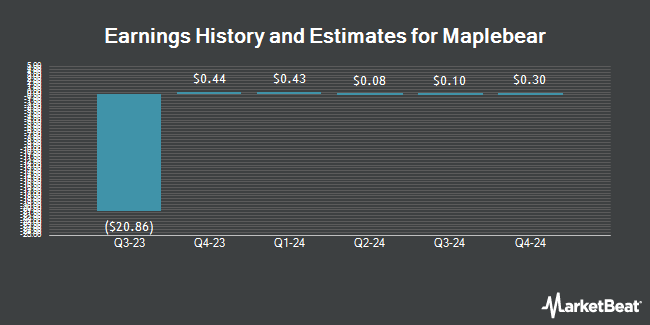

Maplebear Inc. (NASDAQ:CART - Free Report) - Analysts at Wedbush raised their Q4 2024 earnings estimates for Maplebear in a research report issued on Wednesday, November 13th. Wedbush analyst S. Devitt now expects that the company will post earnings per share of $0.37 for the quarter, up from their prior forecast of $0.33. Wedbush currently has a "Neutral" rating and a $38.00 target price on the stock. The consensus estimate for Maplebear's current full-year earnings is $1.17 per share. Wedbush also issued estimates for Maplebear's Q1 2025 earnings at $0.38 EPS, Q2 2025 earnings at $0.36 EPS, Q3 2025 earnings at $0.37 EPS and Q4 2025 earnings at $0.42 EPS.

Maplebear (NASDAQ:CART - Get Free Report) last announced its earnings results on Tuesday, November 12th. The company reported $0.42 earnings per share for the quarter, beating the consensus estimate of $0.22 by $0.20. The firm had revenue of $852.00 million during the quarter, compared to the consensus estimate of $844.03 million. Maplebear had a return on equity of 13.32% and a net margin of 13.37%. The firm's revenue for the quarter was up 11.5% compared to the same quarter last year. During the same quarter in the prior year, the company earned ($20.86) EPS.

A number of other analysts also recently weighed in on CART. Bank of America increased their price target on shares of Maplebear from $50.00 to $51.00 and gave the company a "neutral" rating in a report on Wednesday. Jefferies Financial Group assumed coverage on shares of Maplebear in a research note on Wednesday, October 16th. They issued a "hold" rating and a $43.00 target price for the company. Oppenheimer boosted their price target on Maplebear from $55.00 to $60.00 and gave the company an "outperform" rating in a research note on Wednesday. Macquarie upped their price target on Maplebear from $50.00 to $52.00 and gave the company an "outperform" rating in a report on Thursday. Finally, Stifel Nicolaus lifted their price objective on Maplebear from $52.00 to $55.00 and gave the stock a "buy" rating in a report on Monday, October 28th. Twelve equities research analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the company's stock. According to MarketBeat.com, Maplebear currently has an average rating of "Moderate Buy" and an average price target of $47.29.

Get Our Latest Report on Maplebear

Maplebear Stock Performance

Shares of CART traded down $0.09 during mid-day trading on Thursday, hitting $42.93. The company's stock had a trading volume of 5,916,783 shares, compared to its average volume of 3,976,563. The stock's 50-day moving average is $41.85 and its two-hundred day moving average is $36.51. The firm has a market capitalization of $11.20 billion, a PE ratio of 28.56, a price-to-earnings-growth ratio of 1.50 and a beta of 1.12. Maplebear has a one year low of $22.13 and a one year high of $50.01.

Insiders Place Their Bets

In other news, CAO Alan Ramsay sold 2,486 shares of the company's stock in a transaction that occurred on Friday, September 20th. The shares were sold at an average price of $41.39, for a total transaction of $102,895.54. Following the transaction, the chief accounting officer now directly owns 99,225 shares in the company, valued at approximately $4,106,922.75. This represents a 2.44 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. In related news, General Counsel Morgan Fong sold 29,253 shares of the firm's stock in a transaction dated Thursday, November 7th. The stock was sold at an average price of $48.03, for a total value of $1,405,021.59. Following the transaction, the general counsel now owns 258,406 shares in the company, valued at $12,411,240.18. This trade represents a 10.17 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CAO Alan Ramsay sold 2,486 shares of Maplebear stock in a transaction dated Friday, September 20th. The stock was sold at an average price of $41.39, for a total value of $102,895.54. Following the completion of the sale, the chief accounting officer now owns 99,225 shares of the company's stock, valued at approximately $4,106,922.75. The trade was a 2.44 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 118,710 shares of company stock valued at $4,978,164 in the last 90 days. 36.00% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Several hedge funds have recently modified their holdings of CART. Verition Fund Management LLC raised its stake in shares of Maplebear by 54.0% during the third quarter. Verition Fund Management LLC now owns 630,809 shares of the company's stock worth $25,699,000 after buying an additional 221,091 shares during the last quarter. Vinva Investment Management Ltd bought a new stake in shares of Maplebear during the 3rd quarter valued at $212,000. Zurcher Kantonalbank Zurich Cantonalbank lifted its stake in shares of Maplebear by 95.1% in the 3rd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 30,258 shares of the company's stock valued at $1,233,000 after purchasing an additional 14,750 shares during the period. FORA Capital LLC acquired a new position in shares of Maplebear in the 3rd quarter valued at $5,231,000. Finally, Beaconlight Capital LLC boosted its holdings in Maplebear by 54.7% during the third quarter. Beaconlight Capital LLC now owns 213,797 shares of the company's stock worth $8,710,000 after buying an additional 75,598 shares during the last quarter. Institutional investors own 63.09% of the company's stock.

Maplebear Company Profile

(

Get Free Report)

Maplebear Inc, doing business as Instacart, engages in the provision of online grocery shopping services to households in North America. It sells and delivers grocery products, as well as pickup services through a mobile application and website. It also operates virtual convenience stores; and provides software-as-a-service solutions to retailers.

Read More

Before you consider Maplebear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Maplebear wasn't on the list.

While Maplebear currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.