Prosperity Bancshares, Inc. (NYSE:PB - Free Report) - Equities research analysts at Wedbush lowered their FY2026 earnings per share estimates for shares of Prosperity Bancshares in a report released on Tuesday, November 5th. Wedbush analyst D. Chiaverini now forecasts that the bank will earn $6.40 per share for the year, down from their previous estimate of $6.45. Wedbush has a "Outperform" rating and a $90.00 price objective on the stock. The consensus estimate for Prosperity Bancshares' current full-year earnings is $5.05 per share.

PB has been the subject of several other research reports. Barclays increased their target price on shares of Prosperity Bancshares from $75.00 to $76.00 and gave the company an "equal weight" rating in a research note on Thursday, October 24th. Royal Bank of Canada reissued a "sector perform" rating and set a $77.00 price target on shares of Prosperity Bancshares in a research report on Thursday, October 24th. Piper Sandler increased their price objective on Prosperity Bancshares from $73.00 to $80.00 and gave the stock an "overweight" rating in a research report on Thursday, July 25th. Hovde Group boosted their target price on Prosperity Bancshares from $80.50 to $82.50 and gave the stock an "outperform" rating in a research note on Monday, August 26th. Finally, Truist Financial lowered Prosperity Bancshares from a "buy" rating to a "hold" rating and cut their price objective for the stock from $81.00 to $79.00 in a research note on Friday, September 20th. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and nine have issued a buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $78.96.

View Our Latest Report on PB

Prosperity Bancshares Stock Down 1.9 %

NYSE:PB traded down $1.56 during trading hours on Thursday, reaching $79.32. 331,677 shares of the stock were exchanged, compared to its average volume of 570,417. Prosperity Bancshares has a 52 week low of $54.38 and a 52 week high of $81.11. The firm has a 50 day simple moving average of $72.58 and a 200-day simple moving average of $67.45. The stock has a market capitalization of $7.56 billion, a P/E ratio of 17.17, a P/E/G ratio of 1.08 and a beta of 0.89.

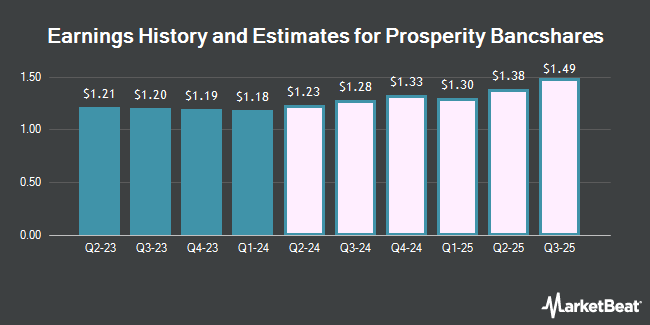

Prosperity Bancshares (NYSE:PB - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The bank reported $1.34 earnings per share for the quarter, topping the consensus estimate of $1.31 by $0.03. Prosperity Bancshares had a return on equity of 6.46% and a net margin of 25.39%. The firm had revenue of $459.00 million during the quarter, compared to the consensus estimate of $299.83 million. During the same period last year, the company earned $1.20 earnings per share.

Institutional Trading of Prosperity Bancshares

Several hedge funds and other institutional investors have recently made changes to their positions in the company. GAMMA Investing LLC increased its stake in Prosperity Bancshares by 59.6% in the 2nd quarter. GAMMA Investing LLC now owns 474 shares of the bank's stock worth $29,000 after purchasing an additional 177 shares during the period. Quarry LP boosted its holdings in shares of Prosperity Bancshares by 533.3% during the 2nd quarter. Quarry LP now owns 494 shares of the bank's stock valued at $30,000 after purchasing an additional 416 shares during the last quarter. Quest Partners LLC boosted its holdings in shares of Prosperity Bancshares by 3,147.1% in the 2nd quarter. Quest Partners LLC now owns 552 shares of the bank's stock worth $34,000 after purchasing an additional 535 shares during the period. Strategic Financial Concepts LLC purchased a new position in shares of Prosperity Bancshares in the 2nd quarter valued at $43,000. Finally, Headlands Technologies LLC acquired a new stake in Prosperity Bancshares in the second quarter worth about $46,000. 80.69% of the stock is currently owned by institutional investors.

Prosperity Bancshares Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, January 2nd. Stockholders of record on Friday, December 13th will be issued a $0.58 dividend. This represents a $2.32 annualized dividend and a dividend yield of 2.92%. The ex-dividend date is Friday, December 13th. This is an increase from Prosperity Bancshares's previous quarterly dividend of $0.56. Prosperity Bancshares's dividend payout ratio is presently 49.26%.

Prosperity Bancshares Company Profile

(

Get Free Report)

Prosperity Bancshares, Inc operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers. It accepts various deposit products, such as demand, savings, money market, and time accounts, as well as and certificates of deposit. The company also offers 1-4 family residential mortgage, commercial real estate and multifamily residential, commercial and industrial, agricultural, and non-real estate agricultural loans, as well as construction, land development, and other land loans; consumer loans, including automobile, recreational vehicle, boat, home improvement, personal, and deposit account collateralized loans; term loans and lines of credit; and consumer durables and home equity loans, as well as loans for working capital, business expansion, and purchase of equipment and machinery.

Recommended Stories

Before you consider Prosperity Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prosperity Bancshares wasn't on the list.

While Prosperity Bancshares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.