Written by Matthew Paulson

October 18, 2015

I don't know about you, but I'm a big fan of companies that pay strong dividends and have a history of growing their dividends. When a company is committed to paying a dividend and growing their dividend over time, they are usually very committed to their shareholders. They are also less likely to ineffeciently use their capital by doing things like making risky acquisitions. Many of the companies that pay high dividends, like Coke, Johnson and Johnson, Philip Morris and General Mills also have low beta's and aren't nearly as volatile as the S&P 500. While a good dividend stock might not be as exciting as a hot tech stock, they still make for a great part of any portfolio.

If you're also a fan of dividend-paying stocks, I wanted to let you know about some free dividend tools that we've added to the MarketBeat website in the last week:

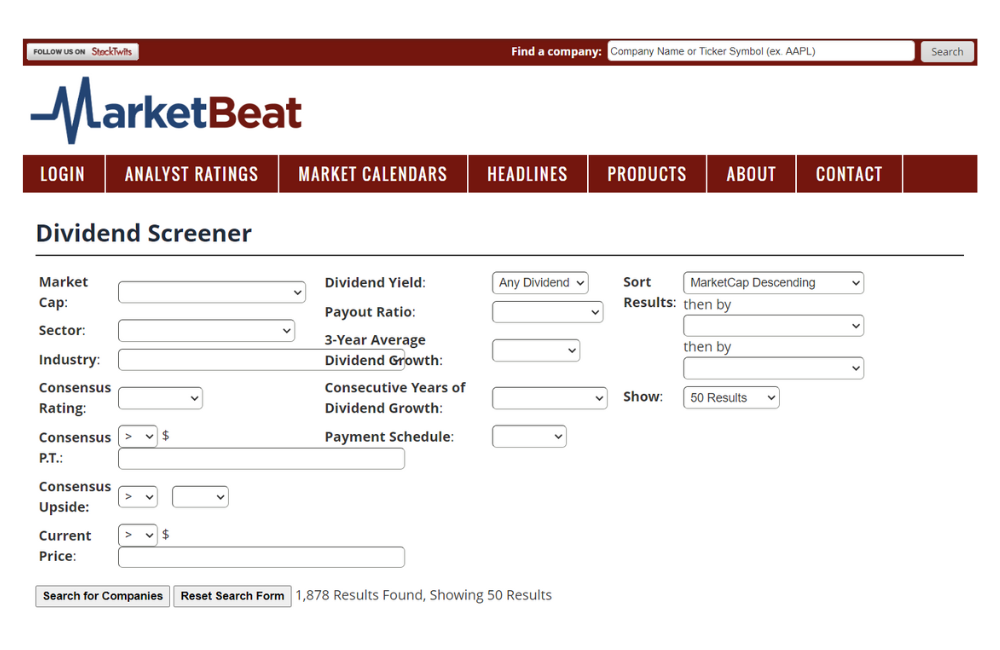

- Dividend Screener - Find companies that meet a specific yield, payout ratio or dividend growth criteria

- Dividend Aristocrats - This is a list of companies on the S&P 500 that have raised their dividend for 25 years in a row.

- Dividend Achievers - This is a list of companies on the S&P 500 that have raised their dividend for 10 years in a row.

- Ex-Dividend Calendar - View a list of companies that are scheduled to go ex-dividend in the next week.

- High-Yield Dividend Stocks - View a list of companies that pay at least a 3.5% dividend.

Like this article? Share it with a colleague.