It's a measurement of the overall market direction and performance using a basket of the leading stocks and companies in the economy. There are many stock market indexes. We will do a deep dive into the mechanics and uses of a stock market index. By the end of this article, you can answer the question, "What is a stock market index?"

What is a Stock Market Index?

If you've wondered, "What is an index?" or "What is index in stock market?" the definition of an index is one that comprises a basket of selected stocks representing the leading companies in their respective sectors and industries. You can calculate the value of a stock market index using weighted averages of the stock prices or market capitalizations. The value or price of the index becomes a benchmark — a measuring tool — against other stocks, indexes and overall market performance. Stock market indexes, also referred to as stock market indices, enable investors to compare the performance of their stocks or portfolio to the market's overall performance.

Why Are Market Indexes Important?

Stock indexes enable you to gauge the overall direction of the markets. If the markets are strong, it is also a sign of a healthy economy and vice versa. Stock market indexes provide an easy benchmark against any stocks or asset you wish to compare with. Investors naturally want their stocks and portfolios to perform better than the "crowd." Stock market indexes let you measure your performance against the market.

You can also measure volatility and market risk with a market index. The VIX index measures the expected market volatility of the S&P 500 index. When the VIX is high, it indicates more volatility and selling. When the VIX is low, markets tend to rise. The consumer price index (CPI) measures the inflation rate, which can trigger the U.S. Federal Reserve (Fed) to adjust monetary policy and make interest rate changes, impacting the stock market.

When they say the stock market has outperformed every financial instrument in the past century, they refer to the stock market indices. There is a misunderstanding in believing that the index represents every stock. For example, the Dow Jones Industrial Average started with 12 companies' stocks and has grown to 30 large-cap companies that represent the performance of the U.S. stock market. However, it's not comprehensive, considering that there are over 6,000 stocks in the U.S. stock market. It is likely the most common benchmark index to most people in the country and is usually referred to the most on the nightly news.

Types of Market Indexes

Indexes can focus on specific themes or categories. There are many different types of stock market indices. What are the indexes? Here are some of the most common indexes you will find.

Benchmark Market Indexes

These indexes are the most commonly used and represent the large sections of the total stock market. These are the benchmark indexes used when you hear stock market performance stats on the radio or television. Benchmarks compare and measure performance. Here are the three most common broad-based market indexes:

- The S&P 500 index represents the 500 or so leading U.S. large-cap companies.

- The Dow Jones Industrial Average (DJIA) represents 30 large-cap leading U.S. companies.

- The Nasdaq Composite index represents approximately 3,000 NASDAQ-listed stocks.

These indexes have blue-chip companies that pay out a dividend, which in turn pays out investors.

Sector Indexes

These represent the sectors within a benchmark index for investors who want to track specific sectors like the S&P 500 Healthcare index or S&P 500 Consumer Discretionary index for leading consumer discretionary stocks.

Global Indexes

These represent the key benchmark indexes for international stock markets. The FTSE 100 is the Financial Times Stock Exchange 100, representing leading companies in the U.S. The CAC 40 represents the largest 40 French stocks. The DAX represents 40 blue chips in German stocks. The top 225 Japanese companies comprise the Nikkei 225. The Hang Seng index represents the 73 largest companies in the Hong Kong stock market.

Market-Cap Indexes

These indexes are arranged by their market capitalization. Benchmark indexes comprise large-cap companies with a market cap of $10 billion or higher. Mid-cap stocks have a market cap of $2 billion to $10 billion. Small-cap stocks have a market cap of $250 billion to $2 billion. Micro-cap stocks have a market valuation of less than $250 million. The S&P 400 MidCap and Russell 2000 Index are popular indexes categorized with companies falling into the appropriate market caps.

Example of a Market Index

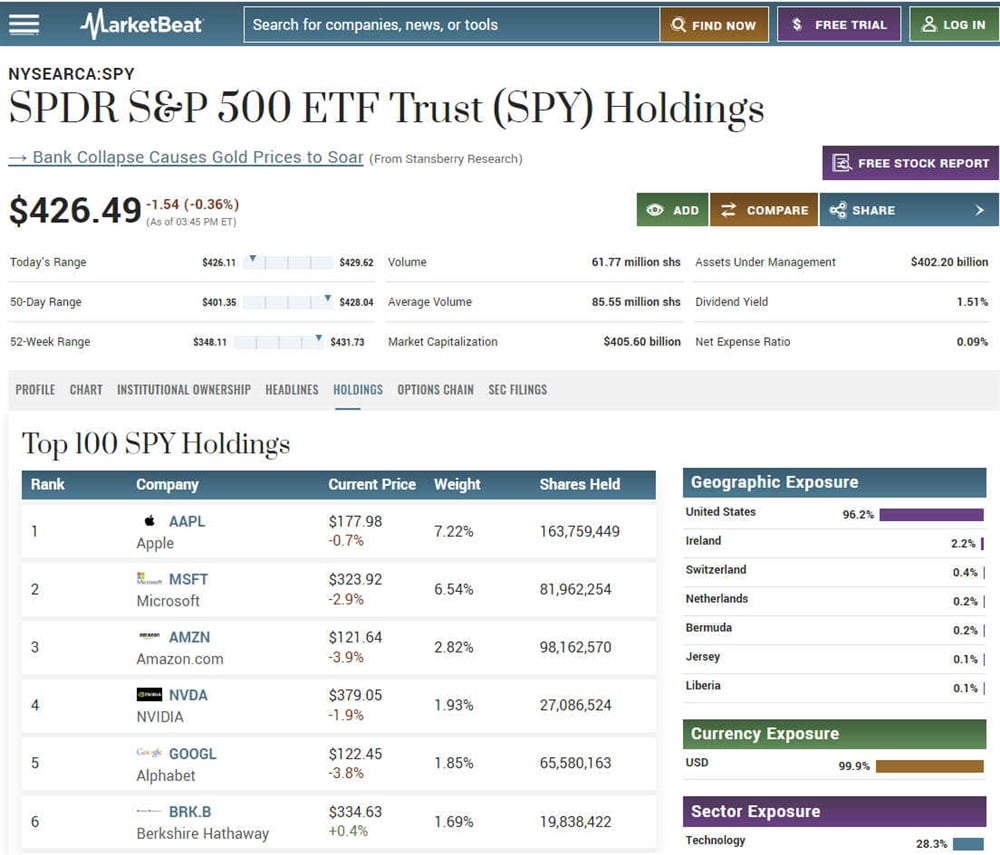

Here's an example of one of the most widely followed benchmark indices, the S&P 500 index. We can examine it using an exchange-traded-fund (ETF) called the SPDR S&P 500 ETF Trust (NYSEARCA: SPY).

The S&P 500 index is a basket of around 500 stocks representing the performance of large-cap U.S. companies and the overall economy. It was started by Standard & Poor's in 1957. The index currently holds 504 stocks, with the five largest holdings accounting for over 20% of the index. The top three holdings are information technology leaders, including Apple Inc. (NASDAQ: AAPL), Microsoft Co. (NASDAQ: MSFT), Amazon.com Inc. (NASDAQ: AMZN), Nvidia Co. (NASDAQ: NVDA) and Alphabet Inc. (NASDAQ: GOOGL).

How to Use a Market Index

There are various ways to use a market index to help with investing and trading. One of the most common methods is to use a market index to compare the performance of your stocks or portfolio. Here are four steps to comparing a stock to the market index.

Step 1: Select a stock market index.

Select the proper benchmark index. If your stock is in the financial, industrial, utilities, consumer staples and energy sectors, consider using the S&P 500 index. If your stock is in the technology or communications sector or has a high beta, use the NASDAQ composite since most technology stocks, growth stocks and momentum stocks are listed on the NASDAQ. You can also find most momentum themes like meme stocks, short squeezes and artificial intelligence (AI) on the NASDAQ. The DJIA index can offer a general comparative benchmark, but it is limited in scope and breadth since it only has 30 stocks in the index.

Step 3: Overlay a chart.

Consider overlaying the stock and index charts to see how well they track visually. You will notice the same inflection points in many cases where the stock will turn when the benchmark index turns, which is called a positive correlation. There may be times when they diverge, which is called a negative correlation. It's good to note if the stock is currently positively or negatively correlated with the market.

Compare year-to-date (YTD) performance with the benchmark index to the YTD return on your stock. You can also compare yearly and five-year performance to see how your stock has performed historically with the benchmark index. If your stock continues to underperform all three of those periods, then it's an underperforming stock. If your stock has performed better than all three time frames, it's an outperforming stock. Compare dividend yield with your stock and the index. Also, compare the average price-earnings (P/E) on your benchmark index versus your stock to see if the valuation is above or below. If it's above, then consider trimming your exposure. If it's below, consider adding some exposure.

Market Index Weighting

Stock market indexes can be weighted differently. When asking what is an index in the stock market, it's essential also to know how the index is weighted. Different weighting can have other impacts when it comes to index valuations. Here are the two commons types of market index weightings.

- Market capitalization-weighted: These indexes are the most common type of weighting. A stock's total market cap weights these indexes. Each stock in the index is weighted based on its market cap, which is the stock price multiplied by the total outstanding shares. Stocks with larger market caps will have a more significant impact on the overall index. The S&P 500 index and the NASDAQ Composite are market cap-weighted indexes. Critics argue that this impacts the largest components in the index too much, and it can distort the health of the general markets.

- Price-weighted indexes: These indexes are calculated based on the stock prices of their components. Higher-priced stocks will have a more significant impact on the index. The Dow Jones Industrial Average is the most popular price-weighted index.

- Equal-weight indexes: These indexes give the exact weighting to all stocks in the index. Even a 2% move in a small-cap stock impacts the index as much as a 2% move in a large-cap stock. This is a variation of the benchmark indexes, like the S&P 500 Equal Weight Index.

An Overview of Index Funds

You may have heard the term and wondered, "What is a stock market index fund?" Index funds are mutual funds or exchange-traded funds (ETFs) that track the performance of the underlying market index. They enable investors to invest in a market index without buying every component of stock. Index funds mirror the performance of the underlying index by purchasing all the component stocks. It's a one-stop shop to get the performance of the whole index under a single instrument.

For example, investors can buy shares of the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) to invest in the S&P 500 index. They can also track the index using the SPY ETF. ETFs provide transparency, liquidity and the ability to hedge compared to mutual funds. With mutual funds, you place the order and wait until the following day to see where you filled it. You can't short mutual funds, either, so you can't hedge a position when needed. Remember that index funds are always buying or selling their component stocks, ensuring liquidity for those stocks.

While momentum stocks and high fliers tend to gain most of the attention in business media, the reality is that most stocks underperform the S&P 500 index. There is a straightforward reason for this. Unlike individual investors that hold their stocks long-term through thick and thin and boom and bust in their retirement accounts (IRAs) or retirement savings, the S&P 500 index will replace underperforming stocks periodically. They swap out the losers. This is why the top five holdings are information technology stocks, which have performed incredibly strongly in the past two decades. Information technology has increased its weighting to 28.6% versus financial services at 11.87% in 2023. Financials had the highest weight in the S&P 500 index, with 23.4% in March 2000, as the technology bubble and bear market emerged.

FAQs

Here are some answers to frequently asked questions.

What does a stock market index do?

Stock market indexes help to provide a benchmark to measure the performance of the markets and the economy. It represents the macro markets' general trend and quantifies the specific markets' performance.

How do you read a stock market index?

You can use ETFs like the SPY, QQQ, and DIA to gauge the direction of the trend on a chart. You can also use technical analysis to gauge the support and resistance levels and provides a complete playing field of the price history to gauge where the markets can go.

What are three examples of stock market indexes?

The three most commonly used stock market indexes are the Dow Jones Industrial Average, S&P 500 and the NASDAQ Composite Index. They generally tend to move together. However, they can diverge depending on which sectors are strong on any particular day. A significant bounce or drop in the heaviest-weighted stocks can distort the performance, dragging the index in one direction much more significantly than a smaller company would.