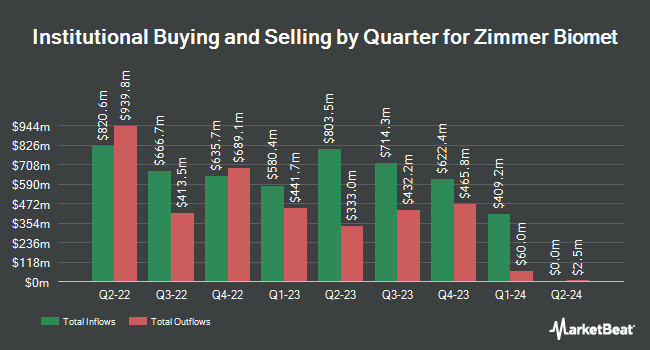

Moran Wealth Management LLC reduced its position in Zimmer Biomet Holdings, Inc. (NYSE:ZBH - Free Report) by 95.1% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 2,867 shares of the medical equipment provider's stock after selling 55,938 shares during the quarter. Moran Wealth Management LLC's holdings in Zimmer Biomet were worth $309,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors also recently made changes to their positions in ZBH. Prospera Private Wealth LLC bought a new position in shares of Zimmer Biomet in the third quarter valued at about $81,000. B. Metzler seel. Sohn & Co. Holding AG bought a new stake in Zimmer Biomet during the 3rd quarter worth about $4,571,000. Banque Cantonale Vaudoise raised its holdings in Zimmer Biomet by 108.7% during the 3rd quarter. Banque Cantonale Vaudoise now owns 29,823 shares of the medical equipment provider's stock worth $3,219,000 after purchasing an additional 15,535 shares during the last quarter. FWG Holdings LLC raised its holdings in Zimmer Biomet by 2.9% during the 3rd quarter. FWG Holdings LLC now owns 3,591 shares of the medical equipment provider's stock worth $372,000 after purchasing an additional 101 shares during the last quarter. Finally, Pathstone Holdings LLC raised its holdings in Zimmer Biomet by 5.2% during the 3rd quarter. Pathstone Holdings LLC now owns 73,039 shares of the medical equipment provider's stock worth $7,885,000 after purchasing an additional 3,612 shares during the last quarter. 88.89% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

ZBH has been the subject of a number of recent analyst reports. Evercore ISI reduced their price target on Zimmer Biomet from $113.00 to $110.00 and set an "in-line" rating for the company in a research report on Tuesday, October 1st. BTIG Research reduced their price target on Zimmer Biomet from $134.00 to $126.00 and set a "buy" rating for the company in a research report on Thursday, October 3rd. JPMorgan Chase & Co. reduced their price target on Zimmer Biomet from $125.00 to $120.00 and set a "neutral" rating for the company in a research report on Monday, September 16th. Oppenheimer reduced their price target on Zimmer Biomet from $145.00 to $135.00 and set an "outperform" rating for the company in a research report on Tuesday, October 15th. Finally, Raymond James dropped their price objective on Zimmer Biomet from $128.00 to $123.00 and set an "outperform" rating on the stock in a research note on Monday, October 14th. Two investment analysts have rated the stock with a sell rating, twelve have assigned a hold rating and seven have assigned a buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $123.22.

Check Out Our Latest Stock Analysis on ZBH

Zimmer Biomet Trading Up 1.7 %

ZBH stock traded up $1.82 during mid-day trading on Friday, reaching $110.22. The company's stock had a trading volume of 2,015,059 shares, compared to its average volume of 1,734,120. The company has a market cap of $21.94 billion, a price-to-earnings ratio of 20.96, a price-to-earnings-growth ratio of 1.99 and a beta of 1.02. The business's 50 day moving average price is $106.79 and its 200 day moving average price is $109.78. The company has a current ratio of 1.36, a quick ratio of 0.70 and a debt-to-equity ratio of 0.38. Zimmer Biomet Holdings, Inc. has a 12 month low of $101.47 and a 12 month high of $133.90.

Zimmer Biomet (NYSE:ZBH - Get Free Report) last announced its earnings results on Wednesday, October 30th. The medical equipment provider reported $1.74 earnings per share (EPS) for the quarter, meeting the consensus estimate of $1.74. The company had revenue of $1.82 billion for the quarter, compared to analysts' expectations of $1.80 billion. Zimmer Biomet had a return on equity of 12.95% and a net margin of 14.27%. Zimmer Biomet's quarterly revenue was up 4.1% on a year-over-year basis. During the same quarter in the previous year, the firm earned $1.65 earnings per share. On average, equities research analysts predict that Zimmer Biomet Holdings, Inc. will post 7.99 EPS for the current year.

Zimmer Biomet Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, October 31st. Investors of record on Monday, September 30th were paid a dividend of $0.24 per share. The ex-dividend date of this dividend was Monday, September 30th. This represents a $0.96 dividend on an annualized basis and a dividend yield of 0.87%. Zimmer Biomet's payout ratio is 18.25%.

Zimmer Biomet Profile

(

Free Report)

Zimmer Biomet Holdings, Inc, together with its subsidiaries, operates as a medical technology company worldwide. The company designs, manufactures, and markets orthopedic reconstructive products, such as knee and hip products; S.E.T. products, including sports medicine, biologics, foot and ankle, extremities, and trauma products; craniomaxillofacial and thoracic products comprising face and skull reconstruction products, as well as products that fixate and stabilize the bones of the chest to facilitate healing or reconstruction after open heart surgery, trauma, or for deformities of the chest.

Featured Articles

Before you consider Zimmer Biomet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zimmer Biomet wasn't on the list.

While Zimmer Biomet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.