Here’s a wild prediction for the rest of 2024: “sleepy” (but very high yielding) emerging-market bonds will clobber today’s high-flying AI stocks.

Sounds ridiculous, right?

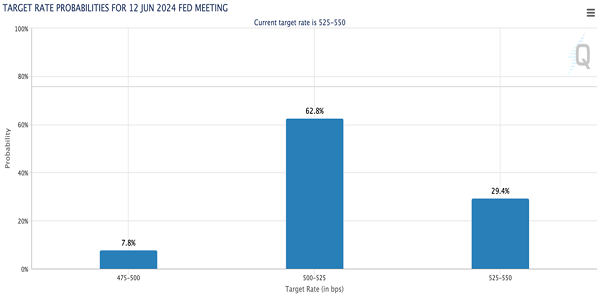

Well, it’s one of those seemingly weird calls that’s absolutely on the table after the first Fed rate cut drops—a date that, if futures traders are right, will arrive as soon as June:

Interest Rates Are About to Pull a 180

Source: CME Group

Here’s where emerging-market bonds come in: When rates drop, the US dollar gets banged up—it always does. That will light a fire under EM bonds.

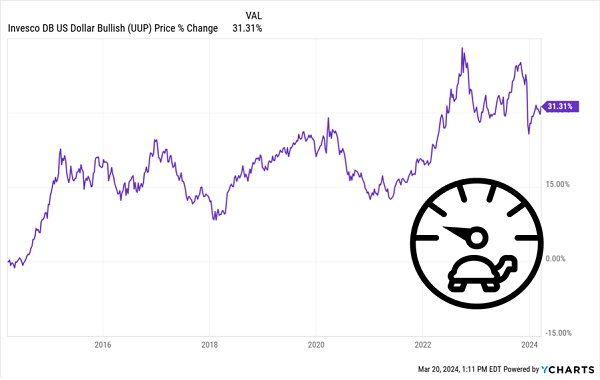

And given that the dollar has been en fuego for the past decade, the greenback’s drop could very well be swift. Heck, you can already see it starting to happen:

A Sweet 10-Year Run for the Buck—and the Seeds of a Pullback

You can see the dollar starting to flag on the right side of that chart.

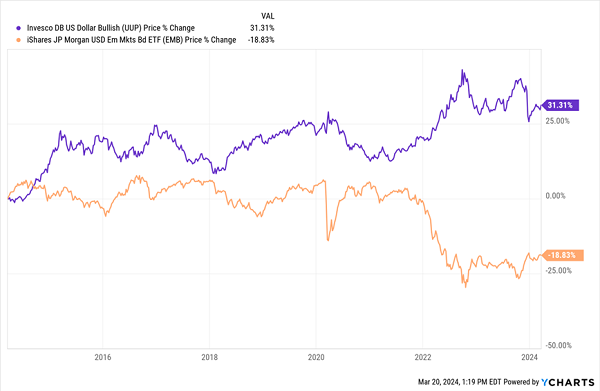

A weak buck is a big catalyst for EM bonds. Foreign countries and companies often borrow in US dollars, rather than their own currency. But they still have to service the debt in their own currency, or buy US dollars to do it, and a burlier US dollar makes that more difficult.

Thus, EM bonds suffer when the dollar is rising, which is why it’s best to buy them when the dollar is heading flat to lower. That’s what we’re seeing now.

When the Buck Drops, EM Bonds Soar

I know what you’re thinking: “Brett, I’ve been hearing about rate cuts for a year now, and they keep getting pushed back.”

That’s true, but those rate cuts will come. Inflation is waning, and most of all, the calendar is starting to work against our man Jay: according to the latest “dot pl0t,” Fed members expect three rate cuts over the rest of this year, and one thing the Fed hates to do is surprise the market.

That means if Jay wants to get those three cuts in—and he does!—he’s gotta get moving. And besides, even if cuts are put off, we just get more time to grab our passports and load up on the best overseas bonds!

In other words, we’ve got ourselves a sweet setup in EM bonds no matter how the next few months play out. So how are we going to play it?

CEFs Let Us Shop the World for 7.5%+ Dividends (on Sale)

I’ve got two plays for you to consider as we tap this superb EM dividend (and gain) opportunity. Both are closed-end funds (CEFs) that sport deep discounts to net asset value (NAV, or the value of the bonds they hold). They also pay 7.5%+ dividends that come our way monthly, too.

Let’s get started, starting with our second-favorite fund of this duo.

Silver Medal: Western Asset Emerging Markets Debt Fund (EMD)

It might seem odd to rank EMD second, since it yields an outsized 10.9% and sports an outsized discount to match: right now, we can pick up shares for 11.2% below the fund’s portfolio value.

EMD holds a diversified basket of emerging-market debt (with 239 holdings in all) that’s 96% invested in US-dollar-denominated bonds, which cuts our currency risk. It holds the bulk of its investments in sovereign debt (48%), but holds a good bit in corporate debt (30%), as well.

It also holds 12% in “quasi-sovereign” bonds issued by independent organizations with close ties to the government, which, in turn, backstops the bonds. A good example: EMD’s minor holding of bonds issued by Argentine state-owned oil company Ecopetrol SA.

As for credit quality, EMD largely stays out of the investment-grade arena, with just under 9% of its portfolio in the A, AA and AAA ratings. That’s exactly what we want because it’s easier for management to find value in the junk-bond aisle.

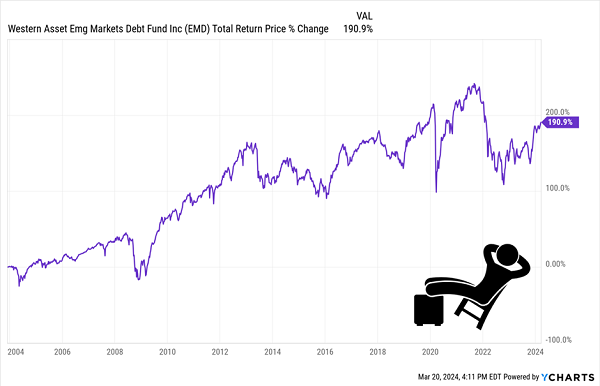

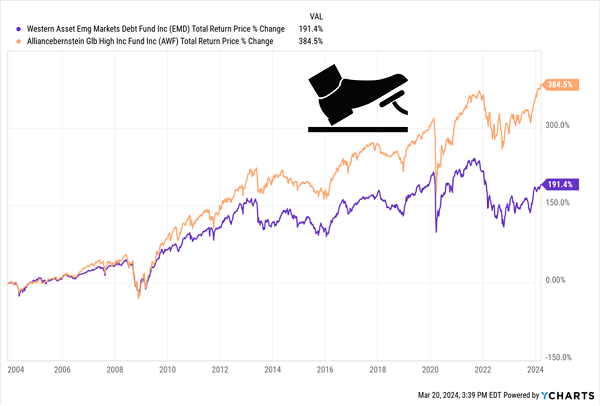

So why isn’t EMD our fave pick here? Three reasons, starting with performance: Since inception back in 2003, EMD has returned 191%, including dividends.

EMD’s Ho-Hum Long-Term Performance

That’s okay—but it pales in comparison to the numbers put up by our next fund.

Other caution signs include relatively high volatility (EMD’s five-year beta rating is 1.75, meaning it’s 75% more volatile than the S&P 500) and significant leverage, at 28% of the portfolio.

The bottom line? We’ve got a passable EM-bond holding here, especially as rates fall. But we can do better.

Gold Medal: AllianceBernstein Global High Income Fund (AWF)

AWF, a long-time holding in my Contrarian Income Report service, yields less than EMD—7.5% as I write this—and trades at a smaller 5.8% discount, too.

But this is one case in dividend-land where less really is more.

The fund invests in everything from US Treasuries to South African bonds to mortgage-backed securities. And like EMD, it doesn’t mess around with highly graded issues. Less than 10% of its portfolio is in AAA-, AA- and A-rated debt.

But from here on, AWF takes a different turn. When it comes to management, for example, the performance numbers aren’t close: AWF has doubled up our silver medalist’s total return since EMD’s inception in 2003:

AWF Laps Its EM Cousin

That performance is the direct result of the confidence and deep connections (vital in the bond world) of AWF’s management. That, in turn, stems from AWF’s longer history: the fund was launched back in 1993 and has put up a 1,560% total return since.

Moreover, as you can see in the chart above, AWF held up better than EMD as rates soared in 2022 and 2023, giving the fund momentum heading into a lower-rate—and far more beneficial for EM bonds—environment.

Leverage? AWF doesn’t use it. And it’s steadier than EMD, too, with a lower five-year beta of 1.27.

Finally, a couple more words on the discount: while it is a little on the small side compared to EMD, AWF’s markdown narrowed to as little as 3% in late 2021, when rates bottomed out, so we can expect some upside from a narrowing discount here, too.

Go Beyond Bonds With This 9%-Yielding Monthly Payer Portfolio

The wonderful thing about CEFs is that we can use them to invest well beyond emerging-market bonds. There are CEFs that hold stocks, corporate bonds, real estate investment trusts, preferred stocks—just about any asset you can imagine.

That means we can access all of our favorite stocks and bonds, from stalwarts like Johnson & Johnson (JNJ) to Microsoft (MSFT) and Visa (V), at prices far lower than we’d pay if we bought them “direct” on the market, thanks to CEFs’ discounts to NAV.

And we’ll bag much bigger dividends, too: As I write this, the average CEF yields right around 8%.

Here’s one more thing few people realize about CEFs: the majority of these funds pay dividends monthly—including EMD and AWF.

To make it as simple as possible for you to take advantage of these rare high—and monthly—dividends, I’ve put together a very special portfolio I’m recommending all income investors buy now: I call it my “9% Monthly Dividend Portfolio.”

That’s right, the investments inside yield 9%, on average. That’s enough to pay you a sweet $45,000 a year on a $500K investment—or $3,750 a month!

Click here to read a full backgrounder on this unique monthly payer portfolio and download a FREE Special Report revealing the names and tickers of all 5 investments inside.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report