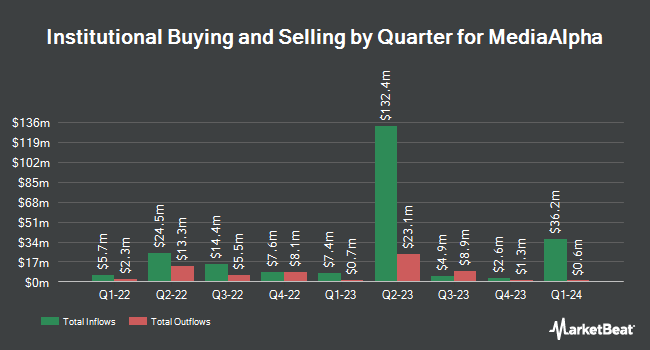

TimesSquare Capital Management LLC lowered its stake in shares of MediaAlpha, Inc. (NYSE:MAX - Free Report) by 14.6% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 916,405 shares of the company's stock after selling 156,155 shares during the period. TimesSquare Capital Management LLC owned 1.38% of MediaAlpha worth $16,596,000 at the end of the most recent quarter.

Other large investors also recently made changes to their positions in the company. Driehaus Capital Management LLC grew its holdings in MediaAlpha by 208.4% during the second quarter. Driehaus Capital Management LLC now owns 1,436,615 shares of the company's stock worth $18,920,000 after purchasing an additional 970,840 shares during the period. Divisadero Street Capital Management LP acquired a new stake in MediaAlpha during the 2nd quarter valued at $7,956,000. Emerald Advisers LLC boosted its position in MediaAlpha by 51,407.5% during the second quarter. Emerald Advisers LLC now owns 598,517 shares of the company's stock worth $7,882,000 after purchasing an additional 597,355 shares during the period. Clearline Capital LP increased its holdings in shares of MediaAlpha by 1,255.3% in the second quarter. Clearline Capital LP now owns 576,728 shares of the company's stock valued at $7,596,000 after purchasing an additional 534,176 shares during the last quarter. Finally, Ghisallo Capital Management LLC lifted its stake in shares of MediaAlpha by 535.3% during the 2nd quarter. Ghisallo Capital Management LLC now owns 487,500 shares of the company's stock worth $6,420,000 after buying an additional 410,764 shares during the last quarter. Institutional investors and hedge funds own 64.39% of the company's stock.

Analyst Ratings Changes

Several brokerages have issued reports on MAX. Keefe, Bruyette & Woods restated an "outperform" rating and set a $26.00 price objective (up from $25.00) on shares of MediaAlpha in a research report on Thursday, August 1st. The Goldman Sachs Group lifted their price target on MediaAlpha from $20.00 to $26.00 and gave the stock a "buy" rating in a report on Friday, November 1st. One equities research analyst has rated the stock with a hold rating and six have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $25.14.

View Our Latest Stock Report on MAX

MediaAlpha Stock Performance

Shares of MAX stock traded up $0.56 during trading on Monday, hitting $12.70. The company had a trading volume of 895,710 shares, compared to its average volume of 583,738. The stock's 50-day moving average price is $17.55 and its 200 day moving average price is $16.97. MediaAlpha, Inc. has a one year low of $8.90 and a one year high of $25.78. The firm has a market capitalization of $842.01 million, a P/E ratio of 71.41 and a beta of 1.23.

MediaAlpha (NYSE:MAX - Get Free Report) last released its earnings results on Wednesday, October 30th. The company reported $0.17 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.13 by $0.04. The company had revenue of $259.13 million for the quarter, compared to analyst estimates of $246.96 million. MediaAlpha had a negative return on equity of 11.98% and a net margin of 1.41%. On average, research analysts anticipate that MediaAlpha, Inc. will post 0.42 earnings per share for the current fiscal year.

Insider Activity

In other MediaAlpha news, insider Eugene Nonko sold 72,000 shares of the firm's stock in a transaction on Wednesday, October 30th. The stock was sold at an average price of $20.67, for a total value of $1,488,240.00. Following the sale, the insider now owns 1,550,990 shares of the company's stock, valued at approximately $32,058,963.30. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Corporate insiders own 11.53% of the company's stock.

MediaAlpha Company Profile

(

Free Report)

MediaAlpha, Inc, through its subsidiaries, operates an insurance customer acquisition platform in the United States. It optimizes customer acquisition in various verticals of property and casualty insurance, health insurance, and life insurance. The company was founded in 2014 and is headquartered in Los Angeles, California.

Featured Articles

Before you consider MediaAlpha, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MediaAlpha wasn't on the list.

While MediaAlpha currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.