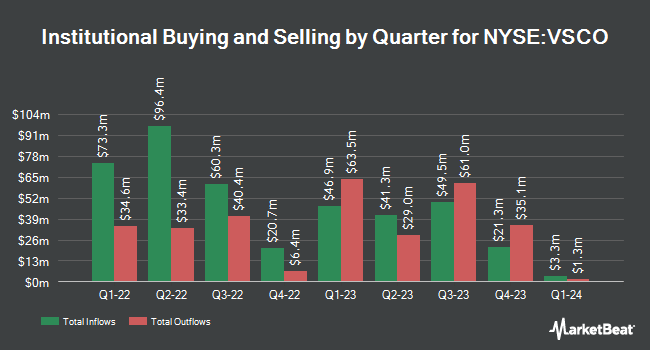

Principal Financial Group Inc. decreased its stake in Victoria's Secret & Co. (NYSE:VSCO - Free Report) by 4.5% in the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 369,510 shares of the company's stock after selling 17,367 shares during the quarter. Principal Financial Group Inc. owned about 0.47% of Victoria's Secret & Co. worth $9,496,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds have also recently modified their holdings of the company. Farther Finance Advisors LLC grew its stake in Victoria's Secret & Co. by 13.6% during the 3rd quarter. Farther Finance Advisors LLC now owns 6,955 shares of the company's stock valued at $179,000 after purchasing an additional 835 shares during the last quarter. Nisa Investment Advisors LLC boosted its stake in shares of Victoria's Secret & Co. by 26.6% in the third quarter. Nisa Investment Advisors LLC now owns 14,006 shares of the company's stock worth $360,000 after buying an additional 2,940 shares during the last quarter. Patriot Financial Group Insurance Agency LLC purchased a new stake in shares of Victoria's Secret & Co. in the third quarter worth about $301,000. Carolina Wealth Advisors LLC purchased a new position in Victoria's Secret & Co. during the third quarter worth approximately $92,000. Finally, Everence Capital Management Inc. purchased a new position in Victoria's Secret & Co. during the third quarter worth approximately $216,000. Hedge funds and other institutional investors own 90.29% of the company's stock.

Victoria's Secret & Co. Stock Down 1.2 %

Shares of VSCO stock traded down $0.45 during trading hours on Tuesday, hitting $36.13. 598,649 shares of the company were exchanged, compared to its average volume of 2,724,561. The business has a 50 day moving average of $28.14 and a two-hundred day moving average of $22.84. The company has a current ratio of 1.00, a quick ratio of 0.31 and a debt-to-equity ratio of 2.27. Victoria's Secret & Co. has a 52 week low of $15.12 and a 52 week high of $37.72. The company has a market capitalization of $2.84 billion, a PE ratio of 21.27 and a beta of 2.10.

Victoria's Secret & Co. (NYSE:VSCO - Get Free Report) last posted its earnings results on Wednesday, August 28th. The company reported $0.40 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.38 by $0.02. Victoria's Secret & Co. had a net margin of 2.25% and a return on equity of 44.06%. The company had revenue of $1.42 billion during the quarter, compared to analysts' expectations of $1.41 billion. Analysts anticipate that Victoria's Secret & Co. will post 1.98 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several equities research analysts recently commented on the company. TD Cowen increased their price target on Victoria's Secret & Co. from $20.00 to $26.00 and gave the company a "hold" rating in a report on Friday, August 30th. Telsey Advisory Group reissued a "market perform" rating and issued a $27.00 target price on shares of Victoria's Secret & Co. in a report on Thursday, October 17th. The Goldman Sachs Group upped their price objective on Victoria's Secret & Co. from $17.00 to $19.00 and gave the company a "sell" rating in a research note on Friday, August 30th. Jefferies Financial Group boosted their target price on Victoria's Secret & Co. from $30.00 to $40.00 and gave the stock a "buy" rating in a research report on Tuesday, November 12th. Finally, Morgan Stanley upped their price target on Victoria's Secret & Co. from $20.00 to $23.00 and gave the stock an "equal weight" rating in a report on Friday, August 30th. Three equities research analysts have rated the stock with a sell rating, four have assigned a hold rating and three have assigned a buy rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $26.30.

View Our Latest Analysis on VSCO

Victoria's Secret & Co. Company Profile

(

Free Report)

Victoria's Secret & Co operates as a specialty retailer of women's intimate, and other apparel and beauty products worldwide. It offers bras, panties, lingerie, casual sleepwear, and athleisure and swim, as well as fragrances and body care; and loungewear, knit tops, activewear, and accessories and beauty under the Victoria's Secret, PINK, and Adore Me brands.

Further Reading

Before you consider Victoria's Secret & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Victoria's Secret & Co. wasn't on the list.

While Victoria's Secret & Co. currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.