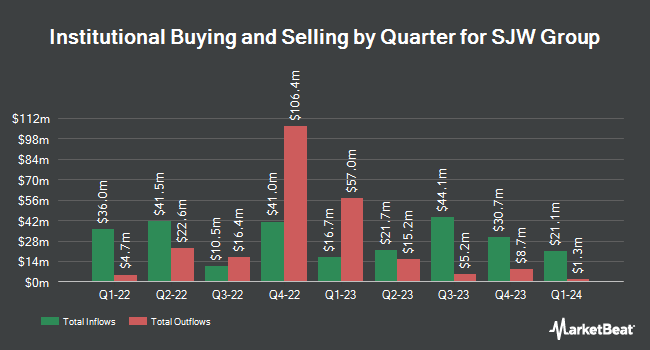

Victory Capital Management Inc. cut its holdings in SJW Group (NYSE:SJW - Free Report) by 8.4% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 174,734 shares of the utilities provider's stock after selling 15,985 shares during the period. Victory Capital Management Inc. owned 0.53% of SJW Group worth $10,154,000 as of its most recent filing with the SEC.

Several other hedge funds have also recently added to or reduced their stakes in the business. Nuance Investments LLC lifted its position in shares of SJW Group by 17.5% in the 2nd quarter. Nuance Investments LLC now owns 1,565,428 shares of the utilities provider's stock worth $84,877,000 after acquiring an additional 233,601 shares during the period. Millennium Management LLC raised its stake in shares of SJW Group by 2,491.2% in the second quarter. Millennium Management LLC now owns 113,781 shares of the utilities provider's stock valued at $6,169,000 after purchasing an additional 109,390 shares in the last quarter. Assenagon Asset Management S.A. lifted its position in SJW Group by 29.4% in the third quarter. Assenagon Asset Management S.A. now owns 212,299 shares of the utilities provider's stock worth $12,337,000 after purchasing an additional 48,200 shares during the period. IQ EQ FUND MANAGEMENT IRELAND Ltd boosted its stake in SJW Group by 144.6% during the second quarter. IQ EQ FUND MANAGEMENT IRELAND Ltd now owns 64,359 shares of the utilities provider's stock worth $3,490,000 after buying an additional 38,044 shares in the last quarter. Finally, Cubist Systematic Strategies LLC increased its holdings in SJW Group by 445.4% in the 2nd quarter. Cubist Systematic Strategies LLC now owns 45,946 shares of the utilities provider's stock valued at $2,491,000 after buying an additional 37,521 shares during the period. Institutional investors own 84.29% of the company's stock.

Analyst Ratings Changes

SJW has been the topic of several recent research reports. StockNews.com lowered shares of SJW Group from a "hold" rating to a "sell" rating in a research report on Tuesday, October 29th. Bank of America assumed coverage on SJW Group in a report on Friday, September 20th. They issued a "neutral" rating and a $65.00 target price for the company. Finally, Wells Fargo & Company cut their price objective on SJW Group from $63.00 to $61.00 and set an "equal weight" rating for the company in a report on Tuesday, October 29th.

View Our Latest Analysis on SJW Group

SJW Group Price Performance

NYSE SJW traded up $0.41 during trading hours on Friday, reaching $55.76. 388,742 shares of the company's stock were exchanged, compared to its average volume of 189,627. The firm has a fifty day moving average of $57.15 and a 200-day moving average of $57.02. The company has a current ratio of 0.77, a quick ratio of 0.77 and a debt-to-equity ratio of 1.25. SJW Group has a one year low of $51.17 and a one year high of $70.43. The stock has a market cap of $1.82 billion, a PE ratio of 20.20, a price-to-earnings-growth ratio of 3.31 and a beta of 0.63.

SJW Group Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 2nd. Shareholders of record on Monday, November 4th will be issued a dividend of $0.40 per share. This represents a $1.60 annualized dividend and a yield of 2.87%. The ex-dividend date is Monday, November 4th. SJW Group's dividend payout ratio is 57.97%.

SJW Group Profile

(

Free Report)

SJW Group, through its subsidiaries, provides water utility and other related services in the United States. It operates in Water Utility Services and Real Estate Services segments. The company engages in the production, purchase, storage, purification, distribution, wholesale, and retail sale of water and wastewater services; and supplies groundwater from wells, surface water from watershed run-off and diversion, reclaimed water, and imported water purchased from the Santa Clara Valley Water District.

Recommended Stories

Before you consider SJW Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SJW Group wasn't on the list.

While SJW Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.