Zurcher Kantonalbank Zurich Cantonalbank decreased its position in Newmont Co. (NYSE:NEM - Free Report) by 5.8% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 602,212 shares of the basic materials company's stock after selling 37,126 shares during the quarter. Zurcher Kantonalbank Zurich Cantonalbank owned about 0.05% of Newmont worth $32,188,000 as of its most recent SEC filing.

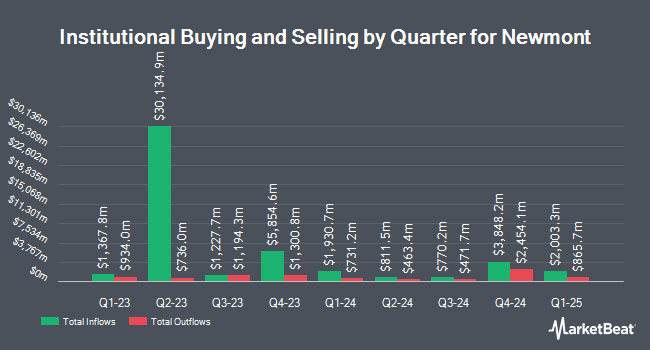

A number of other large investors also recently made changes to their positions in the company. Janus Henderson Group PLC raised its stake in Newmont by 19.1% in the 1st quarter. Janus Henderson Group PLC now owns 341,907 shares of the basic materials company's stock worth $12,256,000 after purchasing an additional 54,761 shares in the last quarter. LRI Investments LLC acquired a new stake in shares of Newmont in the first quarter valued at approximately $25,000. Swedbank AB bought a new stake in shares of Newmont in the first quarter valued at approximately $29,788,000. Cetera Investment Advisers grew its position in Newmont by 990.2% during the first quarter. Cetera Investment Advisers now owns 205,894 shares of the basic materials company's stock worth $7,379,000 after buying an additional 187,008 shares in the last quarter. Finally, Cetera Advisors LLC increased its stake in Newmont by 30.3% during the 1st quarter. Cetera Advisors LLC now owns 21,464 shares of the basic materials company's stock worth $769,000 after acquiring an additional 4,987 shares during the period. Institutional investors own 68.85% of the company's stock.

Analyst Ratings Changes

A number of analysts have recently weighed in on the company. JPMorgan Chase & Co. upgraded Newmont from a "neutral" rating to an "overweight" rating in a research report on Tuesday, November 19th. CIBC downgraded shares of Newmont from a "sector outperform" rating to a "neutral" rating in a research note on Monday, October 28th. Jefferies Financial Group raised their target price on shares of Newmont from $54.00 to $63.00 and gave the company a "buy" rating in a report on Friday, October 4th. Cibc World Mkts downgraded shares of Newmont from a "strong-buy" rating to a "hold" rating in a report on Monday, October 28th. Finally, CLSA began coverage on shares of Newmont in a research note on Friday. They issued an "underperform" rating on the stock. One equities research analyst has rated the stock with a sell rating, eight have assigned a hold rating, seven have assigned a buy rating and two have given a strong buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $54.31.

View Our Latest Analysis on NEM

Insiders Place Their Bets

In related news, CEO Thomas Ronald Palmer sold 20,000 shares of the stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $52.47, for a total value of $1,049,400.00. Following the transaction, the chief executive officer now directly owns 291,469 shares in the company, valued at $15,293,378.43. This trade represents a 6.42 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, EVP Peter Toth sold 3,000 shares of the business's stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $53.81, for a total transaction of $161,430.00. Following the sale, the executive vice president now owns 91,596 shares of the company's stock, valued at $4,928,780.76. This trade represents a 3.17 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 46,000 shares of company stock worth $2,444,440. 0.06% of the stock is currently owned by company insiders.

Newmont Trading Down 0.2 %

Shares of NEM traded down $0.08 during trading hours on Friday, hitting $41.96. 6,192,863 shares of the stock were exchanged, compared to its average volume of 10,502,084. The firm has a market capitalization of $47.77 billion, a P/E ratio of -27.61, a price-to-earnings-growth ratio of 0.36 and a beta of 0.51. The company has a debt-to-equity ratio of 0.30, a current ratio of 1.96 and a quick ratio of 1.73. Newmont Co. has a fifty-two week low of $29.42 and a fifty-two week high of $58.72. The business has a 50-day moving average of $49.09 and a 200-day moving average of $47.42.

Newmont (NYSE:NEM - Get Free Report) last issued its earnings results on Wednesday, October 23rd. The basic materials company reported $0.81 earnings per share for the quarter, missing analysts' consensus estimates of $0.86 by ($0.05). The business had revenue of $4.61 billion during the quarter, compared to the consensus estimate of $4.67 billion. Newmont had a positive return on equity of 9.80% and a negative net margin of 7.03%. The company's revenue for the quarter was up 84.7% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $0.36 earnings per share. On average, research analysts expect that Newmont Co. will post 3.08 EPS for the current year.

Newmont Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, December 23rd. Investors of record on Wednesday, November 27th will be paid a dividend of $0.25 per share. This represents a $1.00 annualized dividend and a yield of 2.38%. The ex-dividend date is Wednesday, November 27th. Newmont's dividend payout ratio is presently -65.79%.

Newmont Profile

(

Free Report)

Newmont Corporation engages in the production and exploration of gold. It also explores for copper, silver, zinc, and lead. The company has operations and/or assets in the United States, Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia, Papua New Guinea, Ecuador, Fiji, and Ghana.

Read More

Before you consider Newmont, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Newmont wasn't on the list.

While Newmont currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report