Los Angeles Capital Management LLC reduced its stake in shares of The Pennant Group, Inc. (NASDAQ:PNTG - Free Report) by 30.5% in the third quarter, according to its most recent filing with the SEC. The institutional investor owned 42,971 shares of the company's stock after selling 18,850 shares during the period. Los Angeles Capital Management LLC owned about 0.14% of The Pennant Group worth $1,534,000 as of its most recent filing with the SEC.

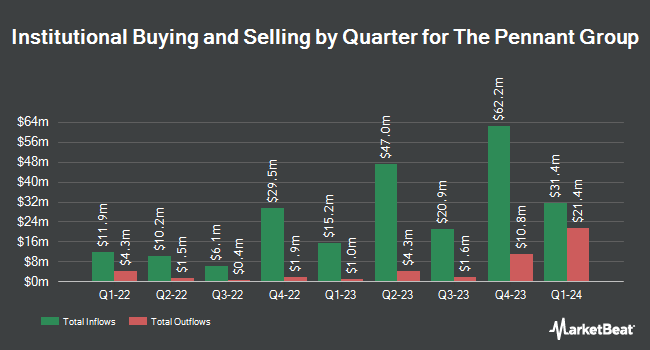

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Sei Investments Co. increased its holdings in The Pennant Group by 679.7% during the 1st quarter. Sei Investments Co. now owns 136,026 shares of the company's stock worth $2,670,000 after purchasing an additional 118,581 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank boosted its stake in shares of The Pennant Group by 292.5% in the 2nd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 21,738 shares of the company's stock worth $504,000 after buying an additional 16,200 shares during the last quarter. Bailard Inc. purchased a new position in shares of The Pennant Group in the 2nd quarter worth approximately $253,000. Renaissance Technologies LLC boosted its stake in shares of The Pennant Group by 17.1% in the 2nd quarter. Renaissance Technologies LLC now owns 267,300 shares of the company's stock worth $6,199,000 after buying an additional 39,000 shares during the last quarter. Finally, Federated Hermes Inc. boosted its stake in shares of The Pennant Group by 600.0% in the 2nd quarter. Federated Hermes Inc. now owns 54,045 shares of the company's stock worth $1,253,000 after buying an additional 46,324 shares during the last quarter. 85.88% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently weighed in on PNTG shares. Oppenheimer boosted their target price on The Pennant Group from $34.00 to $37.00 and gave the stock an "outperform" rating in a research note on Friday, November 8th. Truist Financial boosted their target price on The Pennant Group from $34.00 to $38.00 and gave the stock a "hold" rating in a research note on Monday, October 7th. Stephens reiterated an "overweight" rating and issued a $40.00 price objective on shares of The Pennant Group in a research note on Wednesday, October 9th. Finally, Royal Bank of Canada upped their price objective on The Pennant Group from $26.00 to $38.00 and gave the company an "outperform" rating in a research note on Wednesday, October 23rd.

Get Our Latest Stock Report on The Pennant Group

The Pennant Group Price Performance

PNTG traded down $0.90 during trading on Thursday, reaching $31.90. The stock had a trading volume of 147,568 shares, compared to its average volume of 198,634. The stock has a market cap of $1.10 billion, a PE ratio of 46.99, a PEG ratio of 3.47 and a beta of 2.02. The company has a debt-to-equity ratio of 0.58, a quick ratio of 1.12 and a current ratio of 1.12. The Pennant Group, Inc. has a one year low of $12.65 and a one year high of $37.13. The business has a 50-day moving average of $33.79 and a 200-day moving average of $28.77.

About The Pennant Group

(

Free Report)

The Pennant Group, Inc provides healthcare services in the United States. It operates in two segments, Home Health and Hospice Services, and Senior Living Services. The company offers home health services, including clinical services, such as nursing, speech, occupational and physical therapy, medical social work, and home health aide services; and hospice services comprising clinical care, education, and counseling services for the physical, spiritual, and psychosocial needs of terminally ill patients and their families.

Further Reading

Before you consider The Pennant Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Pennant Group wasn't on the list.

While The Pennant Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.