Not to worry, though — MarketBeat's earnings per share calculator can do the heavy lifting. First, you'll still need to understand how EPS is used to evaluate publicly traded companies.

What Are Earnings Per Share?

Publicly traded companies (at least those on major exchanges) must publish earnings reports documenting their performance every quarter over the preceding three months. When companies deliver these reports, there are two important data points for investors: earnings, which detail how the company performed in the previous quarter, and guidance, which looks at what the company expects moving forward.

In addition, company executives must file a 10-Q with the SEC, which contains the quarterly income statement. The income statement is where EPS data is publicly published.

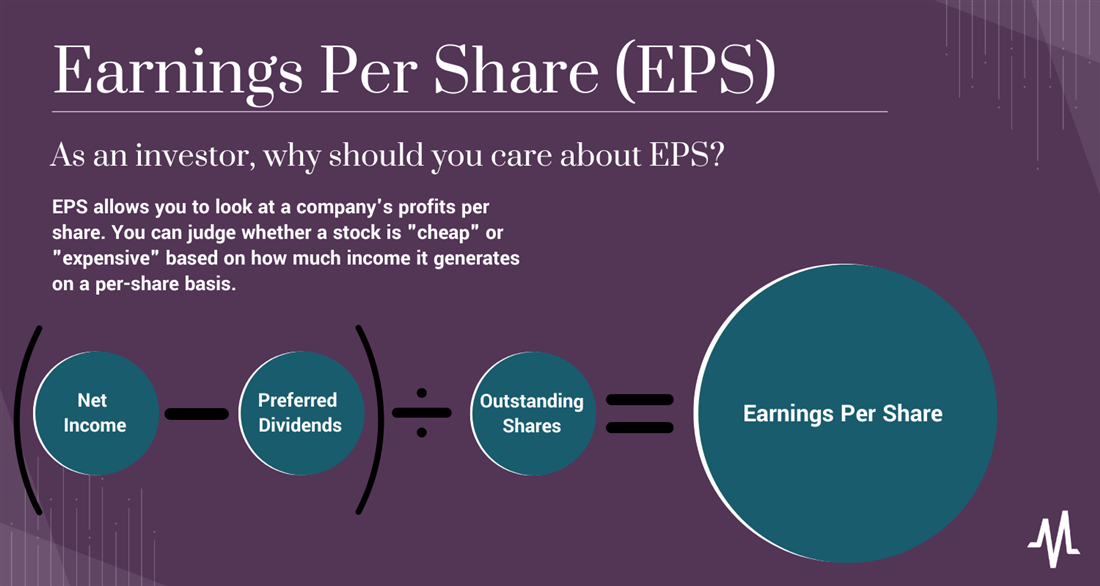

The earnings per share calculation is a valuation metric that allows investors to look at a company's profits per share. With a little back-of-the-napkin math, investors can judge whether the stock is "cheap" or "expensive" based on how much income it generates on a per-share basis. Of course, no metric is perfect on its own, and EPS has flaws, but more on that later.

EPS is a convenient metric for investors because it produces a single, easily digestible number to use as a proxy for a company's valuation. EPS can also help you formulate other metrics, such as P/E ratios (which you can look up using MarketBeat's P/E ratio calculator).

The earnings per share formula looks like this:

EPS = (Net Income - Preferred Dividends) / Shares Outstanding

Seems simple enough, right? The main issue with EPS formula calculators is ensuring that you input the correct data. You can find these numbers in the balance sheet and income statements produced by the company each quarter.

How to Calculate Earnings Per Share

To learn how to calculate earnings per share, you’ll need to understand the different variables in the formula first.

- Net income: To find a company’s quarterly net income, you must subtract all expenses from revenue. Net income (or net profit) strips away items like the cost of goods sold (COGS), taxes, labor costs and so on to find the exact dollar amount the company will be retaining.

- Preferred dividends: If the company has issued preferred stock, then any preferred dividends must be subtracted from net income. Since preferred stock functions as a hybrid of debt/equity, preferred dividends are guaranteed but won’t apply to common shareholders. Not all companies issue preferred stock, so this variable may be zero in certain EPS calculations. Preferred dividends differ from ordinary dividends paid to common shareholders and are factored into net income. (Learn about dividend investing using the MarketBeat dividend calculator.)

- Outstanding shares: Outstanding shares are simply a count of all stock held by shareholders, institutions and company insiders. Outstanding shares are an elastic number, so the end-of-the-quarter tally is incorporated into the EPS formula.

Here’s a basic walkthrough:

Let’s say Company X reports earnings and announces $2 billion in net income for the quarter but owes $200 million in preferred dividends. If the company has 400 million shares outstanding, you’ll calculate its EPS like this:

($2,000,000,000 - $200,000,000) / 400,000,000 = 4.50

Company X would report $4.50 in earnings per share in this particular quarter.

Example of Using the MarketBeat Earnings Per Share Calculator

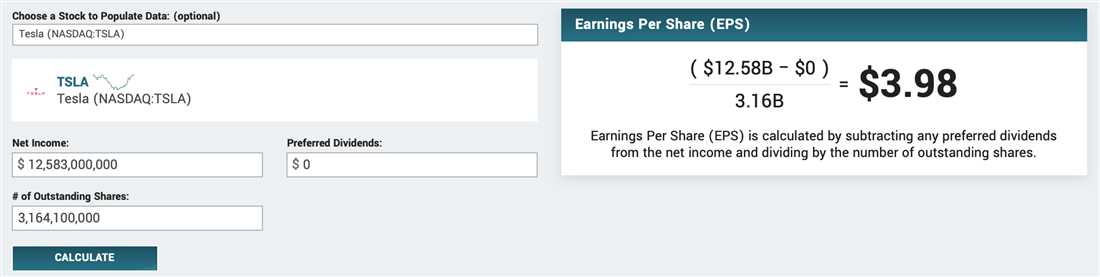

To illustrate how to use the MarketBeat EPS calculator, let’s use everyone’s favorite volatile car company: Tesla Motors Inc. (NASDAQ: TSLA).

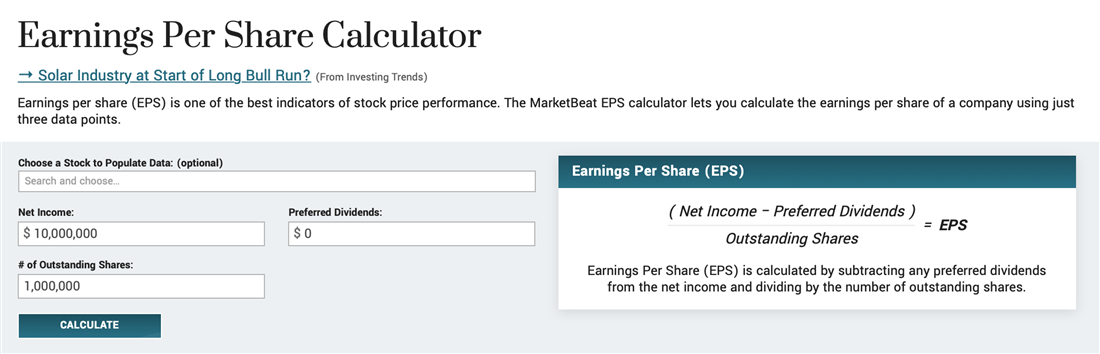

First, you’ll load up the calculator page, which looks like this:

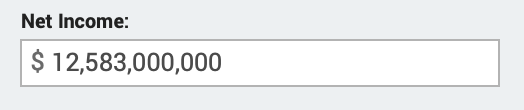

Choose the stock you want to analyze from the search bar (which will populate based on the ticker) or enter the financial data to explore from past years or quarters. The first data point to enter is net income. For example, Tesla’s most recent report announced $12.556 billion in net income.

Next, you’ll need to subtract Tesla’s preferred dividends. Thankfully, Tesla has no preferred dividends to pay, so you can enter “$0.”

Now, you’ll enter the total shares outstanding. You can use total shares outstanding to find basic EPS or add in dilutive shares to get diluted EPS. (Note: total shares outstanding is the default option when using the auto-populate feature.)

Next, hit the calculate button, and the formula will fill to give you Tesla’s EPS calculation.

The EPS calculator can help compare Tesla’s previous EPS numbers to current ones to see how fast they’re growing or to compare their performance against other companies in the industry. For example, here’s how Tesla stacks up against Ford Motor Company (NYSE: F), General Motors Company (NYSE: GM) and the Honda Motor Company Ltd. (NYSE: HMC).

The EPS calculator and other MarketBeat tools, like the compound interest calculator, can assist in evaluating your investment strategy and asset allocation.

Basic EPS vs. Diluted EPS

In the above formula, the number calculated is known as basic EPS since a few variables are purposely left out of the equation. Basic EPS uses net income divided by total outstanding shares, but the total outstanding shares number is different from the total potential outstanding shares.

Companies can’t issue new stock anytime they feel like it. Share issuance must be voted on and approved by the company’s board before new equity can enter the market. But other types of securities can become common shares in certain situations. For example, what about company stock options issued to employees? These don’t count toward the total shares outstanding, but they can become common stock shares if exercised.

Diluted EPS considers this factor and combines all the securities that could convert to common stock in the future. These "potential shares" are known as dilutive shares and include securities like convertible preferred stock, stock warrants, stock options and any other security that could convert into common shares in the future.

Since dilutive shares add to the total outstanding share count, a company's diluted EPS will always be lower than its basic EPS. Of course, not every stock option will be exercised, nor will every preferred share be converted to common stock. Therefore, you should use diluted and basic EPS when calculating the value of a company on a per-share basis.

How Can You Use EPS to Invest?

Milton Friedman famously said, “The business of business is business,” which is a snarky way of saying that the goal of every company is to turn a profit. A business without earnings won’t be in business for very long, especially in public markets. Learning how to calculate earnings per share can provide investors info about the health of a particular company.

EPS is most useful when comparing companies across similar industries or stock sectors or when looking at a single company over a period of time. For example, EPS can show investors if a company is growing or stagnating and how its performance stacks up to similar firms.

What is a Good EPS?

In the example above, the EPS calculator showed that Tesla earned $3.98 per share. Is that a good or a bad number? The answer, of course, is “it depends.” An EPS number by itself will tell an investor little about the company's actual performance, even if the number is negative and the company is losing money per share. The importance of EPS becomes clear when we compare the number to past earnings reports or other companies in the sector.

Let’s compare Tesla to one of its most prominent competitors: Ford Motor Company. In its most recent quarter, Ford reported $17.94 billion in net income and had 4.02 billion shares of outstanding stock. Since Ford also pays zero preferred dividends, its EPS totaled $4.46, meaning Ford earned about $0.48 more per share than Tesla did in the most recent quarter.

What Are the Limitations of EPS?

EPS can be a helpful metric when evaluating company performance, but it does have certain limitations. Here are a few downsides of using EPS as the only statistic to measure a firm:

- Easy to game: Individuals can manipulate EPS with creative accounting, mergers and acquisitions or share buybacks. None of these things are necessarily nefarious, but they can throw some EPS numbers into havoc. Remember, executives have strong incentives to show continuous EPS growth.

- Exceptional expenses: Companies occasionally leave certain expenses out of EPS numbers if they’re “non-core.” This practice is known as adjusted EPS, which can be misleading if the costs left off are significant.

- Inflation and debt: Rising inflation and unsustainable debt loads often create serious issues within firms. Unfortunately, neither inflation or debt factors into the EPS calculation. Diligent investors can only perform a comprehensive investment analysis with knowledge of inflation rates or debt levels.

EPS is a Useful but Limited Stock Evaluation Metric

EPS offers investors a quick and often satisfactory way to measure a company's profitability compared to previous quarters and other companies in the same sector. But even the best financial metrics can mislead on their own, and EPS is no different. EPS leaves several central data points out of its calculation (i.e., debt) and works best when used with other metrics, such as debt/equity ratio or dividend payout ratio.

FAQs

Still have questions about EPS calculations? Here are the quick answers to a few of the more commonly asked questions.

What is EPS and how does it help investors?

Earnings per share is a metric that allows investors to evaluate the profitability of a specific company on a per-share basis.

How do you calculate earnings per share?

To calculate earnings per share, you can use the MarketBeat EPS calculator. In addition, you’ll need to know the net income figures and the number of outstanding shares, plus whether the company pays any preferred dividends.

EPS comes in three forms: basic, diluted and adjusted. The basic EPS formula requires investors to subtract preferred dividend payouts from net income and divide by the company’s most recent tally of total shares outstanding. The basic EPS formula leaves dilutive shares like convertible preferred stock, stock options and warrants out of the equation.