inc. now owns 1,752,993 shares of the construction company's stock worth $68,419,000 after acquiring an additional 313,957 shares during the period. Massachusetts Financial Services Co. MA boosted its stake in Summit Materials by 6.0% in the third quarter. Massachusetts Financial Services Co. MA now owns 7,639,798 shares of the construction company's stock valued at $298,181,000 after acquiring an additional 429,062 shares during the last quarter. Finally, Intech Investment Management LLC purchased a new position in Summit Materials in the third quarter valued at about $1,097,000.

Summit Materials Price Performance

Shares of Summit Materials stock traded down $0.15 on Friday, reaching $50.94. The stock had a trading volume of 1,656,201 shares, compared to its average volume of 1,310,994. The business's 50 day moving average is $43.98 and its two-hundred day moving average is $40.26. The company has a current ratio of 3.10, a quick ratio of 2.48 and a debt-to-equity ratio of 0.62. Summit Materials, Inc. has a 1 year low of $34.38 and a 1 year high of $53.49. The company has a market cap of $8.95 billion, a P/E ratio of 62.30 and a beta of 1.14.

Summit Materials (NYSE:SUM - Get Free Report) last posted its earnings results on Wednesday, October 30th. The construction company reported $0.75 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.70 by $0.05. The business had revenue of $1.11 billion for the quarter, compared to analysts' expectations of $1.17 billion. Summit Materials had a net margin of 3.92% and a return on equity of 6.90%. The business's revenue for the quarter was up 49.9% compared to the same quarter last year. During the same period in the prior year, the company posted $0.81 EPS. As a group, research analysts anticipate that Summit Materials, Inc. will post 1.64 EPS for the current year.

Analyst Ratings Changes

SUM has been the topic of a number of research reports. Longbow Research reaffirmed a "neutral" rating on shares of Summit Materials in a report on Tuesday. Barclays upgraded Summit Materials from an "equal weight" rating to an "overweight" rating and boosted their target price for the company from $45.00 to $52.00 in a research note on Tuesday, October 29th. Truist Financial reaffirmed a "hold" rating and set a $52.50 price target (down previously from $60.00) on shares of Summit Materials in a research report on Tuesday. Loop Capital reissued a "hold" rating and issued a $52.50 price objective (down previously from $54.00) on shares of Summit Materials in a report on Tuesday. Finally, Morgan Stanley assumed coverage on shares of Summit Materials in a report on Monday, August 26th. They set an "overweight" rating and a $51.00 price objective on the stock. One investment analyst has rated the stock with a sell rating, nine have issued a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $50.81.

View Our Latest Report on SUM

About Summit Materials

(

Free Report)

Summit Materials, Inc operates as a vertically integrated construction materials company in the United States and Canada. It operates in three segments: West, East, and Cement. The company offers aggregates, cement, ready-mix concrete, asphalt paving mixes, and concrete products, as well as plastics components.

Featured Stories

Before you consider Summit Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Summit Materials wasn't on the list.

While Summit Materials currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.