Thrivent Financial for Lutherans trimmed its stake in AECOM (NYSE:ACM - Free Report) by 10.0% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 271,788 shares of the construction company's stock after selling 30,359 shares during the period. Thrivent Financial for Lutherans owned about 0.20% of AECOM worth $28,068,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

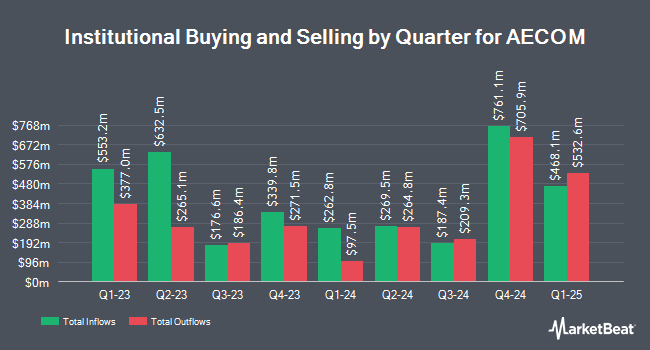

Other institutional investors have also recently made changes to their positions in the company. Ninety One UK Ltd purchased a new stake in AECOM during the second quarter valued at approximately $46,109,000. International Assets Investment Management LLC purchased a new stake in shares of AECOM during the 3rd quarter worth about $42,201,000. DekaBank Deutsche Girozentrale lifted its position in shares of AECOM by 451.9% during the 1st quarter. DekaBank Deutsche Girozentrale now owns 481,769 shares of the construction company's stock valued at $47,617,000 after buying an additional 394,481 shares in the last quarter. Bank of New York Mellon Corp lifted its holdings in AECOM by 18.8% during the second quarter. Bank of New York Mellon Corp now owns 1,628,924 shares of the construction company's stock valued at $143,573,000 after purchasing an additional 258,250 shares in the last quarter. Finally, Impax Asset Management Group plc boosted its stake in shares of AECOM by 15.5% in the second quarter. Impax Asset Management Group plc now owns 1,752,487 shares of the construction company's stock worth $154,464,000 after acquiring an additional 235,350 shares during the last quarter. Hedge funds and other institutional investors own 85.41% of the company's stock.

AECOM Trading Up 0.6 %

Shares of NYSE ACM traded up $0.61 on Wednesday, reaching $109.44. 554,636 shares of the company traded hands, compared to its average volume of 798,833. The company has a current ratio of 1.13, a quick ratio of 1.13 and a debt-to-equity ratio of 0.98. The stock has a market capitalization of $14.67 billion, a PE ratio of 36.60, a P/E/G ratio of 1.61 and a beta of 1.17. AECOM has a fifty-two week low of $82.23 and a fifty-two week high of $115.74. The company has a 50 day moving average of $105.19 and a 200 day moving average of $95.85.

AECOM (NYSE:ACM - Get Free Report) last announced its quarterly earnings results on Monday, November 18th. The construction company reported $1.27 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.24 by $0.03. The firm had revenue of $1.81 billion during the quarter, compared to the consensus estimate of $1.86 billion. AECOM had a return on equity of 24.14% and a net margin of 1.61%. The firm's quarterly revenue was up 4.9% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.01 EPS. On average, equities research analysts forecast that AECOM will post 4.47 earnings per share for the current fiscal year.

AECOM Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, January 17th. Shareholders of record on Thursday, January 2nd will be issued a $0.26 dividend. The ex-dividend date is Thursday, January 2nd. This represents a $1.04 dividend on an annualized basis and a yield of 0.95%. This is a boost from AECOM's previous quarterly dividend of $0.22. AECOM's dividend payout ratio (DPR) is currently 29.73%.

AECOM declared that its board has initiated a stock buyback plan on Monday, November 18th that authorizes the company to repurchase $1.00 billion in outstanding shares. This repurchase authorization authorizes the construction company to reacquire up to 6.8% of its shares through open market purchases. Shares repurchase plans are usually a sign that the company's board believes its shares are undervalued.

Analysts Set New Price Targets

A number of analysts have recently issued reports on the stock. Citigroup raised their price target on shares of AECOM from $110.00 to $128.00 and gave the stock a "buy" rating in a report on Tuesday, October 22nd. StockNews.com raised AECOM from a "hold" rating to a "buy" rating in a research report on Sunday, October 27th. Royal Bank of Canada increased their price objective on AECOM from $112.00 to $113.00 and gave the stock an "outperform" rating in a research report on Wednesday, August 7th. Barclays increased their price objective on AECOM from $100.00 to $105.00 and gave the stock an "overweight" rating in a research report on Thursday, August 8th. Finally, Robert W. Baird lifted their price objective on AECOM from $113.00 to $122.00 and gave the stock an "outperform" rating in a report on Tuesday. Eight investment analysts have rated the stock with a buy rating, Based on data from MarketBeat, the company has an average rating of "Buy" and an average price target of $116.43.

Get Our Latest Report on ACM

Insider Activity

In related news, CFO Gaurav Kapoor sold 42,400 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $115.34, for a total transaction of $4,890,416.00. Following the transaction, the chief financial officer now owns 31,228 shares in the company, valued at $3,601,837.52. This trade represents a 57.59 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Corporate insiders own 0.42% of the company's stock.

AECOM Profile

(

Free Report)

AECOM, together with its subsidiaries, provides professional infrastructure consulting services worldwide. It operates in three segments: Americas, International, and AECOM Capital. The company offers planning, consulting, architectural and engineering design, construction and program management, and investment and development services to public and private clients.

Recommended Stories

Before you consider AECOM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AECOM wasn't on the list.

While AECOM currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.