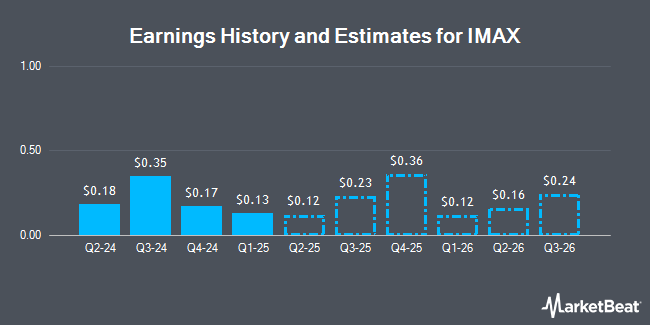

IMAX Co. (NYSE:IMAX - Free Report) - Analysts at Zacks Research lowered their Q4 2024 earnings per share (EPS) estimates for shares of IMAX in a research report issued to clients and investors on Wednesday, November 20th. Zacks Research analyst R. Department now anticipates that the company will post earnings of $0.27 per share for the quarter, down from their prior forecast of $0.28. The consensus estimate for IMAX's current full-year earnings is $0.76 per share. Zacks Research also issued estimates for IMAX's Q1 2025 earnings at $0.10 EPS, Q2 2025 earnings at $0.10 EPS, Q3 2025 earnings at $0.19 EPS and Q3 2026 earnings at $0.18 EPS.

IMAX has been the subject of several other reports. Rosenblatt Securities restated a "buy" rating and issued a $28.00 price objective on shares of IMAX in a research note on Thursday, October 31st. Barrington Research reiterated an "outperform" rating and issued a $24.00 price target on shares of IMAX in a research note on Thursday, October 31st. Roth Mkm increased their price target on IMAX from $27.00 to $28.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Macquarie increased their price target on IMAX from $24.00 to $26.00 and gave the stock an "outperform" rating in a research note on Friday, July 26th. Finally, Wedbush increased their price target on IMAX from $24.00 to $26.00 and gave the stock an "outperform" rating in a research note on Tuesday, September 3rd. One research analyst has rated the stock with a sell rating, two have assigned a hold rating, seven have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, IMAX has an average rating of "Moderate Buy" and an average target price of $24.22.

Get Our Latest Research Report on IMAX

IMAX Stock Up 1.9 %

IMAX traded up $0.48 during mid-day trading on Friday, reaching $25.19. 620,289 shares of the company traded hands, compared to its average volume of 760,864. The stock has a market capitalization of $1.33 billion, a P/E ratio of 55.90, a P/E/G ratio of 1.63 and a beta of 1.22. IMAX has a 52-week low of $13.20 and a 52-week high of $25.51. The company's fifty day moving average price is $21.68 and its 200-day moving average price is $19.43.

IMAX (NYSE:IMAX - Get Free Report) last announced its earnings results on Wednesday, October 30th. The company reported $0.35 earnings per share for the quarter, beating analysts' consensus estimates of $0.23 by $0.12. The business had revenue of $91.50 million during the quarter, compared to analyst estimates of $93.71 million. IMAX had a net margin of 6.74% and a return on equity of 7.53%. The company's quarterly revenue was down 11.9% compared to the same quarter last year. During the same period in the previous year, the business earned $0.27 EPS.

Institutional Inflows and Outflows

A number of institutional investors have recently made changes to their positions in the business. FMR LLC lifted its holdings in shares of IMAX by 108.4% in the 3rd quarter. FMR LLC now owns 3,949,643 shares of the company's stock valued at $81,007,000 after acquiring an additional 2,054,031 shares during the last quarter. Royce & Associates LP lifted its stake in IMAX by 3.1% in the third quarter. Royce & Associates LP now owns 1,822,616 shares of the company's stock worth $37,382,000 after purchasing an additional 54,850 shares during the last quarter. Victory Capital Management Inc. lifted its stake in IMAX by 9.8% in the third quarter. Victory Capital Management Inc. now owns 1,420,592 shares of the company's stock worth $29,136,000 after purchasing an additional 127,371 shares during the last quarter. Private Capital Management LLC lifted its stake in IMAX by 10.0% in the first quarter. Private Capital Management LLC now owns 1,304,364 shares of the company's stock worth $21,092,000 after purchasing an additional 118,649 shares during the last quarter. Finally, Thrivent Financial for Lutherans lifted its stake in IMAX by 5.5% in the second quarter. Thrivent Financial for Lutherans now owns 819,325 shares of the company's stock worth $13,740,000 after purchasing an additional 42,952 shares during the last quarter. Institutional investors own 93.51% of the company's stock.

About IMAX

(

Get Free Report)

IMAX Corporation, together with its subsidiaries, operates as a technology platform for entertainment and events worldwide. The company operates in two segments, Content Solutions and Technology Products and Services. The company offers IMAX DMR, a proprietary technology that digitally remasters films and other content into IMAX formats for distribution to the IMAX network; IMAX Enhanced that provides end-to-end technology across streaming content and entertainment devices at home; and SSIMWAVE, an AI-driven video quality solutions for media and entertainment companies.

Featured Articles

Before you consider IMAX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IMAX wasn't on the list.

While IMAX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.