Unity Software Today

U

Unity Software

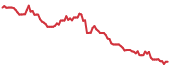

$36.67 +0.15 (+0.41%) As of 07/18/2025 03:59 PM Eastern

- 52-Week Range

- $13.90

▼

$38.96 - Price Target

- $26.43

Unity Software NYSE: U gave investors a reason to take notice in mid-July 2025. The company’s stock jumped over 14% to a new 52-week high. Unity’s stock price jump was powered by a trading volume of nearly 40 million shares, more than three times its daily average.

The immediate trigger was a positive report from an analyst at Jefferies, who raised the stock's price target to $35 and held a firm Buy rating.

The market’s positive reaction suggests a significant shift in investors' perception of the company. For months, the story surrounding Unity focused on a complex turnaround.

Now, that story is changing, with a new focus on clear evidence that the company's strategy is working under its new leadership. The key question for investors is precisely what drives this powerful new wave of analyst optimism.

Why Unity's Ad Business Is Turning Heads

The main reason for the renewed confidence is the accelerating momentum within Unity’s Grow Solutions segment. This division helps game developers attract new players and make money from their creations. It is the heart of Unity's turnaround story, and two recent developments show why analysts are taking notice.

The first is the impressive performance of Unity Vector, the company’s new AI-powered advertising platform. In its first-quarter report, Unity revealed that Vector is already delivering a significant 15-20% performance lift for its advertisers.

For investors, this is a critical update. In digital advertising, results are everything. When a platform delivers a higher return on ad spend, advertisers are motivated to increase their spending on it. This creates a positive cycle that drives high-margin revenue, a key part of Unity’s plan for long-term profitability.

Unity is also thinking beyond its current success. In June 2025, the company launched the Unity Audience Hub, a new platform for creating highly targeted ad campaigns.

This initiative is backed by major partners, including data firm Experian OTCMKTS: EXPGY and streaming giant Roku NASDAQ: ROKU. The Roku partnership is especially important.

It enables Unity to sell ads on Connected TV (CTV) platforms, a large and growing part of the entertainment sector that currently lies outside Unity's traditional mobile gaming space.

This strategic move signals a sophisticated plan to improve Unity's existing ad business and capture new sources of revenue.

Unity’s Disciplined Turnaround Takes Hold

The exciting developments in Unity’s ad business are made more compelling by the stability and discipline seen across the entire company. The market is buying into the growth story now because it is built on a much stronger financial and operational foundation.

A key part of this foundation is the health of Unity’s core Create Solutions business. The successful launch of the Unity 6 engine has helped rebuild trust with software developers after a controversial pricing change in 2023.

This restored confidence is showing up in the company's financials. Revenue from high-margin subscriptions in this segment grew at a double-digit rate in the first quarter, providing a predictable and profitable base for the company.

At the same time, the company's strategic portfolio reset, Unity’s plan to focus only on its most promising products, is showing clear results. The company’s first-quarter financial report highlighted several key improvements:

- Improved Profitability: The company's net loss under generally accepted accounting principles (GAAP) shrank to $78 million. This represents an improvement from the $291 million loss reported in the same quarter a year ago, indicating that the company is managing its costs more effectively.

- Positive Free Cash Flow: Unity generated $7 million in free cash flow, a sign of a financially healthy operation and a reversal from a $15 million cash burn the previous year.

- Higher Adjusted EBITDA Margin: This key measure of operational profitability expanded to 19%, demonstrating that the business is becoming more efficient.

These numbers provide tangible evidence that the company's focus on disciplined execution is paying off, lending credibility to its optimistic outlook.

From Turnaround to Growth: Unity's Next Chapter

Unity Software Stock Forecast Today

12-Month Stock Price Forecast:$26.43-27.92% DownsideModerate BuyBased on 19 Analyst Ratings | Current Price | $36.67 |

|---|

| High Forecast | $39.00 |

|---|

| Average Forecast | $26.43 |

|---|

| Low Forecast | $15.00 |

|---|

Unity Software Stock Forecast DetailsUnity’s recent stock rally represents a decisive vote of confidence from the market. The combination of a revitalized advertising business, a stable core engine, and proven financial discipline is painting a compelling picture of a company on the right track.

While Unity is still completing its strategic shift away from less profitable business lines, the improvements seen today are setting the stage for an expected return to top-line revenue growth in the second half of 2025.

As the benefits from Unity Vector and new partnerships build, the company's focus will likely continue to shift from recovery to expansion.

The next major checkpoint for investors will be the second-quarter earnings report, expected in mid-August. This report will first test whether the company’s strong operational momentum can translate into accelerating financial performance.

For Unity, the story is clearly shifting from a challenging turnaround to one of focused execution and credible, long-term growth potential.

Before you consider Unity Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unity Software wasn't on the list.

While Unity Software currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report