Today we’re going to dive into three funds that, put together, could hold nothing less than the key to financial freedom.

I know that sounds like a bold claim, but it’s tough to argue when you’ve got a three-fund “mini-portfolio” that does all of the following:

- Pays a 12%+ yield that’s sustainable over the long term.

- Pays dividends monthly, making it even easier (and more convenient) for these funds to completely replace your salary.

- Offers a discount today, providing an opportunity for capital gains tomorrow.

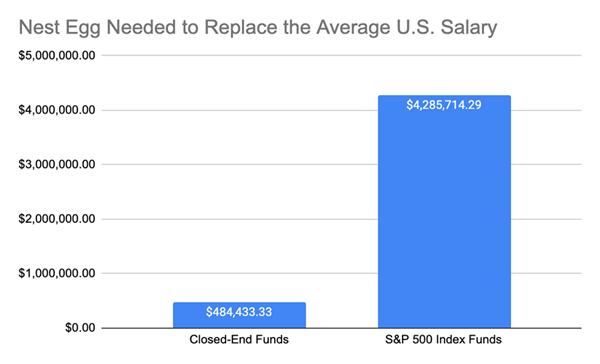

Here’s how the numbers work out on this three-fund setup, consisting entirely of a special kind of fund called a closed-end fund (CEF): a 12% yield means you’re getting $100 per month for every $10,000 you invest. That means a $1-million investment yields a six-figure income!

It also means you can replace the average American income with less than $500,000 invested.

Source: CEF Insider

Retirement becomes much cheaper when you hold funds like these—especially when you compare the kind of payouts they’re throwing off to the miserly yields you’d bank on index funds. Going the index-fund route means you’d need almost 10 times as much money to stop working (if you’re aiming to retire on dividends alone, which we income seekers very much are!).

The surprising (to many folks) truth here is that there are plenty of CEFs that offer this kind of fast-track path to financial independence. CEF managers have little choice but to do so if they want to attract investors.

Monthly payouts are popular among CEF investors, too, so plenty of CEF issuers provide them. But big yields are the main draw here: the CEF market is very small (only about $400 billion in assets under management across fewer than 500 funds), so CEFs need to offer a lot of dividend cash to encourage investors to pay them any attention.

Thanks to those high payouts and the fact that CEFs come from across the investment world—holding everything from blue-chip stocks to bonds and real estate investment trusts (REITs)—we can create a diversified portfolio with just three funds while maintaining that 12% payout I just mentioned.

The three funds we’ll delve into now give us just that.

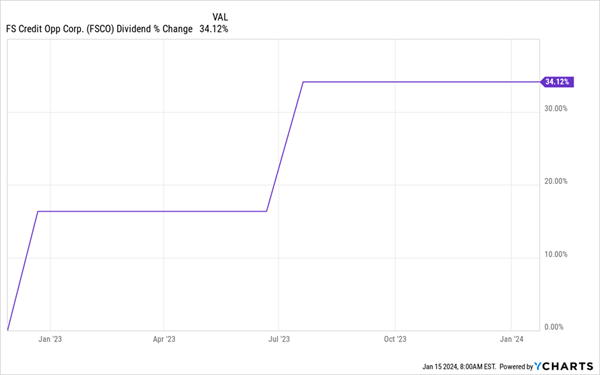

High-Yield CEF Pick No. 1: FS Credit Opportunities Corp. (FSCO)

Let’s start with FSCO, a corporate bond–focused fund with a staggering 18% discount to net asset value (NAV, or the value of its underlying portfolio). That discount is the key to judging a CEF’s value. In the case of FSCO, it means investors are paying around 82 cents for every dollar of assets the fund holds.

That big discount exists in large part because this is a new fund, just released in late 2022. CEF investors tend to be conservative and like to wait for a fund to develop a long history before buying (a blessing for us value-oriented folks who like to work fast).

FSCO’s Rapid-Succession Payout Hikes

Not only does FSCO yield 12%, but higher interest rates on its portfolio give the fund more income to pass on to shareholders—which it’s done through two payout hikes in the little over a year since its IPO.

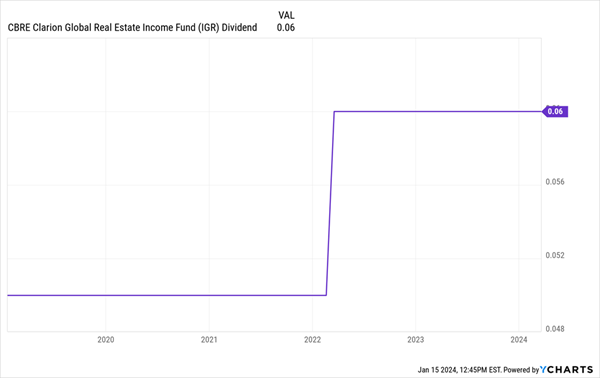

High-Yield CEF Pick No. 2: CBRE Global Real Estate Income Fund (IGR)

Now let’s add IGR to our portfolio. This fund trades at a smaller 11% discount, thanks to its longer history, and its payout, which comes out monthly and yields 13.4% on an annualized basis, is very compelling.

IGR’s portfolio is globally diversified, as you’d expect from the name, while its payout has grown in the last five years, despite the pandemic and the effect of higher rates on the real estate market. On the US side of things, the fund holds well-known REITs like warehouse owner Prologis (PLD), cell-tower REIT Crown Castle (CCI) and Public Storage (PSA).

High Yield and Growing Payouts—Available at a Bargain

IGR’s discount has narrowed in recent weeks, but at 11%, it’s still overdone given the steady income the fund provides—and the fact that it broke into premium territory as recently as March 2023.

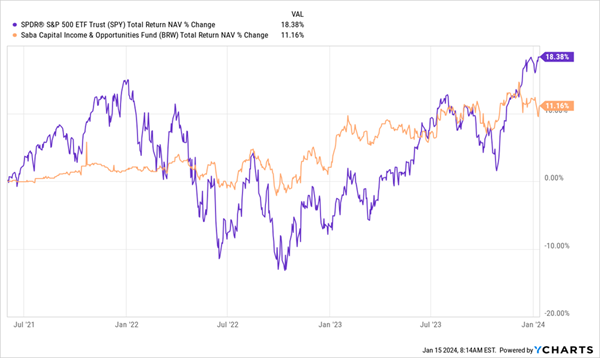

High-Yield CEF Pick No. 3: Saba Capital Income & Opportunities Fund (BRW)

Finally there’s BRW, which trades at an 8.4% discount to NAV while yielding 13.8%—much higher than our 12% target.

BRW is a bit of an odd duck, a diversified fund with 539 holdings spanning the worlds of corporate loans, bonds and assets in America and abroad. It’s managed by Saba Capital Management, whose billionaire principal, Boaz Weinstein, has made waves by going after lagging CEFs and pushing their managers to perform better.

Saba took over BRW from Voya Investment Management in mid-2021. Before that, the fund was a serial underperformer on a NAV basis. Since the buy, Weinstein and his team have started to turn things around, helping BRW slowly start to perform better relative to the broader market.

Saba Purchase Spurs a Turnaround That’s Still in Progress

To be sure, BRW is still trailing the S&P 500 as of this writing, but note that it fell much less than the market during the 2022 crash, suggesting this lower-volatility fund should post better compounded returns over the long term. That assumption is underlined by the fact that it’s still trading at an undeserved discount.

All of this also suggests that BRW’s dividend, which is paid out monthly, isn’t going anywhere.

Put together, these three funds don’t get you $100 per month for every $10,000 invested—they get you $109 per $10,000 invested, so you’ve got a nice extra margin of safety here. Plus, all three funds’ overwrought discounts point to rising market prices as these markdowns vanish.

5 More Standout “Dividend Deals” Yielding 9.2%, Paying Every Month

The CEF market is literally the last place you can get deals like the ones we just discussed following 2023’s market bounce. In addition to these three, there are other bargain-priced, high-yield CEFs out there waiting for us, too.

That list starts with 5 other monthly paying CEFs at the top of our buy list now. These stout funds trade at such wide discounts I’m calling for 20%+ price upside this year, in addition to their 9.2% average yields!

Don’t miss your chance to buy these outsized dividends cheap! Click here to read more about these 5 top buys and download a FREE Special Report revealing their names and tickers.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report