Toronto Dominion Bank lifted its stake in shares of Barrick Gold Corp (NYSE:GOLD - Free Report) TSE: ABX by 9.8% in the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 6,035,814 shares of the gold and copper producer's stock after acquiring an additional 538,204 shares during the quarter. Toronto Dominion Bank owned about 0.35% of Barrick Gold worth $120,052,000 as of its most recent filing with the SEC.

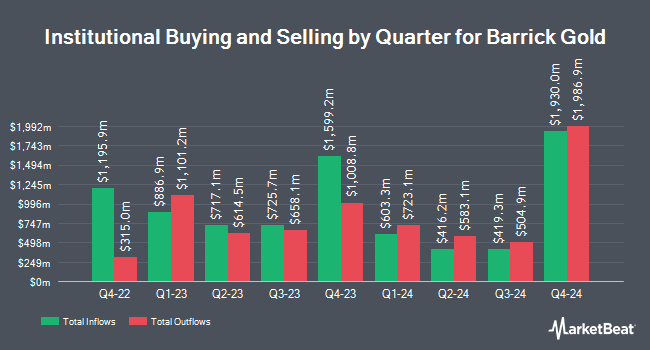

A number of other hedge funds have also made changes to their positions in the stock. Ritholtz Wealth Management boosted its holdings in shares of Barrick Gold by 2.8% in the 3rd quarter. Ritholtz Wealth Management now owns 18,163 shares of the gold and copper producer's stock worth $361,000 after acquiring an additional 502 shares in the last quarter. Greenleaf Trust raised its position in Barrick Gold by 2.1% in the 3rd quarter. Greenleaf Trust now owns 25,659 shares of the gold and copper producer's stock valued at $510,000 after purchasing an additional 540 shares during the last quarter. Moors & Cabot Inc. boosted its stake in Barrick Gold by 0.9% in the third quarter. Moors & Cabot Inc. now owns 64,085 shares of the gold and copper producer's stock worth $1,275,000 after purchasing an additional 579 shares in the last quarter. Silverlake Wealth Management LLC grew its holdings in shares of Barrick Gold by 1.3% during the third quarter. Silverlake Wealth Management LLC now owns 49,890 shares of the gold and copper producer's stock worth $992,000 after purchasing an additional 628 shares during the last quarter. Finally, Avior Wealth Management LLC increased its stake in shares of Barrick Gold by 24.1% in the third quarter. Avior Wealth Management LLC now owns 3,399 shares of the gold and copper producer's stock valued at $68,000 after buying an additional 659 shares in the last quarter. Institutional investors and hedge funds own 62.85% of the company's stock.

Barrick Gold Trading Up 2.9 %

Shares of Barrick Gold stock traded up $0.49 during trading on Wednesday, hitting $17.63. 11,822,694 shares of the company were exchanged, compared to its average volume of 21,466,709. Barrick Gold Corp has a 1-year low of $13.76 and a 1-year high of $21.35. The company has a debt-to-equity ratio of 0.14, a current ratio of 2.65 and a quick ratio of 2.06. The firm has a market capitalization of $30.82 billion, a P/E ratio of 18.82, a price-to-earnings-growth ratio of 0.46 and a beta of 0.53. The firm's fifty day moving average price is $18.81 and its 200 day moving average price is $18.53.

Barrick Gold Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Friday, November 29th will be given a $0.10 dividend. This represents a $0.40 dividend on an annualized basis and a dividend yield of 2.27%. The ex-dividend date is Friday, November 29th. Barrick Gold's dividend payout ratio is currently 43.01%.

Wall Street Analyst Weigh In

Several brokerages recently issued reports on GOLD. Scotiabank reduced their price target on shares of Barrick Gold from $24.00 to $23.00 and set a "sector outperform" rating on the stock in a research report on Monday, November 25th. Argus raised shares of Barrick Gold from a "hold" rating to a "buy" rating and set a $24.00 price target on the stock in a research note on Thursday, August 29th. UBS Group cut shares of Barrick Gold from a "buy" rating to a "neutral" rating and dropped their price objective for the stock from $23.00 to $22.00 in a research report on Wednesday, October 30th. Cibc World Mkts lowered Barrick Gold from a "strong-buy" rating to a "hold" rating in a research report on Monday, November 25th. Finally, CIBC cut Barrick Gold from a "sector outperform" rating to a "neutral" rating in a research note on Monday, November 25th. Four research analysts have rated the stock with a hold rating and eight have given a buy rating to the company's stock. According to MarketBeat.com, Barrick Gold has a consensus rating of "Moderate Buy" and an average target price of $25.60.

Check Out Our Latest Stock Report on GOLD

About Barrick Gold

(

Free Report)

Barrick Gold Corporation is a sector-leading gold and copper producer. Its shares trade on the New York Stock Exchange under the symbol GOLD and on the Toronto Stock Exchange under the symbol ABX.

In January 2019 Barrick merged with Randgold Resources and in July that year it combined its gold mines in Nevada, USA, with those of Newmont Corporation in a joint venture, Nevada Gold Mines, which is majority-owned and operated by Barrick.

Recommended Stories

Before you consider Barrick Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barrick Gold wasn't on the list.

While Barrick Gold currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.