Versor Investments LP bought a new stake in shares of Coca-Cola Consolidated, Inc. (NASDAQ:COKE - Free Report) during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor bought 531 shares of the company's stock, valued at approximately $699,000.

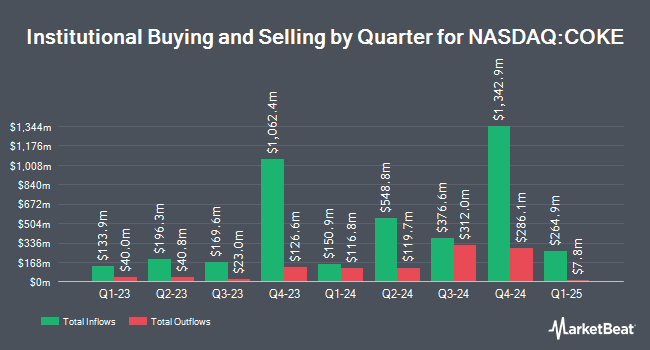

A number of other hedge funds and other institutional investors have also bought and sold shares of the business. SG Americas Securities LLC grew its position in shares of Coca-Cola Consolidated by 50.6% during the 1st quarter. SG Americas Securities LLC now owns 405 shares of the company's stock worth $343,000 after buying an additional 136 shares in the last quarter. Swiss National Bank boosted its stake in Coca-Cola Consolidated by 9.1% in the first quarter. Swiss National Bank now owns 10,765 shares of the company's stock valued at $9,112,000 after acquiring an additional 900 shares in the last quarter. Susquehanna Fundamental Investments LLC purchased a new stake in shares of Coca-Cola Consolidated during the 1st quarter valued at $237,000. Inspire Investing LLC increased its position in Coca-Cola Consolidated by 3.1% during the 1st quarter. Inspire Investing LLC now owns 426 shares of the company's stock valued at $361,000 after buying an additional 13 shares in the last quarter. Finally, ProShare Advisors LLC raised its position in shares of Coca-Cola Consolidated by 4.9% in the 1st quarter. ProShare Advisors LLC now owns 1,087 shares of the company's stock valued at $920,000 after purchasing an additional 51 shares during the last quarter. Hedge funds and other institutional investors own 48.24% of the company's stock.

Coca-Cola Consolidated Stock Performance

Shares of COKE stock traded down $15.52 during mid-day trading on Thursday, reaching $1,215.21. The stock had a trading volume of 38,502 shares, compared to its average volume of 51,933. Coca-Cola Consolidated, Inc. has a 1-year low of $686.75 and a 1-year high of $1,376.84. The business's fifty day moving average is $1,263.63 and its 200-day moving average is $1,151.05. The company has a current ratio of 2.47, a quick ratio of 2.15 and a debt-to-equity ratio of 1.39. The firm has a market cap of $10.65 billion, a price-to-earnings ratio of 21.15 and a beta of 0.85.

Coca-Cola Consolidated (NASDAQ:COKE - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The company reported $18.81 earnings per share for the quarter. Coca-Cola Consolidated had a net margin of 7.81% and a return on equity of 46.94%. The firm had revenue of $1.77 billion for the quarter.

Coca-Cola Consolidated Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, November 8th. Stockholders of record on Friday, October 25th were paid a dividend of $2.50 per share. This is a positive change from Coca-Cola Consolidated's previous quarterly dividend of $0.25. This represents a $10.00 annualized dividend and a dividend yield of 0.82%. The ex-dividend date was Friday, October 25th. Coca-Cola Consolidated's dividend payout ratio is presently 17.40%.

About Coca-Cola Consolidated

(

Free Report)

Coca-Cola Consolidated, Inc, together with its subsidiaries, manufactures, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States. The company offers sparkling beverages; and still beverages, including energy products, as well as noncarbonated beverages comprising bottled water, ready to drink coffee and tea, enhanced water, juices, and sports drinks.

Featured Articles

Before you consider Coca-Cola Consolidated, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola Consolidated wasn't on the list.

While Coca-Cola Consolidated currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.