Thompson Siegel & Walmsley LLC decreased its holdings in Atmus Filtration Technologies Inc. (NYSE:ATMU - Free Report) by 23.5% in the third quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 220,964 shares of the company's stock after selling 67,857 shares during the quarter. Thompson Siegel & Walmsley LLC owned 0.27% of Atmus Filtration Technologies worth $8,293,000 as of its most recent filing with the SEC.

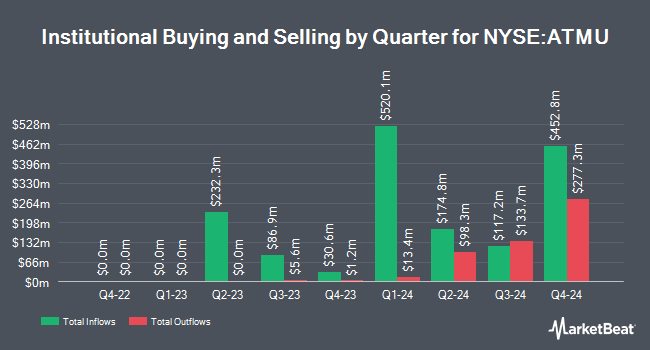

A number of other hedge funds and other institutional investors also recently made changes to their positions in the business. Quarry LP bought a new stake in shares of Atmus Filtration Technologies during the second quarter valued at approximately $29,000. GAMMA Investing LLC increased its stake in shares of Atmus Filtration Technologies by 89.3% in the 3rd quarter. GAMMA Investing LLC now owns 1,641 shares of the company's stock valued at $62,000 after buying an additional 774 shares during the period. Rothschild Investment LLC acquired a new stake in shares of Atmus Filtration Technologies in the 2nd quarter valued at $68,000. KBC Group NV lifted its stake in shares of Atmus Filtration Technologies by 42.1% during the third quarter. KBC Group NV now owns 2,424 shares of the company's stock valued at $91,000 after acquiring an additional 718 shares during the period. Finally, nVerses Capital LLC bought a new position in Atmus Filtration Technologies in the second quarter valued at about $115,000. 32.73% of the stock is owned by institutional investors.

Atmus Filtration Technologies Price Performance

Shares of ATMU traded up $0.71 during mid-day trading on Friday, reaching $44.48. The company had a trading volume of 568,654 shares, compared to its average volume of 1,807,358. The company's 50 day simple moving average is $39.33 and its 200 day simple moving average is $33.74. The company has a market capitalization of $3.70 billion, a price-to-earnings ratio of 20.63, a P/E/G ratio of 4.68 and a beta of 1.68. Atmus Filtration Technologies Inc. has a 1-year low of $21.09 and a 1-year high of $44.66. The company has a debt-to-equity ratio of 2.61, a quick ratio of 1.35 and a current ratio of 2.11.

Atmus Filtration Technologies (NYSE:ATMU - Get Free Report) last issued its quarterly earnings results on Friday, November 8th. The company reported $0.61 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.52 by $0.09. The firm had revenue of $404.00 million for the quarter, compared to the consensus estimate of $403.40 million. Atmus Filtration Technologies had a net margin of 10.84% and a return on equity of 134.28%. The company's revenue for the quarter was up 2.0% on a year-over-year basis. During the same quarter in the previous year, the company earned $0.52 EPS. Analysts expect that Atmus Filtration Technologies Inc. will post 2.45 EPS for the current year.

Atmus Filtration Technologies Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, November 13th. Stockholders of record on Thursday, October 31st were issued a $0.05 dividend. This represents a $0.20 dividend on an annualized basis and a dividend yield of 0.45%. The ex-dividend date was Thursday, October 31st. Atmus Filtration Technologies's payout ratio is currently 9.30%.

Analyst Ratings Changes

A number of brokerages recently commented on ATMU. Wells Fargo & Company cut Atmus Filtration Technologies from an "overweight" rating to an "equal weight" rating and lifted their price objective for the stock from $42.00 to $45.00 in a research note on Monday, November 11th. Robert W. Baird boosted their target price on Atmus Filtration Technologies from $42.00 to $48.00 and gave the stock an "outperform" rating in a research report on Tuesday, November 12th. JPMorgan Chase & Co. lifted their price target on shares of Atmus Filtration Technologies from $39.00 to $47.00 and gave the stock an "overweight" rating in a research report on Friday, October 11th. Finally, Northland Securities upped their price objective on shares of Atmus Filtration Technologies from $49.00 to $50.00 and gave the company an "outperform" rating in a research report on Tuesday, November 12th. One equities research analyst has rated the stock with a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat, Atmus Filtration Technologies has a consensus rating of "Moderate Buy" and an average target price of $44.80.

View Our Latest Stock Analysis on ATMU

Atmus Filtration Technologies Profile

(

Free Report)

Atmus Filtration Technologies Inc designs, manufactures, and sells filtration products under the Fleetguard brand name in North America, Europe, South America, Asia, Australia, Africa, and internationally. The company offers fuel filters, lube filters, air filters, crankcase ventilation, hydraulic filters, coolants, and fuel additives, as well as other chemicals; and fuel water separators and other filtration systems to original equipment manufacturers, dealers/distributors, and end-users.

Further Reading

Before you consider Atmus Filtration Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atmus Filtration Technologies wasn't on the list.

While Atmus Filtration Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.