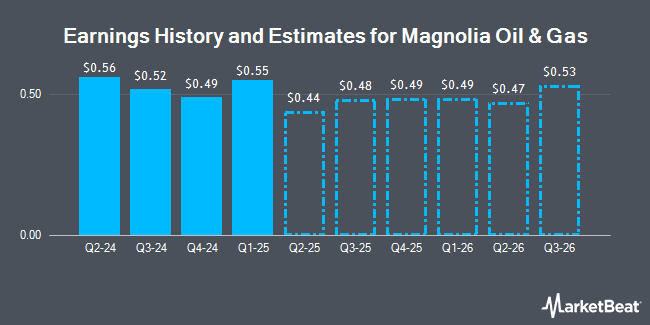

Magnolia Oil & Gas Co. (NYSE:MGY - Free Report) - Investment analysts at Zacks Research dropped their Q4 2024 earnings per share estimates for shares of Magnolia Oil & Gas in a research report issued to clients and investors on Wednesday, November 13th. Zacks Research analyst N. Choudhury now anticipates that the company will post earnings per share of $0.41 for the quarter, down from their previous forecast of $0.46. The consensus estimate for Magnolia Oil & Gas' current full-year earnings is $1.99 per share. Zacks Research also issued estimates for Magnolia Oil & Gas' Q2 2025 earnings at $0.46 EPS, Q3 2025 earnings at $0.48 EPS, FY2025 earnings at $1.91 EPS, Q2 2026 earnings at $0.50 EPS, Q3 2026 earnings at $0.57 EPS and FY2026 earnings at $2.15 EPS.

Magnolia Oil & Gas (NYSE:MGY - Get Free Report) last issued its quarterly earnings data on Wednesday, October 30th. The company reported $0.52 EPS for the quarter, topping analysts' consensus estimates of $0.48 by $0.04. The business had revenue of $333.14 million for the quarter, compared to analyst estimates of $331.45 million. Magnolia Oil & Gas had a net margin of 28.88% and a return on equity of 20.78%.

A number of other research analysts have also commented on the stock. Piper Sandler decreased their price target on shares of Magnolia Oil & Gas from $29.00 to $26.00 and set a "neutral" rating on the stock in a research note on Thursday, August 15th. Mizuho lowered their target price on Magnolia Oil & Gas from $28.00 to $27.00 and set a "neutral" rating on the stock in a research note on Monday, September 16th. Wolfe Research initiated coverage on Magnolia Oil & Gas in a research note on Thursday, July 18th. They issued an "outperform" rating and a $32.00 price target for the company. JPMorgan Chase & Co. lowered their price objective on Magnolia Oil & Gas from $26.00 to $23.00 and set a "neutral" rating on the stock in a research report on Thursday, September 12th. Finally, Wells Fargo & Company cut shares of Magnolia Oil & Gas from an "equal weight" rating to an "underweight" rating and reduced their target price for the company from $26.00 to $22.00 in a research report on Tuesday, October 1st. Two investment analysts have rated the stock with a sell rating, five have assigned a hold rating and six have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $27.67.

Check Out Our Latest Research Report on Magnolia Oil & Gas

Magnolia Oil & Gas Stock Down 1.5 %

NYSE:MGY traded down $0.40 during trading hours on Friday, reaching $26.84. 1,727,860 shares of the stock were exchanged, compared to its average volume of 2,505,016. The company has a debt-to-equity ratio of 0.20, a current ratio of 1.47 and a quick ratio of 1.47. Magnolia Oil & Gas has a twelve month low of $19.16 and a twelve month high of $27.96. The stock has a market cap of $5.28 billion, a PE ratio of 13.29, a PEG ratio of 1.38 and a beta of 1.99. The firm has a 50 day moving average of $25.69 and a 200 day moving average of $25.42.

Magnolia Oil & Gas Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 2nd. Investors of record on Friday, November 8th will be paid a dividend of $0.13 per share. The ex-dividend date of this dividend is Friday, November 8th. This represents a $0.52 annualized dividend and a yield of 1.94%. Magnolia Oil & Gas's dividend payout ratio is currently 25.74%.

Insiders Place Their Bets

In other news, Director Ltd. Enervest sold 7,000,000 shares of the company's stock in a transaction dated Monday, September 23rd. The shares were sold at an average price of $25.86, for a total transaction of $181,020,000.00. Following the transaction, the director now owns 2,099,403 shares in the company, valued at approximately $54,290,561.58. This represents a 76.93 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 1.20% of the stock is currently owned by corporate insiders.

Institutional Trading of Magnolia Oil & Gas

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Harbor Capital Advisors Inc. purchased a new position in shares of Magnolia Oil & Gas during the third quarter valued at approximately $25,000. First Horizon Advisors Inc. grew its stake in shares of Magnolia Oil & Gas by 64.7% in the 3rd quarter. First Horizon Advisors Inc. now owns 1,008 shares of the company's stock worth $25,000 after acquiring an additional 396 shares in the last quarter. Massmutual Trust Co. FSB ADV raised its holdings in shares of Magnolia Oil & Gas by 1,753.6% in the second quarter. Massmutual Trust Co. FSB ADV now owns 1,038 shares of the company's stock valued at $26,000 after purchasing an additional 982 shares during the last quarter. Opal Wealth Advisors LLC purchased a new stake in Magnolia Oil & Gas in the 2nd quarter valued at about $26,000. Finally, GAMMA Investing LLC increased its position in shares of Magnolia Oil & Gas by 184.4% during the second quarter. GAMMA Investing LLC now owns 1,607 shares of the company's stock valued at $41,000 after acquiring an additional 1,042 shares during the last quarter. 94.73% of the stock is owned by institutional investors.

Magnolia Oil & Gas Company Profile

(

Get Free Report)

Magnolia Oil & Gas Corporation, an independent oil and natural gas company, engages in the acquisition, development, exploration, and production of oil, natural gas, and natural gas liquids reserves in the United States. Its properties are located primarily in Karnes County and the Giddings area in South Texas principally comprising the Eagle Ford Shale and the Austin Chalk formation.

Featured Stories

Before you consider Magnolia Oil & Gas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Magnolia Oil & Gas wasn't on the list.

While Magnolia Oil & Gas currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.