If you have a Roth IRA (and maybe more importantly if you don't), a common question you may be asking is, "How much will my Roth IRA grow over time?"

The MarketBeat Roth IRA calculator can help you get a reasonable estimate in just a few easy steps. Like any retirement plan, the growth of your Roth IRA depends on many variables that can change over time.

A Roth IRA's growth differs from other ways to save for retirement. That difference, however, is generally beneficial to almost all investors.

Overview of Roth IRAs

Since you're reading this article, you understand the importance of retirement savings. But you may not be aware that how you save for retirement can make a big difference in how much income you'll have in retirement. One of the best options for many investors is a Roth IRA.

A Roth individual retirement account (IRA) has several unique features that make it different from other IRAs, such as a 401(k). The first is that your contributions to a Roth IRA are not tax-deductible. You make any contribution to a Roth IRA with after-tax dollars.

But wait, we're told you should invest with pre-tax dollars, right? Well, not exactly.

Since you're only taxed once on your income, the advantage of a Roth IRA for many investors is that, with a few exceptions, you don't get tax taken out of any earnings or withdrawals.

Any withdrawal (or distribution) from your Roth IRA won't count toward your taxable earnings for that tax year.

Why is that significant?

Most investors will be in a lower tax bracket when they invest significant after-tax money. You'll cash out with money that is likely to be tax-exempt.

That's precisely the opposite of how a traditional IRA or 401(k) works. In those plans, you put in tax-exempt money but pay the tax when you take a distribution. That distribution is taxed as regular income at your current tax rate.

You don't have to be an expert in the tax code to see how the potential Roth savings will likely benefit many investors. The bottom line for many investors is that you will earn more when you're near retirement than when you started contributing to a Roth IRA.

You can't avoid paying taxes, but with a Roth IRA, you can put the time value of money to work for you by getting tax-free growth.

Contribution Limits

What is the Roth IRA contribution limit? A Roth IRA contribution has limits on an annual basis. In 2023, that amount is $6,500 for individuals under the age of 50 and $7,500 for those above the age of 50.

Funding sources for an allowable IRS Roth IRA include regular contributions from your or your spouse's earned income, including alimony and/or child support, if those funds are related to taxable alimony received from a divorce settlement executed before December 31, 2018.

However, it does not include the following:

- Rental income or other profits from property maintenance

- Interest income

- Pension or annuity income

- Stock dividends and capital gains

- Passive income earned from a partnership in which you do not provide substantial services

Aside from contributions from earned income, other approved contributions include transfers from qualified accounts, rollover contributions from one Roth IRA to another, and conversions from a traditional IRA to a Roth IRA.

Income Limits

In addition to contribution limits, another limitation of a Roth IRA is that it comes with income eligibility restrictions. In 2023, the income limit for a full Roth IRA contribution is $138,000 for a single filer, based on your modified adjusted gross income (MAGI).

However, you can still get a Roth IRA contributions tax benefit if you earn up to $153,000. But there are additional contribution limits between $138,000 and $153,000.

For married couples, the income limit for a full Roth IRA contribution is $218,000, with a maximum income of $228,00 which includes additional contribution limits.

No Withdrawal Ceiling or Floor

There is no age restriction for investing in a Roth IRA. Investors can continue to contribute to a Roth IRA well into their retirement. That's in contrast to a traditional retirement account in which investors cannot make additional contributions after age 70 1/2.

The other benefit is that once you reach the age of 70 ½, you are not required to take a distribution from a Roth IRA. In contrast, that is a requirement of traditional retirement plans.

Know the Five-Year Rule

Like a traditional retirement plan, you can take qualified withdrawals from your Roth IRA at age 59 ½ if you meet certain conditions. To avoid paying taxes, however, your first withdrawal should not occur until five years after your first contribution, known as the five-year rule. If you meet this provision, you will only have paid taxes on the money you contributed to your Roth IRA, not the money you took out.

Suppose you must take money from your Roth IRA before turning 59 1/2. In that case, there are provisions under which you can withdraw $10,000 of Roth earnings without penalty (provided at least five years have passed since their initial contribution) for first-time homebuyer expenses.

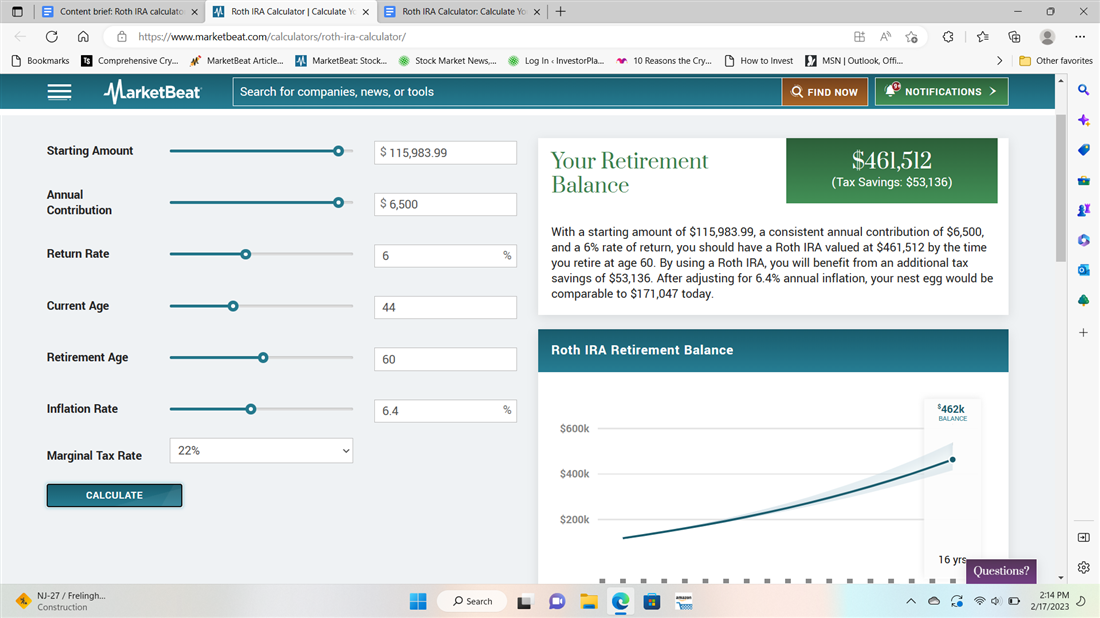

How to Use MarketBeat's Roth IRA Calculator

Now that you understand how a Roth IRA works, including its benefits and potential drawbacks, you're ready to find out just how much your Roth IRA can grow over time. That's where the MarketBeat Roth IRA calculator can help. The calculator lets you see how the growth of your Roth IRA can change based on different inputs.

It's just one addition to MarketBeat's lineup of free, intuitive and easy-to-use calculators to help you stay on track with your investments. For example, the MarketBeat dividends calculator shows how much income your dividend stock portfolio can earn over time. If you like to scale into stock positions, then the MarketBeat stock average calculator will help you calculate your average cost basis.

Want to know how much profit you've made on a stock? Try the MarketBeat stock profit calculator. Use the MarketBeat market cap calculator to find the total equity value of a company. Whether you're a new or experienced options trader, you'll want to use the MarketBeat options profit calculator before you enter a trade.

Starting Amount

If you don't have a Roth IRA, enter the amount you plan to add as your initial contribution. We understand that you may already have money invested in a Roth IRA. In that case, the starting amount should be the current amount in your Roth IRA.

Annual Contribution

The annual contribution is the amount you plan on adding to your Roth IRA annually. If you already have a Roth IRA, use the money you intend to contribute from this point forward. Feel free to adjust the contribution level up or down to see how it affects your result.

Return Rate

The return rate is the percentage of growth an investor should expect from their investment. According to Standard & Poor's information, the average return rate for an IRA between 1971 and 2020 was 10.8 percent. However, early in 2020, analysts from Goldman Sachs estimated that the S&P 500 Index would generate a 6% average annualized return over the next 10 years. Your rate of return, however, should reflect the investments in your portfolio.

Current Age

In this field, you'll enter the age you are now, which may be different from the age you were when you made your first contribution.

Retirement Age

You'll want to enter your planned retirement age for the calculator to provide an accurate result, which may differ from the retirement age the government uses to determine social security benefits. Some people may retire earlier or later than that date. Some may not plan on "retiring" at all. But you need to provide a date for the calculator to have a frame of reference.

Inflation Rate

To get the true value of your Roth IRA, your Roth IRA has to be accurately adjusted for inflation. The inflation rate is the rate at which the cost of goods and services is rising (expressed as a percentage).

The most commonly used measure of inflation is the Consumer Price Index (CPI), which measures the average change over time in the prices paid by urban consumers for a market basket (or index) of consumer goods and services. The number is released every month and is significant because inflation erodes the purchasing power of your dollars (i.e., you pay more to get less).

Marginal Tax Rate

Another factor that impacts the long-term value of your Roth IRA is your marginal tax rate. Remember, a key benefit of a Roth IRA is that the money you contribute gets taxed as normal income and it will affect how much your IRA grows.

Example of a Real-Life Scenario

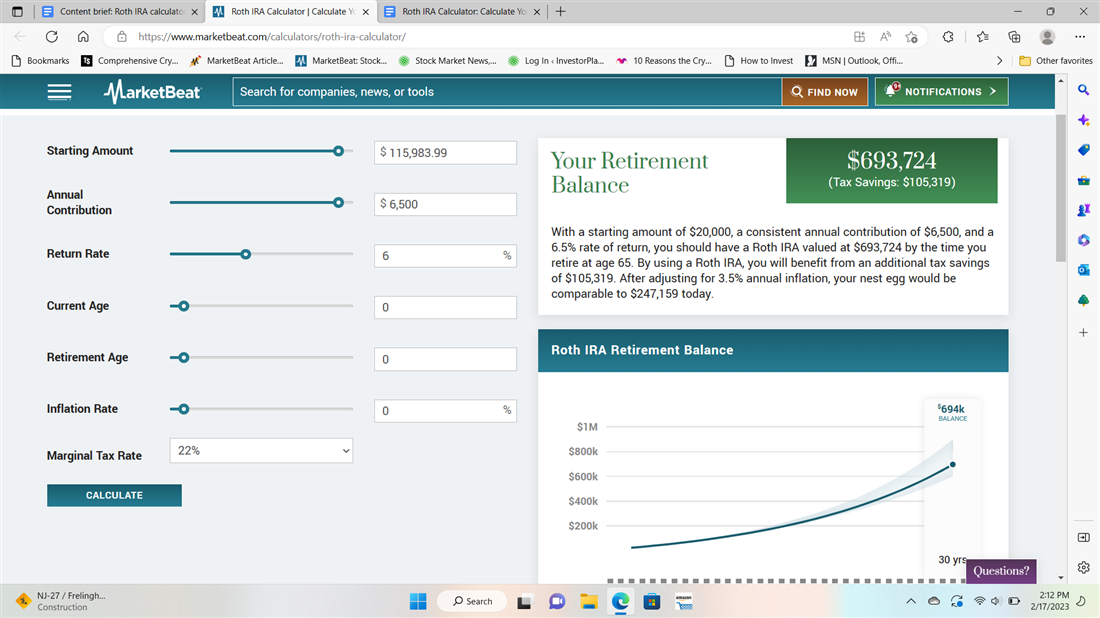

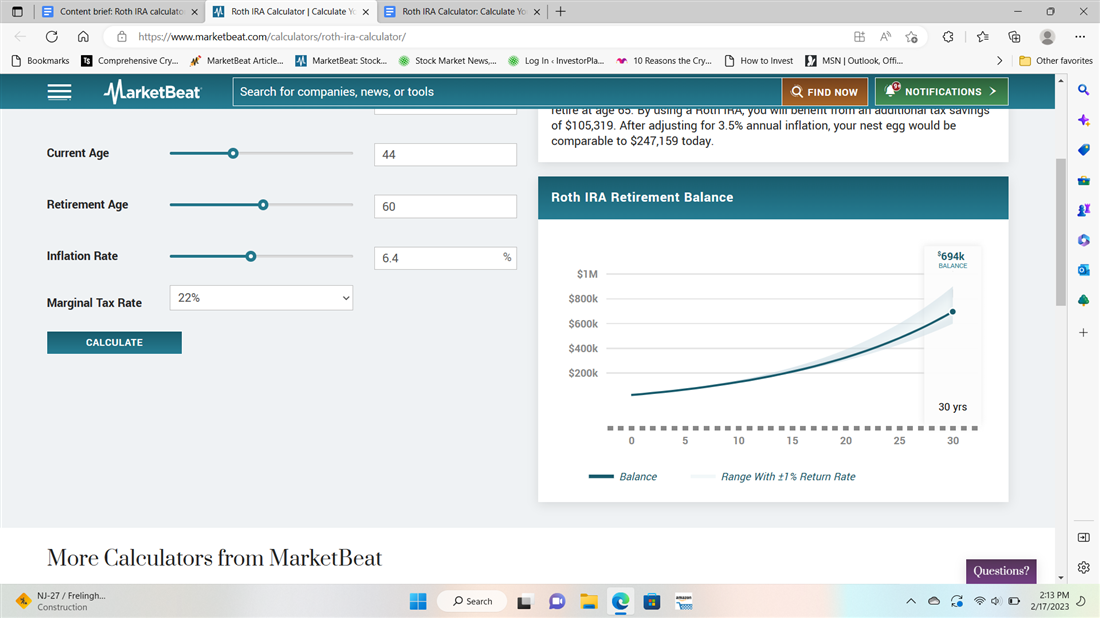

Here's a hypothetical example using information plugged into the MarketBeat Roth IRA calculator. Let's take a starting balance of $115,983.99 and put that in the starting amount field. Then we'll assume that this person makes a full $6,500 annual contribution at a return rate of 6%.

To fill in the other fields, let's assume the investor is 44 years old and wants to retire at age 60. The inflation rate of 6.4% was the CPI reading for January 2023, and this investor was in the 22% tax bracket.

According to the calculator, this investor should have a Roth IRA valued at $461,512 by age 60. Using a Roth IRA, the investor benefited from an additional tax savings of $53,136. After adjusting for 6.4% annual inflation, your nest egg would be comparable to $171,047 today.

What if our hypothetical investor had a goal of $500,000? Since they can't add any more funds to the Roth IRA, the solution would be to delay retirement. Waiting just one year would get them to around $495,000, and waiting two years would get them to $531,944.

But another option wouldn't require them to delay retiring at 60. The initial example assumed an annual return rate of 6%, But by increasing that by a single percent, our investor hit their goal of $500,000 by age 60.

Roth IRA Alternatives

Although a Roth IRA is appropriate for many investors, some investors, particularly high-income investors, may find it too limiting. Plus, many investors find the contribution limit to be a drawback.

One workaround for this may be a backdoor Roth IRA. This clever loophole allows high-income earners to get the backend benefits of a Roth IRA.

Here's how it works. You open a traditional IRA and make nondeductible contributions, then immediately convert it into a Roth IRA before you start to get capital gains on your investments. This is the cleanest way to do a backdoor IRA. There are resources available that provide much more detail.

However, a Roth IRA only has to be one part of your retirement portfolio. Some additional options include:

- Standard brokerage accounts: Capital gains and qualified dividends receive capital gains treatment at lower tax rates. However, there are no additional tax benefits.

- Employer-sponsored plans: This is usually in the form of a 401(k) plan. In this program, many employers will make matching contributions up to a certain percentage for their employees.

- Traditional IRAs: Some investors may find the investment choices of a single IRA too limiting. The good news is you can have as many traditional IRAs as you want, provided that the total contributions don't exceed the IRS limit.

- SIMPLE IRAs: A SIMPLE (Savings Incentive Match Plan for Employees) IRA tailors to small business owners and sole proprietors and allows both employers and employees to gain access to tax benefits. Employees do not have to contribute to a SIMPLE IRA; an employer must make annual contributions.

- Annuities: These are long-term investments issued by insurance companies to give you a fixed-income stream that can protect you from outliving your money. An annuity provides tax-deferred growth and guaranteed income. You can make contributions with pre-tax or after-tax dollars.

Why Use a Roth IRA Calculator to Plan?

A Roth IRA calculator allows you to see the impact of different decisions on your next egg over time. It also allows you to see how slower or weaker growth in your investment in your Roth IRA returns will affect your time horizon.

The Roth IRA Calculator: Plan for the Future You Want

When meeting your retirement goals, time in the market is one of the most critical steps. But even if you're getting a late start, there's time to get the retirement you want. Because of the tax benefits, a Roth IRA is an ideal choice for many investors. Use the MarketBeat Roth IRA Calculator to estimate how much you need to set aside today for the retirement you want tomorrow.

FAQs

Like any investment, the results you get from your Roth IRA will vary from other investors. It's never a good idea to compare the performance of your Roth IRA with that of others. You'll see why when you look at the answers to these frequently asked questions.

How much will a Roth IRA grow in 10 years?

The answer to this question will depend on two factors. The primary factor will be how much you contribute. But it also will depend on the rate of return on your underlying investments. For example, the ten years between 2011 and 2021 likely brought significantly higher growth than 2001 to 2010, a period marked by two bear markets.

How much should I put in a Roth IRA?

There's no right or wrong answer to the question of "How much should I have in my Roth IRA?" But most financial professionals advise you to put in the maximum amount allowed per year to get the most significant benefit.

The IRS limits Roth IRA contributions to $6,500 annually as of 2023 if you're under 50. If you're older than 50, that amount is $7,500. Both numbers are $500 higher than in 2022. However, if you're starting to invest or have limited funds available, something is better than nothing.

How much should I put in a Roth IRA per month?

There is no monthly contribution requirement to have a Roth IRA. Furthermore, the amount you put into a Roth IRA per month is less important than the amount you put in per year. Since your goal is to let the time-value of money work in your favor, it can be an advantage to make a one-time annual payment.

For example, put your tax refund or an employer bonus into your Roth IRA and not make other contributions during the year. That allows you that contribution to benefit from compounding faster and for longer than if you contributed monthly.

However, for many investors, monthly contributions to a Roth IRA are an excellent way to add discipline to their investing goals.