Hedge funds, endowments, and other institutional investors have been selling shares of these 15 stocks in the last 90 days. Large institutional investors are systematically dumping shares of these stocks. We're talking about hedge funds, pension funds, sovereign wealth funds, and university endowments.

Institutional investors don't easily get swayed by the hot stocks that retail investors are pouring money into. They also don't panic when the market takes a turn for the worse. They don't sell when one piece of bad news hits a company. They make very large bets on very large companies that play out over time. These bets are backed by the best investment research that institutional money can buy.

When institutions start to sell shares of a stock, you know it's a decision that wasn't made lightly. They see something seriously wrong with a company's fundamentals and believe it will underperform the market for the next several years. When multiple large institutional investors all start selling shares of a stock, you should take notice and hope that stock isn't part of your portfolio.

We combed through every 13D and 13F filing that institutional investors have filed with the SEC in the last 90 days to identify stocks that institutional investors are selling. After reviewing more than 5,000 filings, we have identified 15 companies that institutional investors have been selling. Big money investors are liquidating millions of dollars in shares of these companies.

Are any of these 15 stocks currently in your portfolio? You'll want to see this list before making your next trade.

- Net Outflows of from Institutional Investors in Dollars

- $170,606,863,156.00

- Net Outflows of from Institutional Investors in Shares

- 37,304,898

- Number of Institutional Transactions in the Last 90 Days

- 1,270

Booking Holdings Inc, formerly The Priceline Group Inc, is a provider of travel and restaurant online reservation and related services. The Company, through its online travel companies (OTCs), connects consumers wishing to make travel reservations with providers of travel services across the world. It offers consumers an array of accommodation reservations (including hotels, bed and breakfasts, hostels, apartments, vacation rentals and other properties) through its Booking.com, priceline.com and agoda.com brands.

More about Booking

- Net Outflows of from Institutional Investors in Dollars

- $36,784,141,456.00

- Net Outflows of from Institutional Investors in Shares

- 230,969,116

- Number of Institutional Transactions in the Last 90 Days

- 457

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

More about MongoDB

#3 - Live Nation Entertainment (NYSE:LYV)

- Net Outflows of from Institutional Investors in Dollars

- $33,502,477,748.00

- Net Outflows of from Institutional Investors in Shares

- 263,053,374

- Number of Institutional Transactions in the Last 90 Days

- 415

Live Nation Entertainment, Inc operates as a live entertainment company worldwide. It operates through Concerts, Ticketing, and Sponsorship & Advertising segments. The Concerts segment promotes live music events in its owned or operated venues, and in rented third-party venues. This segment operates and manages music venues; produces music festivals; creates and streams associated content; and offers management and other services to artists.

More about Live Nation Entertainment

#4 - CyberArk Software (NASDAQ:CYBR)

- Net Outflows of from Institutional Investors in Dollars

- $19,221,384,075.00

- Net Outflows of from Institutional Investors in Shares

- 58,990,253

- Number of Institutional Transactions in the Last 90 Days

- 403

CyberArk Software Ltd., together with its subsidiaries, develops, markets, and sells software-based identity security solutions and services in the United States, Europe, the Middle East, Africa, and internationally. Its solutions include Privileged Access Manager, which offers risk-based credential security and session; Vendor Privileged Access Manager combines Privileged Access Manager and Remote Access to provide secure access to third-party vendors; Dynamic Privileged Access, a SaaS solution that provides just-in-time access to Linux Virtual Machines; Endpoint Privilege Manager, a SaaS solution that secures privileges on the endpoint; and Secure Desktop, a solution that protects access to endpoints.

More about CyberArk Software

#5 - Guidewire Software (NYSE:GWRE)

- Net Outflows of from Institutional Investors in Dollars

- $17,516,071,857.00

- Net Outflows of from Institutional Investors in Shares

- 91,620,838

- Number of Institutional Transactions in the Last 90 Days

- 344

Guidewire Software, Inc provides a platform for property and casualty (P&C) insurers worldwide. The company offers Guidewire InsuranceSuite Cloud, such as PolicyCenter Cloud, BillingCenter Cloud, and ClaimCenter Cloud applications. It also provides Guidewire InsuranceNow, a cloud-based platform that offers policy, billing, and claims management functionality to insurers; and Guidewire InsuranceSuite for Self-Managed.

More about Guidewire Software

#6 - MACOM Technology Solutions (NASDAQ:MTSI)

- Net Outflows of from Institutional Investors in Dollars

- $15,584,470,945.00

- Net Outflows of from Institutional Investors in Shares

- 160,185,743

- Number of Institutional Transactions in the Last 90 Days

- 228

MACOM Technology Solutions Holdings, Inc, together with its subsidiaries, designs and manufactures analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum in the United States, China, Australia, Japan, Malaysia, Singapore, South Korea, Taiwan, Thailand, and internationally.

More about MACOM Technology Solutions

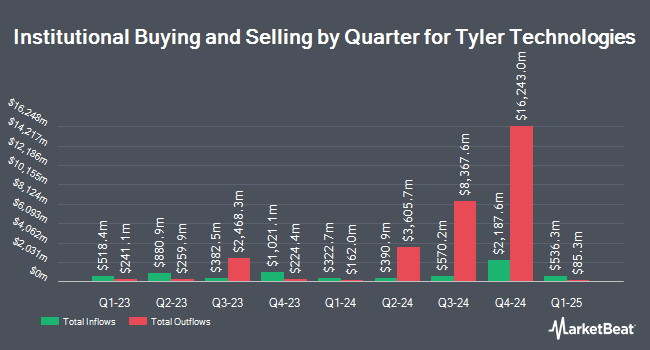

#7 - Tyler Technologies (NYSE:TYL)

- Net Outflows of from Institutional Investors in Dollars

- $14,600,875,916.00

- Net Outflows of from Institutional Investors in Shares

- 25,588,143

- Number of Institutional Transactions in the Last 90 Days

- 485

Tyler Technologies, Inc provides integrated information management solutions and services for the public sector. It operates in two segments, Enterprise Software and Platform Technologies. The company offers platform and transformative technology solutions, including cybersecurity for government agencies; data and insights solutions; digital solutions that helps workers and policymakers to share, communicate, and leverage data; payments solutions, such as billing, presentment, merchant onboarding, collections, reconciliation, and disbursements; platform technologies, an application development platform that enables government workers to build solutions and applications; and outdoor recreation solutions, including campsite reservations, activity registrations, licensing sales and renewals, and real-time data for conservation and park management.

More about Tyler Technologies

- Net Outflows of from Institutional Investors in Dollars

- $11,382,621,388.00

- Net Outflows of from Institutional Investors in Shares

- 270,576,717

- Number of Institutional Transactions in the Last 90 Days

- 311

Affirm Holdings, Inc operates a platform for digital and mobile-first commerce in the United States, Canada, and internationally. The company's platform includes point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. Its commerce platform, agreements with originating banks, and capital markets partners enables consumers to pay for a purchase over time with terms ranging up to 60 months.

More about Affirm

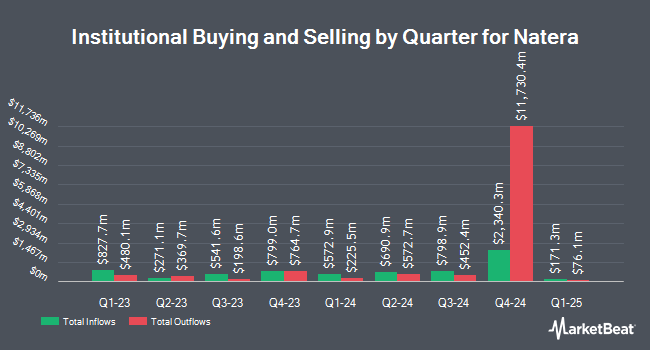

- Net Outflows of from Institutional Investors in Dollars

- $8,992,475,803.00

- Net Outflows of from Institutional Investors in Shares

- 60,727,146

- Number of Institutional Transactions in the Last 90 Days

- 409

Natera, Inc, a diagnostics company, develops and commercializes molecular testing services worldwide. Its products include Panorama, a non-invasive prenatal test that screens for chromosomal abnormalities of a fetus, as well as in twin pregnancies; Horizon carrier screening test for individuals and couples determine if they are carriers of genetic variations that cause certain genetic conditions; Vistara single-gene NIPT screens for 25 single-gene disorders that cause severe skeletal, cardiac, and neurological conditions; Spectrum, preimplantation genetic tests for couples undergoing IVF; Anora that analyzes miscarriage tissue from women; Empower, a hereditary cancer screening test; and non-invasive prenatal paternity product, which allows a couple to establish paternity without waiting for the child to be born.

More about Natera

#10 - Microchip Technology (NASDAQ:MCHP)

- Net Outflows of from Institutional Investors in Dollars

- $7,648,069,290.00

- Net Outflows of from Institutional Investors in Shares

- 198,486,175

- Number of Institutional Transactions in the Last 90 Days

- 747

Microchip Technology Incorporated engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia. The company offers general purpose 8-bit, 16-bit, and 32-bit mixed-signal microcontrollers; 32-bit embedded mixed-signal microprocessors; and specialized microcontrollers for automotive, industrial, computing, communications, lighting, power supplies, motor control, human machine interface, security, wired connectivity, and wireless connectivity applications.

More about Microchip Technology

#11 - Liberty Live Group (NASDAQ:LLYVA)

- Net Outflows of from Institutional Investors in Dollars

- $6,912,336,434.00

- Net Outflows of from Institutional Investors in Shares

- 102,359,491

- Number of Institutional Transactions in the Last 90 Days

- 77

Liberty Live Group operates in the media, communications, and entertainment industries primarily in North America and the United Kingdom. The company is headquartered in Englewood, Colorado.

#12 - Spotify Technology (NYSE:SPOT)

- Net Outflows of from Institutional Investors in Dollars

- $5,530,776,955.00

- Net Outflows of from Institutional Investors in Shares

- 9,621,202

- Number of Institutional Transactions in the Last 90 Days

- 758

Spotify Technology SA, together with its subsidiaries, provides audio streaming subscription services worldwide. It operates through two segments, Premium and Ad-Supported. The Premium segment offers unlimited online and offline streaming access to its catalog of music and podcasts without commercial breaks to its subscribers.

More about Spotify Technology

- Net Outflows of from Institutional Investors in Dollars

- $4,915,002,685.00

- Net Outflows of from Institutional Investors in Shares

- 36,175,635

- Number of Institutional Transactions in the Last 90 Days

- 261

Stride, Inc, a technology-based education service company, engages in the provision of proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally. Its technology-based products and services enable clients to attract, enroll, educate, track progress, support, and facilitate individualized learning for students.

More about Stride

#14 - Coinbase Global (NASDAQ:COIN)

- Net Outflows of from Institutional Investors in Dollars

- $4,447,650,335.00

- Net Outflows of from Institutional Investors in Shares

- 25,410,788

- Number of Institutional Transactions in the Last 90 Days

- 655

Coinbase Global, Inc provides financial infrastructure and technology for the crypto economy in the United States and internationally. The company offers the primary financial account in the crypto economy for consumers; and a marketplace with a pool of liquidity for transacting in crypto assets for institutions.

More about Coinbase Global

#15 - iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA:HYG)

- Net Outflows of from Institutional Investors in Dollars

- $3,519,316,879.00

- Net Outflows of from Institutional Investors in Shares

- 45,252,885

- Number of Institutional Transactions in the Last 90 Days

- 191

iShares iBoxx $ High Yield Corporate Bond ETF (the Fund), formerly iShares iBoxx $ High Yield Corporate Bond Fund, is an exchange-traded fund (ETF). The Fund seeks to track the investment results of the Markit iBoxx USD Liquid High Yield Index (the Index), which is a rules-based index consisting of liquid the United States dollar-denominated, high yield corporate bonds for sale in the United States, as determined by the index provider.

More about iShares iBoxx $ High Yield Corporate Bond ETF

More Investing Slideshows: