StockNews.com upgraded shares of TJX Companies (NYSE:TJX - Free Report) from a hold rating to a buy rating in a research note released on Saturday morning.

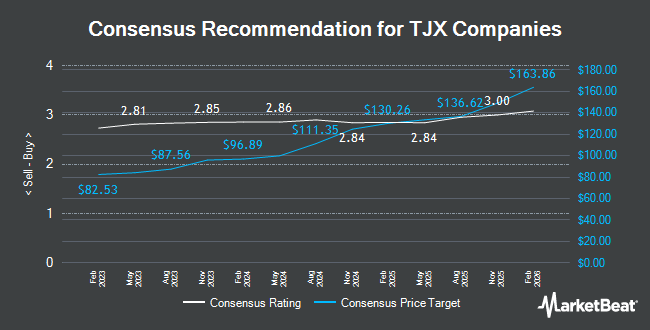

TJX has been the subject of a number of other research reports. Evercore ISI upped their price target on shares of TJX Companies from $138.00 to $142.00 and gave the stock an "outperform" rating in a report on Thursday, November 21st. Robert W. Baird upped their target price on TJX Companies from $113.00 to $128.00 and gave the stock an "outperform" rating in a research note on Thursday, August 22nd. Loop Capital raised their target price on TJX Companies from $125.00 to $140.00 and gave the company a "buy" rating in a report on Thursday, August 22nd. Jefferies Financial Group boosted their price target on TJX Companies from $130.00 to $140.00 and gave the stock a "buy" rating in a report on Thursday, August 22nd. Finally, TD Cowen raised their price objective on TJX Companies from $130.00 to $132.00 and gave the company a "buy" rating in a research note on Friday, November 22nd. Three investment analysts have rated the stock with a hold rating and fifteen have issued a buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $129.47.

Check Out Our Latest Stock Analysis on TJX Companies

TJX Companies Stock Performance

Shares of NYSE:TJX opened at $125.69 on Friday. TJX Companies has a 12-month low of $87.44 and a 12-month high of $128.00. The company's 50 day moving average price is $117.29 and its two-hundred day moving average price is $113.26. The firm has a market cap of $141.76 billion, a PE ratio of 29.57, a PEG ratio of 3.11 and a beta of 0.89. The company has a quick ratio of 0.50, a current ratio of 1.19 and a debt-to-equity ratio of 0.35.

TJX Companies (NYSE:TJX - Get Free Report) last released its earnings results on Wednesday, November 20th. The apparel and home fashions retailer reported $1.14 earnings per share for the quarter, beating analysts' consensus estimates of $1.09 by $0.05. The firm had revenue of $14.06 billion during the quarter, compared to the consensus estimate of $13.95 billion. TJX Companies had a return on equity of 61.82% and a net margin of 8.63%. The company's revenue was up 6.0% compared to the same quarter last year. During the same period in the prior year, the company posted $1.03 EPS. Equities research analysts predict that TJX Companies will post 4.18 earnings per share for the current year.

TJX Companies Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Thursday, December 5th. Shareholders of record on Thursday, November 14th will be given a dividend of $0.375 per share. The ex-dividend date is Thursday, November 14th. This represents a $1.50 dividend on an annualized basis and a yield of 1.19%. TJX Companies's dividend payout ratio (DPR) is currently 35.29%.

Insider Activity

In related news, CEO Ernie Herrman sold 15,000 shares of the stock in a transaction on Tuesday, September 10th. The stock was sold at an average price of $117.54, for a total value of $1,763,100.00. Following the transaction, the chief executive officer now directly owns 536,148 shares in the company, valued at $63,018,835.92. This trade represents a 2.72 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 0.13% of the stock is owned by company insiders.

Institutional Investors Weigh In On TJX Companies

A number of institutional investors and hedge funds have recently made changes to their positions in TJX. Richard W. Paul & Associates LLC purchased a new stake in TJX Companies in the 2nd quarter valued at about $25,000. Capital Performance Advisors LLP bought a new position in shares of TJX Companies in the third quarter valued at approximately $29,000. Legacy Investment Solutions LLC purchased a new stake in shares of TJX Companies during the third quarter valued at approximately $30,000. Truvestments Capital LLC bought a new stake in TJX Companies during the third quarter worth $29,000. Finally, Copeland Capital Management LLC bought a new stake in TJX Companies during the third quarter worth $30,000. Institutional investors and hedge funds own 91.09% of the company's stock.

About TJX Companies

(

Get Free Report)

The TJX Companies, Inc, together with its subsidiaries, operates as an off-price apparel and home fashions retailer in the United States, Canada, Europe, and Australia. It operates through four segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. The company sells family apparel, including footwear and accessories; home fashions, such as home basics, furniture, rugs, lighting products, giftware, soft home products, decorative accessories, tabletop, and cookware, as well as expanded pet, and gourmet food departments; jewelry and accessories; and other merchandise.

Recommended Stories

Before you consider TJX Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TJX Companies wasn't on the list.

While TJX Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.