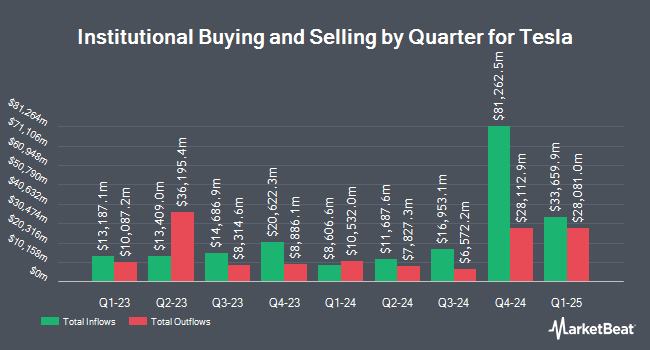

W.G. Shaheen & Associates DBA Whitney & Co grew its holdings in Tesla, Inc. (NASDAQ:TSLA - Free Report) by 85.4% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 5,357 shares of the electric vehicle producer's stock after purchasing an additional 2,467 shares during the period. W.G. Shaheen & Associates DBA Whitney & Co's holdings in Tesla were worth $1,402,000 as of its most recent SEC filing.

Several other large investors have also recently bought and sold shares of the business. China Universal Asset Management Co. Ltd. raised its holdings in shares of Tesla by 0.9% during the 1st quarter. China Universal Asset Management Co. Ltd. now owns 36,399 shares of the electric vehicle producer's stock valued at $6,399,000 after purchasing an additional 331 shares in the last quarter. Bessemer Group Inc. increased its holdings in shares of Tesla by 113.9% during the 1st quarter. Bessemer Group Inc. now owns 65,437 shares of the electric vehicle producer's stock valued at $11,503,000 after acquiring an additional 34,850 shares during the last quarter. Leelyn Smith LLC increased its holdings in shares of Tesla by 107.2% during the 1st quarter. Leelyn Smith LLC now owns 10,831 shares of the electric vehicle producer's stock valued at $1,904,000 after acquiring an additional 5,603 shares during the last quarter. Crewe Advisors LLC bought a new stake in Tesla during the 1st quarter valued at approximately $9,703,000. Finally, Mattern Capital Management LLC boosted its stake in Tesla by 33.6% during the 1st quarter. Mattern Capital Management LLC now owns 5,195 shares of the electric vehicle producer's stock valued at $913,000 after purchasing an additional 1,307 shares during the period. 66.20% of the stock is owned by institutional investors and hedge funds.

Tesla Price Performance

Shares of Tesla stock traded up $6.15 on Tuesday, reaching $344.89. 77,283,572 shares of the stock were exchanged, compared to its average volume of 96,060,273. The firm's 50 day moving average is $254.75 and its 200-day moving average is $222.13. Tesla, Inc. has a one year low of $138.80 and a one year high of $358.64. The company has a debt-to-equity ratio of 0.08, a quick ratio of 1.37 and a current ratio of 1.84. The firm has a market cap of $1.11 trillion, a PE ratio of 94.55, a P/E/G ratio of 10.42 and a beta of 2.29.

Tesla (NASDAQ:TSLA - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The electric vehicle producer reported $0.72 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.58 by $0.14. The business had revenue of $25.18 billion during the quarter, compared to analysts' expectations of $25.47 billion. Tesla had a net margin of 13.07% and a return on equity of 10.24%. The firm's quarterly revenue was up 7.8% compared to the same quarter last year. During the same period in the prior year, the company earned $0.53 EPS. As a group, analysts anticipate that Tesla, Inc. will post 1.99 EPS for the current fiscal year.

Insider Buying and Selling

In other Tesla news, Director Kathleen Wilson-Thompson sold 100,000 shares of the company's stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $346.02, for a total value of $34,602,000.00. Following the completion of the transaction, the director now directly owns 5,400 shares in the company, valued at approximately $1,868,508. This represents a 94.88 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, SVP Xiaotong Zhu sold 297 shares of the company's stock in a transaction that occurred on Friday, September 6th. The shares were sold at an average price of $221.77, for a total transaction of $65,865.69. Following the completion of the transaction, the senior vice president now owns 67,491 shares of the company's stock, valued at approximately $14,967,479.07. This trade represents a 0.44 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 188,797 shares of company stock worth $57,616,781 in the last three months. 20.70% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

TSLA has been the subject of several recent analyst reports. Robert W. Baird restated an "outperform" rating and set a $280.00 target price on shares of Tesla in a research note on Tuesday, August 20th. Phillip Securities downgraded Tesla from a "moderate sell" rating to a "strong sell" rating in a research report on Wednesday, November 13th. Canaccord Genuity Group increased their target price on Tesla from $254.00 to $278.00 and gave the stock a "buy" rating in a report on Thursday, October 24th. Piper Sandler raised their price target on Tesla from $310.00 to $315.00 and gave the company an "overweight" rating in a report on Friday, October 25th. Finally, New Street Research downgraded shares of Tesla from a "buy" rating to a "neutral" rating and set a $225.00 target price on the stock. in a research report on Wednesday, July 24th. Nine research analysts have rated the stock with a sell rating, seventeen have assigned a hold rating and fourteen have assigned a buy rating to the stock. Based on data from MarketBeat.com, Tesla presently has a consensus rating of "Hold" and an average price target of $230.18.

Read Our Latest Report on TSLA

Tesla Company Profile

(

Free Report)

Tesla, Inc designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits; and non-warranty after-sales vehicle, used vehicles, body shop and parts, supercharging, retail merchandise, and vehicle insurance services.

Recommended Stories

Before you consider Tesla, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tesla wasn't on the list.

While Tesla currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.