Zions Bancorporation, National Association (NASDAQ:ZION - Free Report) had its target price lifted by Wells Fargo & Company from $54.00 to $62.00 in a report issued on Friday morning,Benzinga reports. They currently have an equal weight rating on the bank's stock.

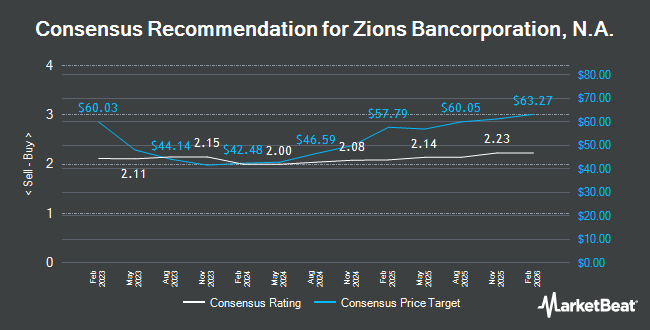

Other research analysts have also issued research reports about the stock. Barclays upped their price target on shares of Zions Bancorporation, National Association from $47.00 to $52.00 and gave the company an "underweight" rating in a research note on Tuesday, October 22nd. Compass Point increased their price objective on shares of Zions Bancorporation, National Association from $49.00 to $54.00 and gave the company a "neutral" rating in a research note on Wednesday, October 23rd. Robert W. Baird upped their price target on shares of Zions Bancorporation, National Association from $52.00 to $55.00 and gave the company a "neutral" rating in a research report on Tuesday, October 22nd. Wedbush raised their price target on shares of Zions Bancorporation, National Association from $52.00 to $55.00 and gave the stock a "neutral" rating in a report on Tuesday, October 22nd. Finally, Morgan Stanley raised their price objective on shares of Zions Bancorporation, National Association from $54.00 to $56.00 and gave the company an "equal weight" rating in a research note on Tuesday, October 22nd. One research analyst has rated the stock with a sell rating, eighteen have given a hold rating and one has given a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $53.59.

Check Out Our Latest Stock Analysis on Zions Bancorporation, National Association

Zions Bancorporation, National Association Stock Down 0.2 %

NASDAQ:ZION traded down $0.09 on Friday, hitting $59.51. 1,095,789 shares of the company's stock were exchanged, compared to its average volume of 2,065,360. The firm has a 50-day moving average price of $50.15 and a 200-day moving average price of $46.92. The company has a debt-to-equity ratio of 0.58, a current ratio of 0.81 and a quick ratio of 0.81. Zions Bancorporation, National Association has a 52 week low of $33.66 and a 52 week high of $61.80. The company has a market cap of $8.79 billion, a P/E ratio of 13.58, a price-to-earnings-growth ratio of 5.33 and a beta of 1.07.

Zions Bancorporation, National Association (NASDAQ:ZION - Get Free Report) last issued its quarterly earnings results on Monday, October 21st. The bank reported $1.37 EPS for the quarter, topping the consensus estimate of $1.16 by $0.21. The firm had revenue of $1.28 billion for the quarter, compared to analysts' expectations of $781.63 million. Zions Bancorporation, National Association had a net margin of 14.09% and a return on equity of 13.89%. During the same period in the previous year, the firm posted $1.13 EPS. As a group, analysts expect that Zions Bancorporation, National Association will post 4.85 EPS for the current fiscal year.

Zions Bancorporation, National Association Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, November 21st. Investors of record on Thursday, November 14th will be paid a dividend of $0.43 per share. The ex-dividend date of this dividend is Thursday, November 14th. This represents a $1.72 annualized dividend and a yield of 2.89%. This is a boost from Zions Bancorporation, National Association's previous quarterly dividend of $0.41. Zions Bancorporation, National Association's payout ratio is currently 39.18%.

Insider Activity at Zions Bancorporation, National Association

In other Zions Bancorporation, National Association news, VP Eric Ellingsen sold 1,238 shares of Zions Bancorporation, National Association stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $60.84, for a total transaction of $75,319.92. Following the completion of the sale, the vice president now directly owns 35,878 shares in the company, valued at $2,182,817.52. The trade was a 3.34 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, EVP Jennifer Anne Smith sold 4,385 shares of the business's stock in a transaction that occurred on Wednesday, October 30th. The stock was sold at an average price of $53.46, for a total transaction of $234,422.10. Following the completion of the sale, the executive vice president now owns 24,714 shares of the company's stock, valued at approximately $1,321,210.44. The trade was a 15.07 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 9,228 shares of company stock valued at $519,048. Corporate insiders own 2.22% of the company's stock.

Institutional Investors Weigh In On Zions Bancorporation, National Association

A number of hedge funds have recently made changes to their positions in the business. Envestnet Portfolio Solutions Inc. raised its holdings in Zions Bancorporation, National Association by 18.9% during the 1st quarter. Envestnet Portfolio Solutions Inc. now owns 10,589 shares of the bank's stock valued at $460,000 after buying an additional 1,680 shares during the last quarter. SG Americas Securities LLC raised its holdings in Zions Bancorporation, National Association by 3.5% during the 1st quarter. SG Americas Securities LLC now owns 13,273 shares of the bank's stock valued at $576,000 after buying an additional 453 shares during the last quarter. Sei Investments Co. raised its holdings in Zions Bancorporation, National Association by 0.7% during the 1st quarter. Sei Investments Co. now owns 73,467 shares of the bank's stock valued at $3,188,000 after buying an additional 530 shares during the last quarter. State Board of Administration of Florida Retirement System raised its holdings in Zions Bancorporation, National Association by 4.3% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 191,539 shares of the bank's stock valued at $8,313,000 after buying an additional 7,911 shares during the last quarter. Finally, Edgestream Partners L.P. bought a new stake in Zions Bancorporation, National Association during the 1st quarter valued at $770,000. 76.84% of the stock is currently owned by institutional investors.

About Zions Bancorporation, National Association

(

Get Free Report)

Zions Bancorporation, National Association provides various banking products and related services primarily in the states of Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming. It operates through Zions Bank, California Bank & Trust, Amegy Bank, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and The Commerce Bank of Washington segments.

Further Reading

Before you consider Zions Bancorporation, National Association, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zions Bancorporation, National Association wasn't on the list.

While Zions Bancorporation, National Association currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report