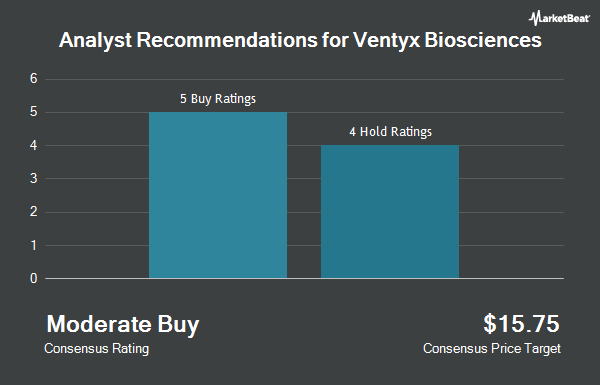

Shares of Ventyx Biosciences, Inc. (NASDAQ:VTYX - Get Free Report) have received an average rating of "Moderate Buy" from the five ratings firms that are presently covering the company, MarketBeat Ratings reports. One investment analyst has rated the stock with a hold rating and four have issued a buy rating on the company. The average 1-year price target among analysts that have updated their coverage on the stock in the last year is $10.00.

Several research analysts have commented on the stock. Oppenheimer reissued an "outperform" rating and issued a $9.00 price target (down from $10.00) on shares of Ventyx Biosciences in a report on Friday, November 8th. Wells Fargo & Company reduced their target price on Ventyx Biosciences from $16.00 to $11.00 and set an "overweight" rating for the company in a research report on Monday, August 12th. Canaccord Genuity Group lowered their price target on Ventyx Biosciences from $15.00 to $14.00 and set a "buy" rating on the stock in a report on Monday, August 12th. Finally, HC Wainwright reissued a "neutral" rating and set a $6.00 price objective on shares of Ventyx Biosciences in a report on Monday, November 11th.

View Our Latest Analysis on Ventyx Biosciences

Institutional Trading of Ventyx Biosciences

Several hedge funds and other institutional investors have recently bought and sold shares of the company. First Light Asset Management LLC purchased a new position in Ventyx Biosciences in the 1st quarter worth approximately $3,437,000. Redmile Group LLC increased its position in shares of Ventyx Biosciences by 944.4% during the first quarter. Redmile Group LLC now owns 2,164,126 shares of the company's stock valued at $11,903,000 after buying an additional 1,956,923 shares during the period. Ikarian Capital LLC raised its position in shares of Ventyx Biosciences by 8,483.8% in the 1st quarter. Ikarian Capital LLC now owns 507,647 shares of the company's stock worth $2,792,000 after acquiring an additional 501,733 shares in the last quarter. Farallon Capital Management LLC bought a new stake in shares of Ventyx Biosciences during the first quarter valued at approximately $17,435,000. Finally, Opaleye Management Inc. lifted its position in Ventyx Biosciences by 12.7% during the first quarter. Opaleye Management Inc. now owns 1,285,000 shares of the company's stock valued at $7,068,000 after buying an additional 145,000 shares during the period. Hedge funds and other institutional investors own 97.88% of the company's stock.

Ventyx Biosciences Trading Up 6.9 %

Shares of Ventyx Biosciences stock traded up $0.12 on Friday, reaching $1.85. The stock had a trading volume of 2,145,864 shares, compared to its average volume of 2,032,574. The business's 50 day moving average is $2.20 and its two-hundred day moving average is $2.69. Ventyx Biosciences has a 1 year low of $1.67 and a 1 year high of $11.48. The company has a market cap of $130.81 million, a P/E ratio of -0.81 and a beta of 0.37.

About Ventyx Biosciences

(

Get Free ReportVentyx Biosciences, Inc, a clinical-stage biopharmaceutical company, develops small molecule product candidates to address a range of inflammatory diseases. The company's lead clinical product candidate is VTX958, a selective allosteric tyrosine kinase type 2 inhibitor for psoriasis, psoriatic arthritis, and Crohn's disease.

Featured Articles

Before you consider Ventyx Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ventyx Biosciences wasn't on the list.

While Ventyx Biosciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.