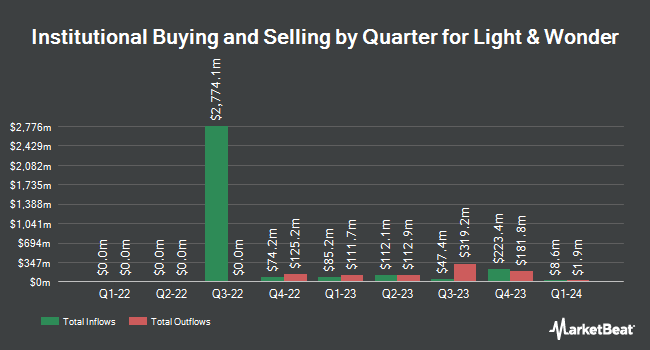

XY Capital Ltd grew its holdings in shares of Light & Wonder, Inc. (NASDAQ:LNW - Free Report) by 200.2% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 35,170 shares of the company's stock after buying an additional 23,456 shares during the quarter. Light & Wonder accounts for approximately 1.1% of XY Capital Ltd's holdings, making the stock its 11th biggest holding. XY Capital Ltd's holdings in Light & Wonder were worth $3,191,000 as of its most recent SEC filing.

A number of other institutional investors have also recently made changes to their positions in the business. Ninety One UK Ltd raised its stake in shares of Light & Wonder by 128.0% in the second quarter. Ninety One UK Ltd now owns 910,298 shares of the company's stock valued at $95,472,000 after acquiring an additional 511,081 shares during the period. Millennium Management LLC grew its holdings in Light & Wonder by 573.3% during the 2nd quarter. Millennium Management LLC now owns 579,340 shares of the company's stock valued at $60,761,000 after purchasing an additional 493,295 shares during the last quarter. Price T Rowe Associates Inc. MD raised its position in Light & Wonder by 102.8% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 767,155 shares of the company's stock worth $78,320,000 after purchasing an additional 388,781 shares during the period. Susquehanna Fundamental Investments LLC bought a new stake in Light & Wonder in the second quarter worth about $23,597,000. Finally, WINTON GROUP Ltd purchased a new position in shares of Light & Wonder during the second quarter valued at approximately $15,539,000. Institutional investors own 88.08% of the company's stock.

Light & Wonder Stock Up 0.8 %

Shares of LNW traded up $0.83 during mid-day trading on Friday, hitting $102.89. The company's stock had a trading volume of 396,997 shares, compared to its average volume of 708,782. The firm has a market capitalization of $9.13 billion, a price-to-earnings ratio of 30.99, a PEG ratio of 0.42 and a beta of 1.75. The company has a current ratio of 1.85, a quick ratio of 1.58 and a debt-to-equity ratio of 4.90. Light & Wonder, Inc. has a 52-week low of $76.52 and a 52-week high of $115.00. The company's 50-day moving average is $99.15 and its 200-day moving average is $99.71.

Light & Wonder (NASDAQ:LNW - Get Free Report) last released its quarterly earnings results on Wednesday, August 7th. The company reported $0.90 EPS for the quarter, missing the consensus estimate of $1.04 by ($0.14). Light & Wonder had a net margin of 9.92% and a return on equity of 40.51%. The firm had revenue of $818.00 million for the quarter, compared to analysts' expectations of $798.09 million. During the same period in the previous year, the company posted $1.02 earnings per share. The business's quarterly revenue was up 11.9% compared to the same quarter last year. On average, equities research analysts forecast that Light & Wonder, Inc. will post 4.41 EPS for the current fiscal year.

Light & Wonder announced that its Board of Directors has authorized a share buyback program on Wednesday, August 7th that allows the company to buyback $1.00 billion in outstanding shares. This buyback authorization allows the company to reacquire up to 10.1% of its stock through open market purchases. Stock buyback programs are typically a sign that the company's board believes its shares are undervalued.

Analyst Upgrades and Downgrades

Several brokerages have recently weighed in on LNW. UBS Group upgraded Light & Wonder from a "neutral" rating to a "buy" rating in a report on Wednesday, September 25th. Maxim Group began coverage on Light & Wonder in a research note on Monday, August 26th. They issued a "buy" rating and a $144.00 target price on the stock. Craig Hallum raised shares of Light & Wonder to a "strong-buy" rating in a research note on Friday, October 4th. JPMorgan Chase & Co. upped their price target on shares of Light & Wonder from $107.00 to $111.00 and gave the stock an "overweight" rating in a report on Thursday, August 8th. Finally, Truist Financial decreased their price objective on shares of Light & Wonder from $120.00 to $115.00 and set a "buy" rating for the company in a report on Wednesday, October 23rd. One investment analyst has rated the stock with a sell rating, four have given a hold rating, six have assigned a buy rating and two have given a strong buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $107.36.

View Our Latest Stock Analysis on LNW

About Light & Wonder

(

Free Report)

Light & Wonder, Inc operates as a cross-platform games company in the United States and internationally. The company operates through three segments: Gaming, SciPlay, and iGaming segments. The Gaming segment sells game content and gaming machine; video gaming terminals; video lottery terminals, including conversion kits and spare parts; and table products, including automatic card shufflers, deck checkers, table roulette chip sorters and other land-based table gaming equipment.

Featured Articles

Before you consider Light & Wonder, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Light & Wonder wasn't on the list.

While Light & Wonder currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.