Townsquare Capital LLC cut its holdings in FirstEnergy Corp. (NYSE:FE - Free Report) by 17.2% in the third quarter, according to the company in its most recent disclosure with the SEC. The fund owned 175,127 shares of the utilities provider's stock after selling 36,375 shares during the quarter. Townsquare Capital LLC's holdings in FirstEnergy were worth $7,767,000 at the end of the most recent reporting period.

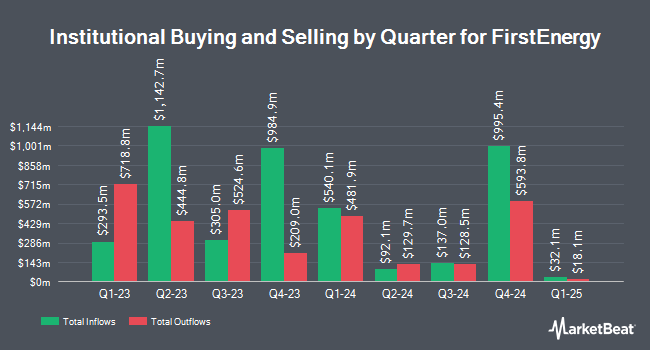

Other institutional investors have also added to or reduced their stakes in the company. Boston Partners grew its holdings in shares of FirstEnergy by 2.3% during the first quarter. Boston Partners now owns 9,517,314 shares of the utilities provider's stock valued at $367,423,000 after buying an additional 218,165 shares during the last quarter. Allspring Global Investments Holdings LLC grew its stake in FirstEnergy by 5.3% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 9,098,472 shares of the utilities provider's stock valued at $403,517,000 after purchasing an additional 457,231 shares during the last quarter. First Pacific Advisors LP increased its holdings in shares of FirstEnergy by 2.0% in the second quarter. First Pacific Advisors LP now owns 3,557,667 shares of the utilities provider's stock valued at $136,152,000 after purchasing an additional 69,512 shares during the period. 1832 Asset Management L.P. raised its stake in shares of FirstEnergy by 7.6% in the second quarter. 1832 Asset Management L.P. now owns 2,725,050 shares of the utilities provider's stock worth $104,288,000 after purchasing an additional 193,540 shares during the last quarter. Finally, Dimensional Fund Advisors LP lifted its holdings in shares of FirstEnergy by 5.8% during the second quarter. Dimensional Fund Advisors LP now owns 1,896,140 shares of the utilities provider's stock worth $72,570,000 after purchasing an additional 104,253 shares during the period. Institutional investors and hedge funds own 89.41% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages recently weighed in on FE. Seaport Res Ptn downgraded shares of FirstEnergy from a "strong-buy" rating to a "hold" rating in a report on Thursday, October 31st. Scotiabank raised their target price on shares of FirstEnergy from $40.00 to $45.00 and gave the stock a "sector perform" rating in a report on Tuesday, August 20th. KeyCorp boosted their target price on shares of FirstEnergy from $47.00 to $48.00 and gave the company an "overweight" rating in a research report on Tuesday, October 22nd. Morgan Stanley cut their price target on FirstEnergy from $52.00 to $50.00 and set an "overweight" rating on the stock in a research report on Friday, November 22nd. Finally, Wells Fargo & Company boosted their price objective on FirstEnergy from $42.00 to $45.00 and gave the company an "equal weight" rating in a report on Thursday, August 1st. One research analyst has rated the stock with a sell rating, eight have assigned a hold rating and four have issued a buy rating to the stock. According to MarketBeat.com, FirstEnergy currently has an average rating of "Hold" and a consensus price target of $45.91.

Check Out Our Latest Stock Analysis on FirstEnergy

FirstEnergy Price Performance

FE traded up $0.34 during trading on Thursday, hitting $42.62. The company's stock had a trading volume of 2,217,297 shares, compared to its average volume of 2,934,371. The firm has a market capitalization of $24.56 billion, a price-to-earnings ratio of 27.50, a P/E/G ratio of 2.27 and a beta of 0.51. FirstEnergy Corp. has a twelve month low of $35.41 and a twelve month high of $44.97. The business's fifty day simple moving average is $42.77 and its 200 day simple moving average is $41.50. The company has a current ratio of 0.56, a quick ratio of 0.46 and a debt-to-equity ratio of 1.58.

FirstEnergy (NYSE:FE - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The utilities provider reported $0.85 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.90 by ($0.05). The company had revenue of $3.73 billion during the quarter, compared to analyst estimates of $3.96 billion. FirstEnergy had a net margin of 6.64% and a return on equity of 11.38%. FirstEnergy's revenue was up 6.9% compared to the same quarter last year. During the same period in the prior year, the business posted $0.88 EPS. On average, equities research analysts forecast that FirstEnergy Corp. will post 2.68 EPS for the current fiscal year.

FirstEnergy Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Sunday, December 1st. Investors of record on Thursday, November 7th will be paid a $0.425 dividend. This represents a $1.70 dividend on an annualized basis and a yield of 3.99%. The ex-dividend date of this dividend is Thursday, November 7th. FirstEnergy's dividend payout ratio is presently 109.68%.

FirstEnergy Profile

(

Free Report)

FirstEnergy Corp., through its subsidiaries, generates, transmits, and distributes electricity in the United States. It operates through Regulated Distribution and Regulated Transmission segments. The company owns and operates coal-fired, nuclear, hydroelectric, wind, and solar power generating facilities.

Featured Articles

Before you consider FirstEnergy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FirstEnergy wasn't on the list.

While FirstEnergy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.