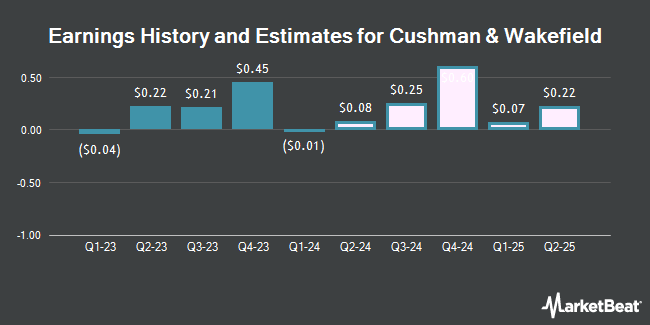

Cushman & Wakefield plc (NYSE:CWK - Free Report) - William Blair lowered their FY2024 earnings per share (EPS) estimates for Cushman & Wakefield in a research report issued on Tuesday, November 5th. William Blair analyst S. Sheldon now expects that the company will post earnings per share of $0.94 for the year, down from their prior forecast of $0.96. The consensus estimate for Cushman & Wakefield's current full-year earnings is $0.87 per share. William Blair also issued estimates for Cushman & Wakefield's Q2 2025 earnings at $0.29 EPS, Q3 2025 earnings at $0.27 EPS, Q4 2025 earnings at $0.63 EPS, FY2025 earnings at $1.27 EPS and FY2026 earnings at $1.70 EPS.

Several other equities analysts also recently commented on CWK. JPMorgan Chase & Co. upped their target price on Cushman & Wakefield from $12.00 to $14.00 and gave the company a "neutral" rating in a research report on Tuesday, July 30th. Raymond James upped their price objective on Cushman & Wakefield from $14.00 to $16.00 and gave the company an "outperform" rating in a report on Thursday, July 25th. Three research analysts have rated the stock with a hold rating and two have given a buy rating to the stock. According to MarketBeat, Cushman & Wakefield has a consensus rating of "Hold" and a consensus price target of $12.80.

View Our Latest Stock Report on CWK

Cushman & Wakefield Stock Performance

CWK traded down $0.54 on Wednesday, reaching $14.63. The company had a trading volume of 4,865,041 shares, compared to its average volume of 2,229,546. The company's fifty day moving average is $13.16 and its 200 day moving average is $11.95. The company has a debt-to-equity ratio of 1.83, a quick ratio of 1.21 and a current ratio of 1.21. The stock has a market cap of $3.35 billion, a P/E ratio of 39.54 and a beta of 1.30. Cushman & Wakefield has a fifty-two week low of $7.28 and a fifty-two week high of $16.11.

Cushman & Wakefield (NYSE:CWK - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The company reported $0.23 EPS for the quarter, beating the consensus estimate of $0.21 by $0.02. The firm had revenue of $2.34 billion for the quarter, compared to the consensus estimate of $1.61 billion. Cushman & Wakefield had a net margin of 0.22% and a return on equity of 12.08%. The company's quarterly revenue was up 2.5% on a year-over-year basis. During the same period in the previous year, the company earned $0.21 earnings per share.

Institutional Investors Weigh In On Cushman & Wakefield

A number of large investors have recently added to or reduced their stakes in the stock. Blue Trust Inc. raised its position in shares of Cushman & Wakefield by 137.5% in the 3rd quarter. Blue Trust Inc. now owns 3,501 shares of the company's stock valued at $48,000 after buying an additional 2,027 shares in the last quarter. CWM LLC increased its stake in Cushman & Wakefield by 61.4% in the second quarter. CWM LLC now owns 5,468 shares of the company's stock valued at $57,000 after acquiring an additional 2,080 shares during the last quarter. GAMMA Investing LLC increased its stake in Cushman & Wakefield by 45.8% in the third quarter. GAMMA Investing LLC now owns 5,186 shares of the company's stock valued at $71,000 after acquiring an additional 1,629 shares during the last quarter. Profund Advisors LLC acquired a new position in Cushman & Wakefield during the second quarter valued at approximately $105,000. Finally, KBC Group NV lifted its stake in Cushman & Wakefield by 31.7% during the third quarter. KBC Group NV now owns 7,961 shares of the company's stock worth $109,000 after purchasing an additional 1,915 shares during the last quarter. Institutional investors and hedge funds own 95.56% of the company's stock.

About Cushman & Wakefield

(

Get Free Report)

Cushman & Wakefield plc, together with its subsidiaries, provides commercial real estate services under the Cushman & Wakefield brand in the United States, Australia, the United Kingdom, and internationally. The company operates through Americas; Europe, Middle East and Africa; and Asia Pacific segments.

Further Reading

Before you consider Cushman & Wakefield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cushman & Wakefield wasn't on the list.

While Cushman & Wakefield currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.